Bitcoin just pulled off a jaw-dropping surge to an all-time high of $81,358 in the time of writing, and in the process, it wiped out $180 million in short positions in less than half a day. Ouch!

No land for short sellers

Traders who were betting on a market drop found themselves in hot water as Bitcoin skyrocketed, leading to major liquidations across the board.

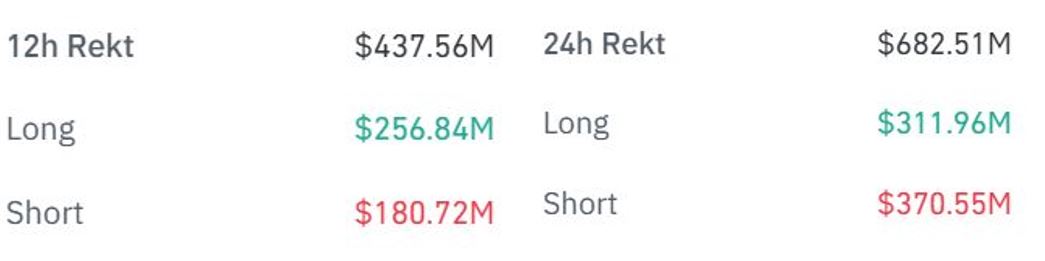

According to CoinGlass, around $180 million worth of short positions were liquidated in just 12 hours.

This latest rally comes on the heels of President-elect Donald Trump’s victory in the U.S. elections, with Bitcoin jumping more than 6% to hit that record high on November 10.

Short sellers were hit the hardest, with about $67 million in liquidated positions for Bitcoin alone. Dogecoin shorts took a hit too, losing around $23 million, while Ethereum shorts saw about $21 million wiped out.

But it wasn’t just short positions that took a beating, long bets also faced the axe, with $256 million liquidated overall.

In total, CoinGlass noted that at least 218,206 traders found their positions liquidated, bringing the grand total to $682.7 million.

Moonvember? More like a rollercoaster!

Interestingly, just days before this spike, November 6 saw nearly $350 million positions liquidated when Bitcoin dipped below $69,000 ahead of the elections.

Now that’s what you call a rollercoaster ride! Bitcoin’s moves have also boosted its market dominance back above 59%, inching closer to its October high of 60%, which is the highest it’s been since April 2021.

The “Trump Effect”

Market sentiment has been overwhelmingly bullish since Trump’s win and the success of pro-crypto candidates in Congress.

Caroline Bowler, CEO of Australian crypto exchange BTC Markets, noted that this price spike is part of what she calls the “Trump Effect,” as retail investors flock back to crypto.

In fact, BTC Markets reported 300% increase in user logins last week, the highest it’s been in six months!

This signals that retail investors are returning as Trump’s political comeback sends ripples through global financial markets.

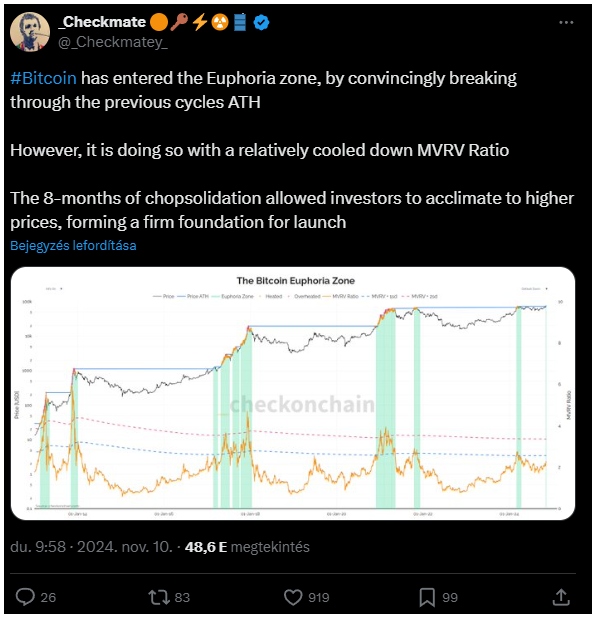

James Check, the popular analyst shared his thoughts on X stating that Bitcoin has entered the “Euphoria zone” after breaking through previous all-time highs convincingly, but he cautioned that this surge comes with a relatively cooled Market Value to Realized Value Ratio.

“The eight months of consolidation allowed investors to acclimate to higher prices, forming a firm foundation for launch.”