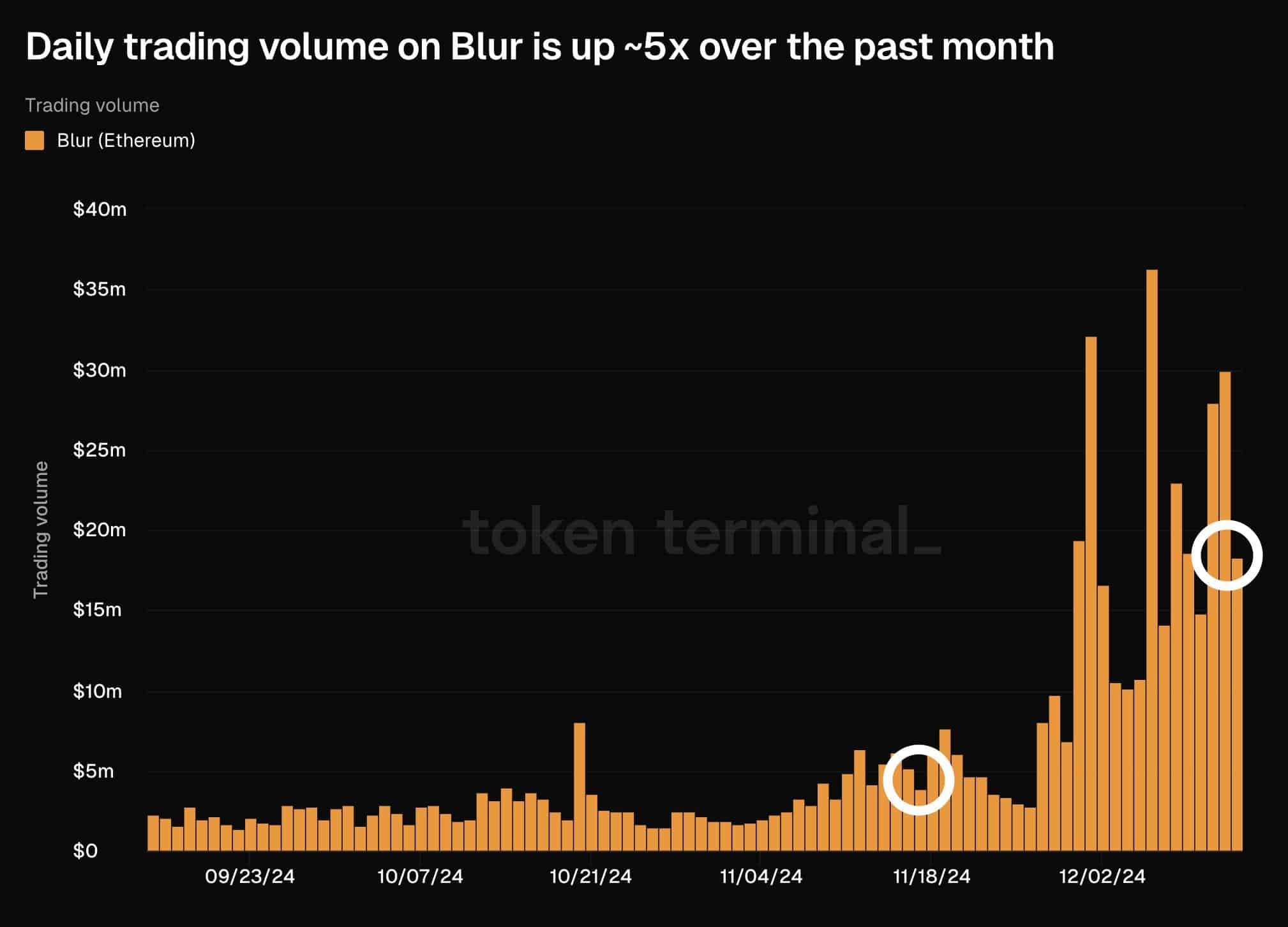

The Blur NFT marketplace is making some serious noise in the sector with its trading volume skyrocketing over five times in the last month This jump has pushed daily trading volume past $35 million, the largest spike yet.

Resurrection of the NFT sector?

This increase in trading volume suggests that interest in NFTs is heating up again, which could have a positive impact on the value of the BLUR token.

It’s worth noting that these volume spikes haven’t been steady, instead, they’ve come in sharp bursts, signaling that traders are reacting quickly to market changes.

If this trend of increased NFT activity continues, analysts think that we might just see BLUR prices respond positively too, mirroring those spikes in trading volume.

But let’s not get ahead of ourselves, this will largely depend on sustained interest in trading on the Blur platform.

