Bitcoin’s been doing its usual dance, prices climbing, miners sweating it out, and everyone wondering if it’s time to jump in or bail out.

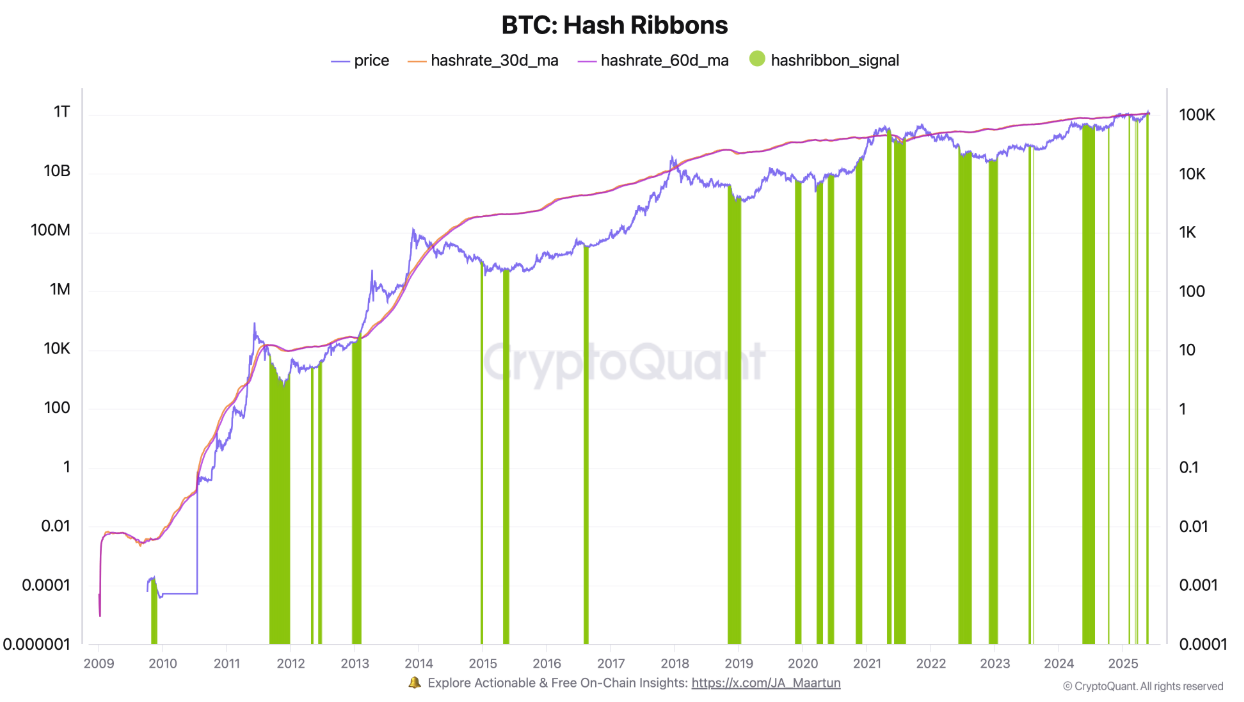

But the Bitcoin Hash Ribbons metric, that clever little indicator tracking miners’ hashrate, just threw up its third buy signal of 2025.

And this ain’t no ordinary signal, it’s historically been a pretty darn accurate way to spot when Bitcoin’s about to make a move upward.

Boy astrology?

So what’s the deal with these Hash Ribbons? They’re basically watching the 30-day and 60-day moving averages of Bitcoin’s mining power, the hashrate.

When these averages flip green, it’s like the miners themselves are whispering, hey, now’s a good time to buy.

CryptoQuant, the analytics platform keeping an eye on all this, says that despite Bitcoin hitting new ATHs last month, the miners’ performance is still shouting buy the dip.

Darkfost, one of CryptoQuant’s sharp contributors, even called it a long-term buying opportunity.

Now, that’s some serious street cred, considering this indicator rarely flashes buy signals. It’s like spotting a unicorn in the wild.

Getting some alpha

Here’s the thing, because while everyone’s busy chasing the hype, this signal’s flying under the radar.

Darkfost pointed out that not many people are paying attention, but those who do might just get ahead of the game.

Imagine your office buddy who always buys stocks when no one’s looking and ends up laughing all the way to the bank. That’s the vibe here.

