Bitwise and GraniteShares filed SEC prospectus documents to launch US election prediction market ETFs tied to election outcome contracts. The filings describe a set of funds linked to U.S. federal elections.

The proposed products would use binary event contracts that settle based on whether a specific election result occurs. Those contracts trade on CFTC regulated exchanges, according to the filings.

The structure creates separate ETFs for separate outcomes. As a result, each fund links its value to a single political result.

Bitwise PredictionShares ETFs target 2026 and 2028 election outcomes

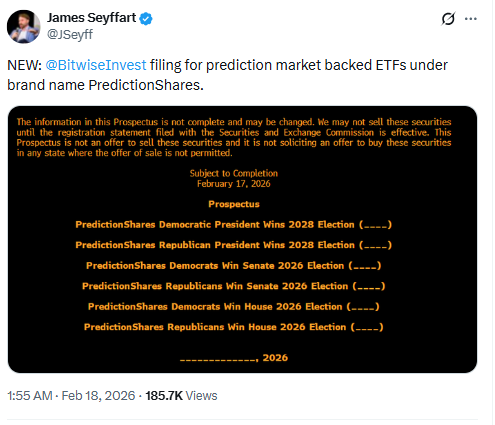

Bitwise filed a prospectus for PredictionShares ETFs, a lineup of election prediction market ETFs intended for a NYSE Arca listing. The filing covers six funds.

Two 2028 presidential election ETFs would pay out based on which party wins the U.S. presidential election on November 7, 2028. One fund tracks a Democratic Party win, while the other tracks a Republican Party win.

Four more funds focus on Congress. Two 2026 Senate election ETFs track whether Democrats or Republicans win the Senate in November 2026, and two 2026 House election ETFs track House control by party.

How binary event contracts drive ETF pricing on CFTC regulated exchanges

Each fund invests at least 80% of its net assets in binary event contracts, the filings said. These are election-linked derivatives that settle at $1 if the outcome happens and $0 if it does not.

The filings describe the contracts as trading on CFTC regulated exchanges. Because of that setup, the ETF share price can move with the market price of the underlying event contracts.

The prospectus also spelled out the downside risk in direct terms. “In the event that a member of the Democratic Party is not the winner of the 2028 Presidential election, the fund will lose substantially all of its value,” the document said.

GraniteShares election prediction market ETFs follow Roundhill as filings stack up

GraniteShares also filed a prospectus for six election prediction market ETFs with the same overall structure. The funds track the same set of election outcomes, including the 2026 midterm election contests and the 2028 presidential race.

Bloomberg ETF analyst James Seyffart commented on the new filings.

“The financialization and ETF-ization of everything continues,”

he said.

Source: James Seyffart on X

Seyffart also pointed to earlier paperwork from another issuer. He said the filings were not the first of their kind, referring to a Roundhill election ETF filing dated Feb. 14, which also outlined six election outcome funds tied to the presidential, Senate, and House races.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: February 18, 2026 • 🕓 Last updated: February 18, 2026