Listen, this Bitcoin market? It’s playing a game of high stakes, and the big players, the whales making moves that you gotta notice.

Meanwhile, the little guys, the small wallets, they’re packing up and heading for the exit.

It’s like watching the office lunchroom, the bosses are grabbing the good stuff, while the interns are left with crumbs.

In or out?

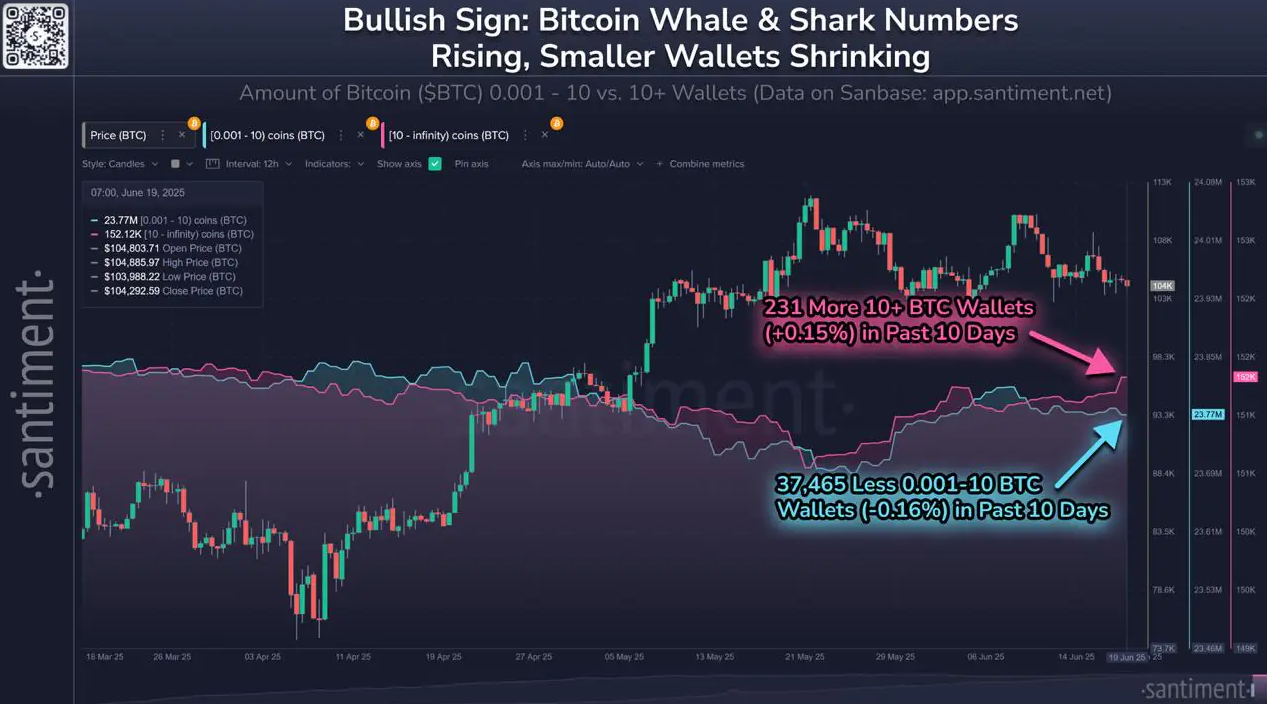

Santiment’s data tells the story loud and clear. In the last 10 days, wallets holding 10 or more Bitcoin have grown by 231 addresses, a modest 0.15% increase, but hey, these are the big fish stacking serious chips.

Meanwhile, wallets holding between 0.001 and 10 BTC? They dropped by a whopping 37,465, about 0.16%. That’s a mass exodus of the smaller players, guys.

What does this mean? Well, it’s classic market behavior. When the big whales start hoarding while the small fry bail, it usually signals one thing, bullish vibes ahead.

The big guys are betting on Bitcoin’s future, scooping up coins while prices stay steady despite the usual volatility.

Something is coming?

Think back to past cycles, when this kind of split happens, it often comes before a big jump.

It’s like when the office decides to invest in a new coffee machine, and suddenly everyone’s productivity shoots up.

The whales’ confidence is a really strong hint that something’s brewing beneath the surface.

It’s good for us?

Why should you care? Because when the institutional heavyweights increase their Bitcoin stash while retail investors hesitate, it’s a sign of growing trust at the top.

The “elite” holders are flexing their muscles, and that’s a huge green flag for the market.

This accumulation phase could very well be the calm before the next storm, the start of Bitcoin’s next big rally. And yea, that would be good!

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.