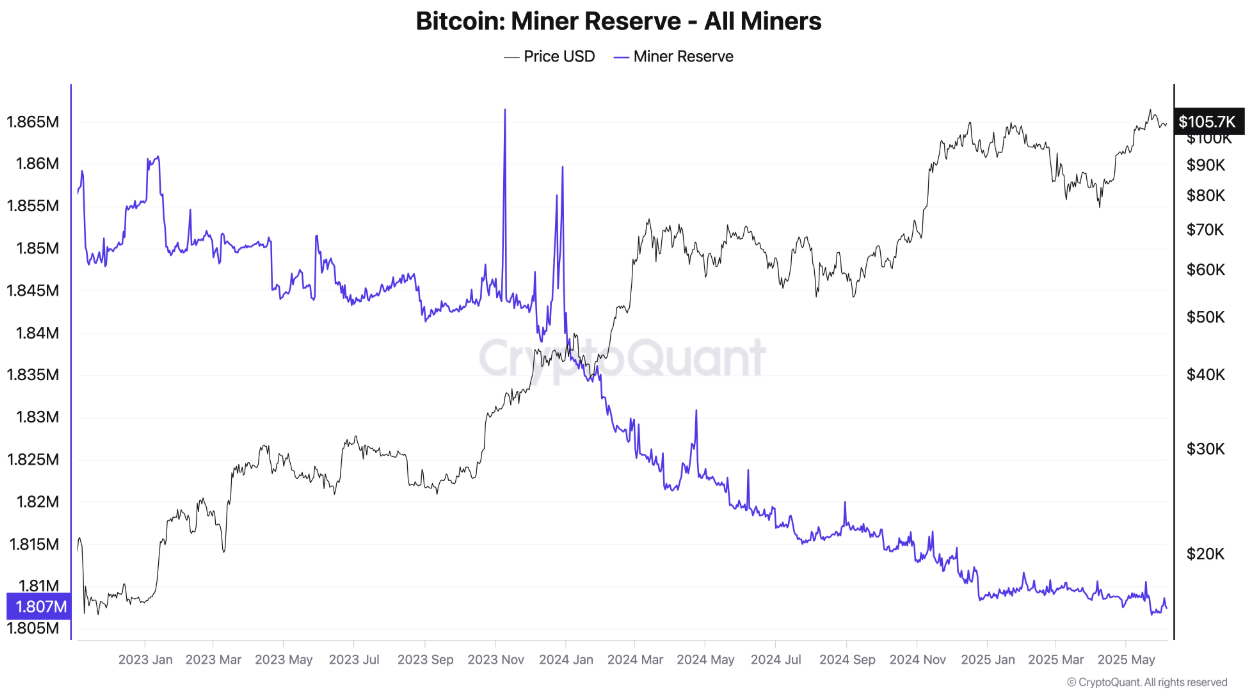

Now, about those miners, their Bitcoin stash has been pretty steady this year, hovering around 1.8 million BTC as of early June.

After a year of heavy selling, they’re holding tight now. It’s like they’ve had their fill of the rollercoaster and decided to chill for a bit.

The second best time?

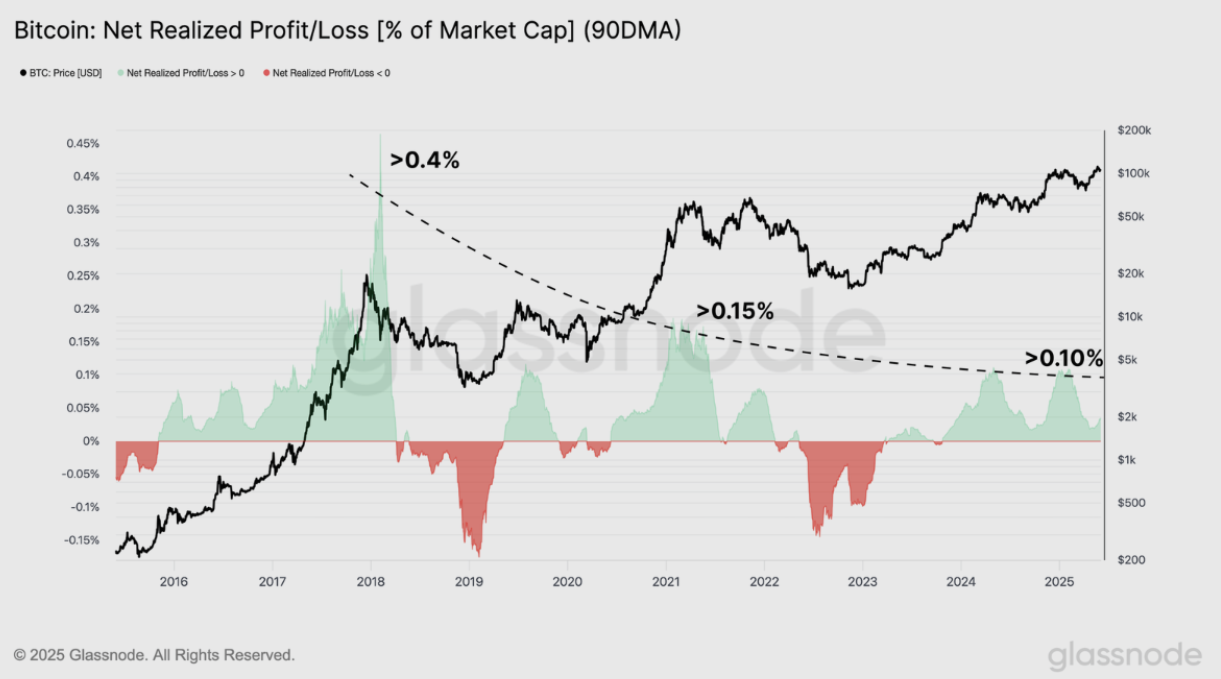

And the whales and long-term holders? They’ve been cashing out at these new highs, sure. But according to Glassnode’s latest research, their profit-taking isn’t the wild, euphoric frenzy we’ve seen in past cycles.

It’s more measured, more calculated, like your colleague who carefully plans their vacation instead of booking a last-minute flight.

The market’s maturing, volatility’s cooling off, and those big players are playing it smart.

So, if you’re watching Bitcoin, the Hash Ribbons are telling you loud and clear, buying now might just be the smart move.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.