Bitcoin’s been playing a wild game lately, huh? One minute it’s down, the next it’s back up like a stubborn street fighter who just won’t stay down.

Now, the big boss of CryptoQuant, Ki Young Ju, he’s been calling the shots on this market for a while.

Again

Ju said earlier that the bull run was done, but guess what? The market’s been telling a different story, and Ju’s starting to squint and reconsider his playbook. Bitcoin just flirted with $94,000, a number we haven’t seen since early March.

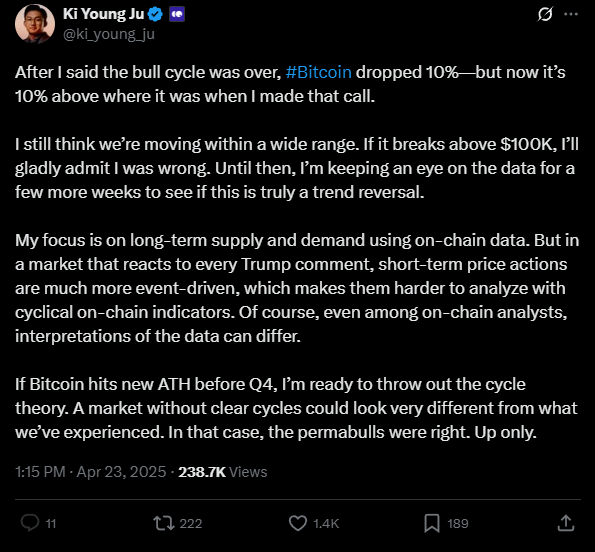

Ju admitted, after Bitcoin took a 10% dip following his bearish call, it bounced back, trading 10% higher than when he made that call.

That’s like a boxer getting knocked down but coming back swinging harder. Ju’s still cautious, though. He says Bitcoin’s stuck in a range, not quite ready to break out just yet.

But if Bitcoin smashes through $100,000 before the last quarter of the year, Ju’s ready to throw out his whole cycle theory.

Just like that, the old rules tossed out the window. The permabulls, those relentless optimists who’ve been saying up only, might actually be right. A market without cycles? That’s a game changer.

“If Bitcoin hits new ATH before Q4, I’m ready to throw out the cycle theory. Up only.”

Bargain

Can you guess what happened? Whale activity. Not the kind you see in the ocean, but the big players with deep pockets are loading up on Bitcoin at major exchanges like Binance and Coinbase.

Every time Bitcoin moves up, these whales are snapping up bags of BTC. It’s like they’re quietly calling the shots behind the scenes, pushing the price higher.

On-chain data backs this up. Long-term holders, people who’ve been sitting on their Bitcoin for over five months, are buying again after a spell of selling.

That’s a sign they believe in the long haul, even if the short-term traders are still jittery and selling when things get shaky.

Agreement

And it’s not just CryptoQuant seeing this. Bloomberg’s ETF analyst Eric Balchunas points out that big institutional investors and corporate giants, like Strategy, are scooping up hundreds of millions in Bitcoin.

They’re absorbing the supply that used to be tossed around by retail traders, making the market a bit more stable, a bit more serious.

So yeah, Bitcoin’s had a strong week, up 10%, beating the crypto market’s 9% gain.

Right now in the time of writing, it’s trading around $92,700, a little dip here and there, but nothing to write home about.

It’s still below its all-time high of $108K by about 15%, to be honest.

Have you read it yet? Trump’s meme token skyrockets 70% after VIP dinner invite

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.