The New York Digital Investment Group, the NYDIG, called Bitcoin as a standout asset for its returns, even with its ups and downs.

Greg Cipolaro, the Global Head of Research at NYDIG, stated that Bitcoin stands apart from the crowd when comparing its performance to other asset classes using the Sharpe ratio.

Unique asset class, unique performance

The Sharpe ratio is a financial tool used to measure how well an asset performs relative to its risk.

It calculates the ratio of extra returns to the volatility of those returns, meaning a higher Sharpe ratio indicates better performance when considering risk.

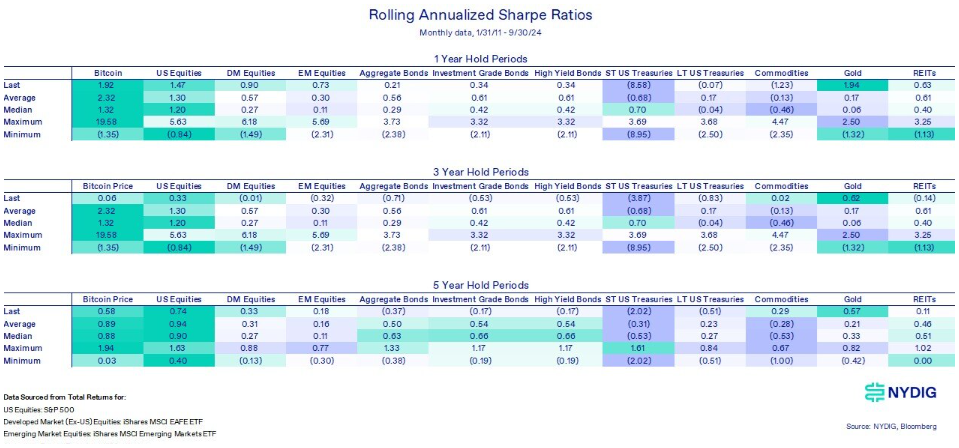

Cipolaro shared data showing the Sharpe ratios of various asset classes, including stocks and bonds, over different time periods.

And Bitcoin is visibly strong. While he noted that gold had a slightly higher Sharpe ratio over the past year, he emphasized that the difference was minimal.

“Bitcoin ranks favorably compared to nearly every asset class on every metric over every time frame.”

The decade-long trend is clear, no matter what banksters say

Cipolaro’s analysis challenges a Goldman Sachs report, which stated that even with a 40% increase this year, Bitcoin’s performance didn’t adequately compensate for its volatility.

He argued that the risks associated with Bitcoin investments are more than justified by the returns, and also pointed out that while Sharpe ratios are helpful for comparing risk-adjusted returns, what really matters is absolute returns when it comes to meeting financial goals.

This metric doesn’t account for all types of risks investors might face, such as censorship or asset seizure.

Market dominance

In an earlier report from October, NYDIG analysts confirmed that Bitcoin continues to be the best-performing asset of the year, even after experiencing a seasonally weak third quarter.

As of now, Bitcoin has been trading steadily after a weekend of limited price movement.

After reaching an intraday high of $63,150 on October 13, its price also reached $65,000 at the time of writing.