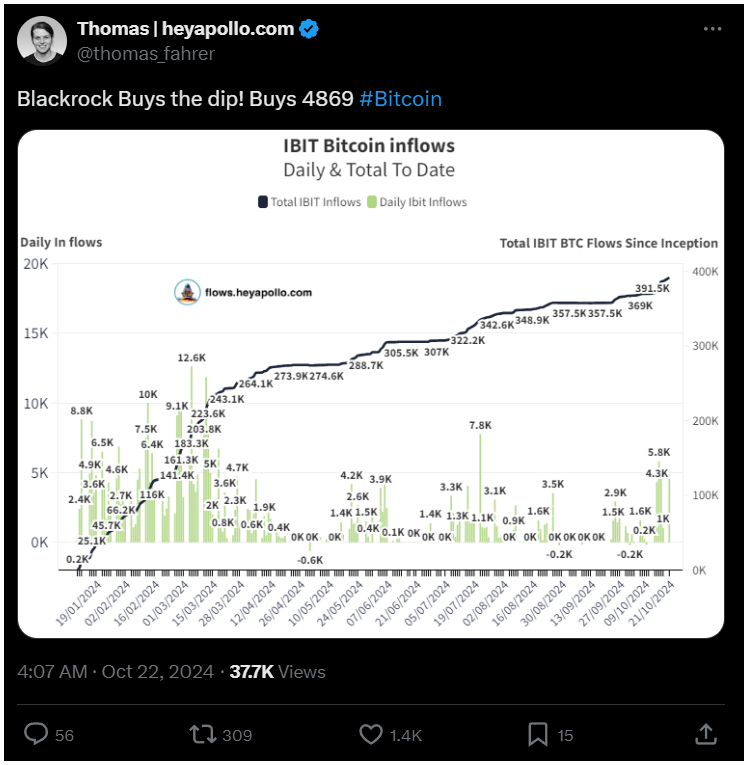

While many competitors are offloading their assets, BlackRock is making moves by purchasing a nice amount of Bitcoin.

In fact, aside from Fidelity’s fund, all other ETFs saw either zero or negative flows, leading to a total net inflow of just $294.3 million across all funds.

BlackRock is the king of the hill

The inflows into BlackRock’s IBIT marks the sixth consecutive day of positive inflows, totaling a $1.47 billion over the past week alone. Since its launch in January, IBIT already accumulated more than $23 billion in total inflows.

Nate Geraci, president of ETF Store noted that the inflows from last week would rank it among the top five ETF launches of 2024 out of 570 ETFs.

Bloomberg ETF analyst Eric Balchunas also mentioned this impressive week for IBIT, calling it the best since March, as he pointed out that its assets under management now place it in the top 2% of all ETFs.

IBIT has taken third place for year-to-date inflows among all trading ETFs, even surpassing the Vanguard Total Stock Market Index Fund.

Fidelity’s Bitcoin ETF saw a quite modest inflow of $5.9 million, while in contrast, ETFs from Bitwise, Ark 21Shares, VanEck, and Grayscale all faced outflows as the markets pulled back.

Challenges for Ethereum ETFs

The situation wasn’t as bright for spot Ethereum ETFs, which experienced a net outflow of $20.8 million.

Grayscale’s ETHE fund suffered another loss of $29.6 million, which canceled out any inflows for BlackRock’s ETHA and VanEck’s ETHV funds.

The ongoing exodus from Grayscale already exceeded $3 billion and continues to weigh down the entire group of Ethereum funds.

This trend is likely to remain til investors move away from the high-fee ETHE fund and redistribute their assets.

Crypto market in red

BlackRock is okay, but the overall crypto market is pulling back hard. Bitcoin dropped 3.3% from its multi-month high of $69,300 and fell back below $67,000 at the time of writing.

Of course, this was somehow anticipated as leverage and BTC futures open interest reached record highs.

As usual, alts took an even harder hit with larger losses seen in Ethereum, Near Protocol, Sui, and Litecoin as total market capitalization dipped to $2.44 trillion.