Bitcoin’s transaction fees have just tumbled to a multi-year low. We’re talking about fees so small they barely make a dent, one-tenth of a satoshi per byte.

To put it simply, that’s like paying a fraction of a penny to send your cash through the blockchain.

Sounds like a win for the everyday Joe sending Bitcoin for a coffee, right? Not so fast, the story is multi-layered.

Minimum rule

For years, Bitcoin’s core developers kept a one satoshi minimum rule, basically, a floor beneath which transactions wouldn’t make it into the mempool, a kind of holding pen miners use to pick which transactions to confirm.

One satoshi, remember, equals one hundred-millionth of a Bitcoin. It’s tiny, but it adds up for the miners keeping the network humming. But some says this decision was centralized. The irony.

Then came the punch. Big business interests pushed developers to relax that fee floor and let more arbitrary data clog up the network, not just straightforward Bitcoin transfers but media and commercial inscriptions.

The idea? More users, more data, more transactions, a bigger pie.

Even miners slashed their minimum fee requirements by 90%, betting the party would kick off and more people would jump aboard.

Less money?

But the party didn’t show up. Transaction activity barely moved. Instead of slicing a bigger pie, everyone got handed smaller slices.

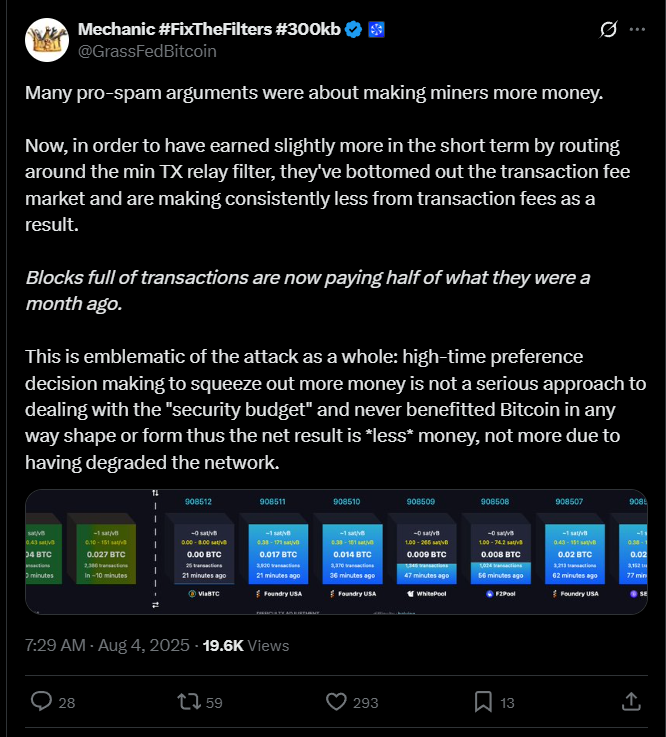

Blocks started to fill less than half their capacity, and fees plummeted hard. Some blocks earn nearly half the transaction fees they did just a month ago. The minimum fee dropped like a hot potato, to 0.1 satoshi per byte.

Now, experts say this decline spells trouble for miners. These tiny fees mean less money flowing in from transactions.

Miners still rake in rewards from the blockchain’s coinbase subsidy, the big chunk of freshly minted Bitcoin per block that makes up about 99.4% of their income right now, but that slices in half every four years.

Safe and sound

So what’s the big picture? Now many say if transaction fees stay permanently low, Bitcoin’s long-term security could be at risk.

Miners might find their incentives shrinking right when the coinbase rewards cut back. It’s like running a mafia family on lean budgets, eventually, the muscle dries up, and so does protection.

So now it’s a battle between ideology and economics. Bitcoin wants to stay open and cheap for users, but it can’t lose sight of keeping its network safe and sound.

Frequently Asked Questions (FAQ)

Why have Bitcoin transaction fees dropped to such low levels?

Bitcoin’s transaction fees have dropped to a multi-year low due to the relaxation of the minimum fee rule. The move was driven by a desire to attract more users and data on the network, but the expected increase in transactions didn’t materialize, leading to lower fees.

What impact does this have on Bitcoin miners?

For miners, this drop in transaction fees means reduced income. Currently, most of their earnings come from the coinbase subsidy, but as this halving process continues, a continued decline in transaction fees could undermine Bitcoin’s security in the long term.

Could Bitcoin’s long-term security be at risk due to low transaction fees?

Yes, many experts believe that if the transaction fees remain low for an extended period, miners may have less incentive to secure the network, especially as the coinbase rewards continue to diminish every four years.

What is the ideal balance for Bitcoin’s transaction fees?

The ideal scenario would be a balance where Bitcoin remains accessible to users with low transaction fees while ensuring enough revenue for miners to keep the network secure. It’s a delicate balancing act between ideology and economics.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 6, 2025 • 🕓 Last updated: August 6, 2025

✉️ Contact: [email protected]