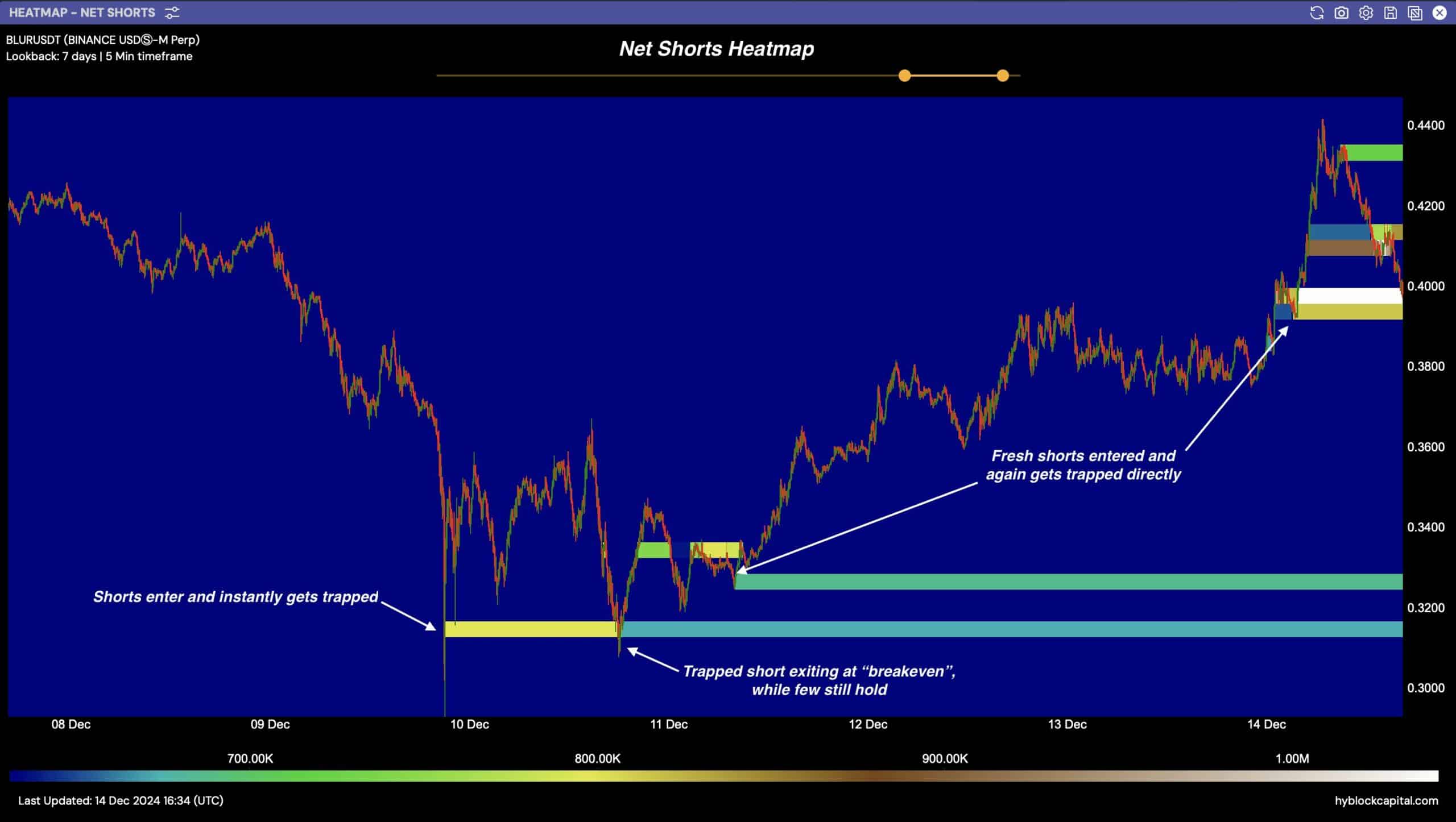

Short sellers get trapped

Short-selling activity for BLUR over the past week caused a quick price spike that left many short sellers caught off guard.

The trapped short sellers signal volatility and show just how risky it can be to bet against a strong upward trend like BLUR’s, especially with leverage, or too much leverage.

If this trend of trapping shorts continues, we could see some short squeezes that might drive prices even higher.

So what will do the BLUR price? Up or down?

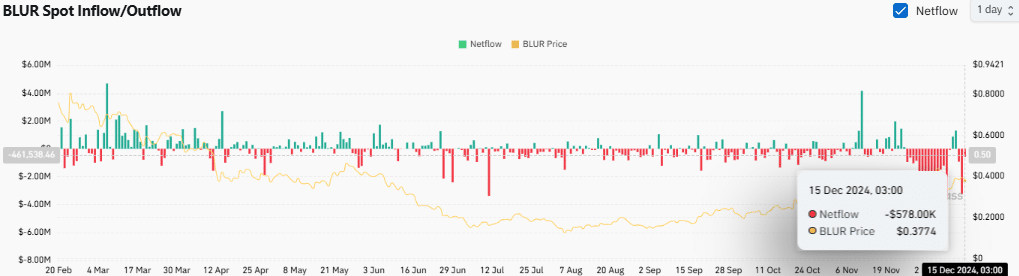

BLUR has been riding the wave of the NFT market resurgence, which started December at around $0.25 and quickly climbed close to $0.45 by mid-month, attracting more traders along the way.

This bullish trend is clearly evident as it consistently stays above both the 50-day and 200-day simple moving averages, signaling strong upside momentum.

The MACD indicator has also been showing positive signs throughout this period, reinforcing that bullish sentiment, and net flows also remained relatively stable despite some rapid outflows, signaling high volatility in the market.

These patterns show that inflows and outflows are the important thing to watch now, because if this trend continues, we could see even more price swings influenced by large transfers in and out of exchanges.