Bitcoin’s hanging tough around $105,000, but don’t get too cozy just yet. The bulls?

They’re struggling, like that one coworker who keeps trying to lead the meeting but keeps getting shut down.

The big question on everyone’s lips, will Bitcoin break below the sacred $100,000 level, or will it bounce back like a chad?

Hold!

Bitcoin’s price is about 6% shy of its ATH, $111,900, remember that? Traders are waving red flags, warning us that June might bring a larger correction. That’s fancy talk for expect a dip, maybe a deeper one.

Since breaking $100K, Bitcoin has been holding above it for three weeks. That’s the key support level, the line in the sand.

But it hasn’t really tested that support convincingly lately. It’s like walking a tightrope without looking down, thrilling, but nerve-wracking.

Michael van de Poppe, the sharp guy behind MN Capital, spotted Bitcoin chilling around $104,300.

After failing to push past $106,000, he says BTC might dip lower before it can muster the strength to climb again.

His chart says keep your eyes glued to $100K on the four-hour timeframe. He calls it a clear rejection and predicts lower prices before any upward momentum.

Resistance and support

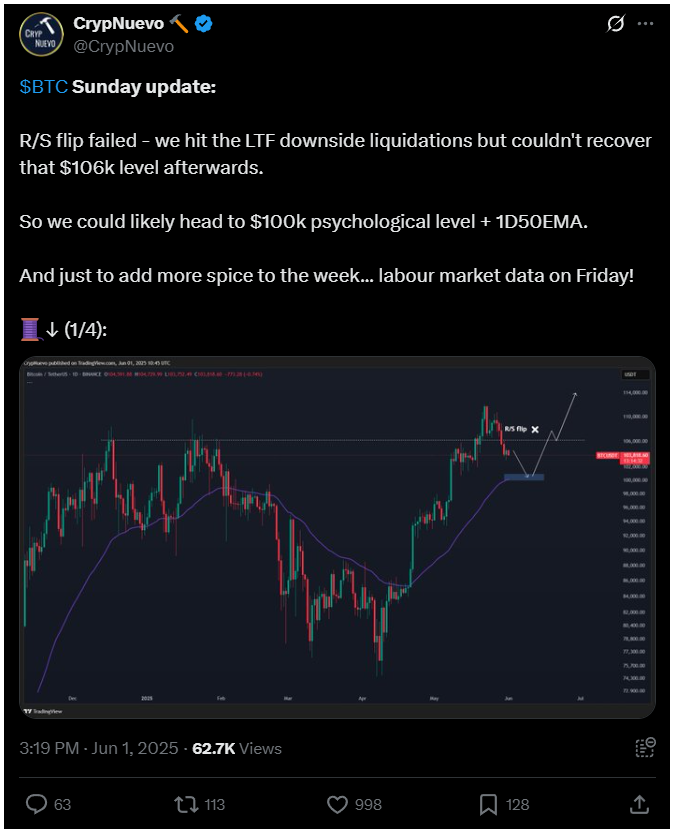

Then there’s CrypNuevo, the pseudonymous analyst who’s got an eye on resistance levels. Bitcoin tried flipping $106,000 from resistance to support, and failed.

So, he’s betting we’ll slide back to that psychological $100,000 level, maybe even hang around the 150-day moving average.

And if you thought that was enough drama, AlphaBTC is throwing in a spicy prediction, as if $100K support breaks, Bitcoin could tumble as low as $90,000.

He expects some sideways action in early June, waiting for hard data and the Federal Open Market Committee’s meeting on June 18 to shake things up.

Liquidity is the key?

Now, liquidity’s piling up like office snacks before a big meeting. Traders see thick bid orders below the current price, especially under $100,000.

CrypNuevo says $100K is a strong psychological level where liquidity stacks up, and that’s probably right. But it will be enough?

Liquidations:

• $100k: It's a strong psychological level and liquidity tends to stack in these levels. Potential retest of this level first.

• $112.5k-$113.5k cluster: The main liquidity area in HTF. We'll eventually hit that range.

Ideally $100k –> $113k. pic.twitter.com/PAKAwyeqCs

— CrypNuevo 🔨 (@CrypNuevo) June 1, 2025

Below $100K, there’s about $170 million in liquidity hanging out near $93,200. On the flip side, the $112,500 to $113,500 range is where sellers are waiting.

AlphaBTC sums it up, and says liquidity’s heavy on both sides, but more concentrated below recent lows.

He wouldn’t be shocked if Bitcoin dips to those lows, then rallies hard to reclaim what’s left above.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.