Bitcoin just shrugged off some heavy war-related fear, uncertainty, and doubt, or FUD, as the cool kids say.

While a couple of years ago, a geopolitical mess like this would’ve sent Bitcoin tumbling faster than your boss’s patience on a Monday morning, this time?

Bitcoin stood its ground around $100,000. Impressive.

Resilience

So, what’s behind this newfound resilience? Is Bitcoin just getting tougher, like a boxer who’s taken a few hits but keeps coming back?

Maybe it’s the tight supply, the solid support, or those bullish on-chain trends that crypto nerds rave about.

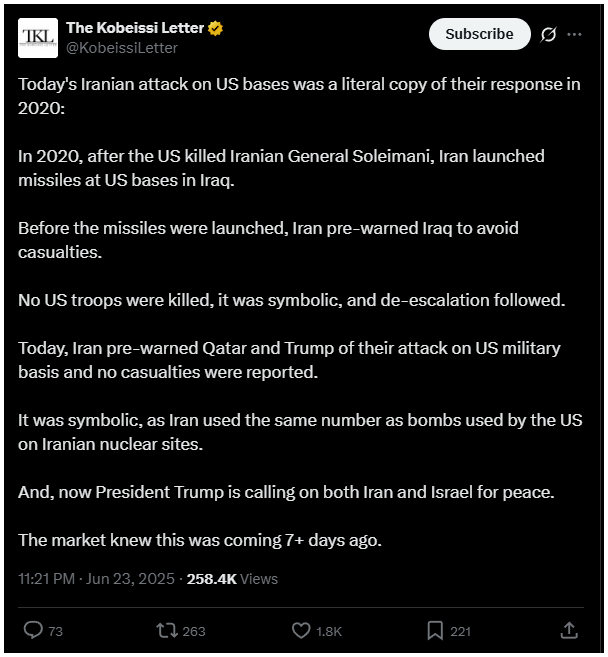

Or maybe the market’s just smarter now, having already priced in a ceasefire based on past political drama.

Whatever it is, Bitcoin’s holding steady for now, but the calm feels like the quiet before the next big rumble.

Now, some skeptics point to Bitcoin’s quick dip to $98,000 on June 22nd and say, see? Macro volatility’s creeping back.

But compared to the brutal 22% drop during the Liberation Day crash, this 11% pullback looks more like a healthy breather than a full-blown panic attack.

The market didn’t buy into the idea that this conflict would drag on forever. A big clue? Oil prices didn’t spike, in fact they actually fell nearly 15% to $60 a barrel, even with Iran throwing punches at U.S. bases.

That’s like expecting a fire drill and finding out it was just someone burning toast in the office kitchen.

Whale power

And get this, the real movers behind the scenes weren’t scared retail investors. It was the whales.

Those big Bitcoin holders, sitting on piles of over 1,000 BTC, decided to take some profits off the table.

On June 16th alone, they dumped 20,000 BTC, pushing Bitcoin below the $105,000 support line and causing a small 2.7% drop the next day.

But since the overall mood stayed chill, Bitcoin’s pullback stayed shallow, reinforcing that this was just a controlled cooldown, not a meltdown.

Tariff tensions

But there are some bad news too. Not bad-bad, but not good either. President Trump’s 90-day tariff pause is set to expire on July 9th. If no new trade deals come through, we’re staring down the barrel of a global trade reset.

Tariffs will bounce back hard, the EU could slap on import taxes up to 50%, China’s holding firm at 30%, and a global baseline of 10% will stick around.

Equity markets have been riding high, with the S&P 500 adding over 1,200 points since mid-April.

Bitcoin’s been no slouch either, jumping 37% and cruising around $105,000 in the time of writing.

But if these tariff tensions reignite inflation through the second half of the year, the Federal Reserve might have to keep interest rates high, killing any hopes for rate cuts.

That’s when those calm whales might get jittery again, ready to react fast.

Volatility could roar back with a vengeance, and Bitcoin’s $100,000 line in the sand might face its toughest test yet, this time with a heavy macroeconomic weight behind it.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.