The Central Bank of Bolivia signed a memorandum of understanding with El Salvador to promote crypto as an alternative to fiat currencies.

The agreement was signed by Acting President Edwin Rojas Ulo and Juan Carlos Reyes García, president of El Salvador’s National Commission of Digital Assets (CNAD). It is effective immediately and does not have an end date.

The Central Bank described crypto as a “viable and reliable alternative” to traditional currencies.

The agreement will focus on policy development and the exchange of crypto intelligence tools. It aims to modernize Bolivia’s financial system and expand access to financial services.

El Salvador, the first country to make Bitcoin (BTC) legal tender, is expected to provide practical insights into regulatory processes. Bolivia is looking to learn from El Salvador’s experience as it develops its own crypto framework.

Crypto Trading in Bolivia Gains Momentum

In June 2024, Bolivia lifted its long-standing ban on crypto and allowed banks to process Bitcoin and stablecoin transactions.

Within three months, the Central Bank reported crypto trading volume of $46.8 million, averaging $15.6 million per month.

This marked a sharp increase compared to the previous 18 months. By June 30, 2025, crypto trading volume in Bolivia reached $294 million, showing continued growth since the policy change.

The Central Bank stated that more Bolivians are using crypto as confidence in digital assets rises. The removal of the ban has supported higher transaction levels across the country.

Bolivia’s Currency Crisis Drives Crypto Use

Bolivia’s economic situation has added urgency to crypto adoption. In March 2025, state-owned oil and gas company Yacimientos Petrolíferos Fiscales Bolivianos was approved to accept crypto for fuel imports. This step addressed a shortage of US dollars needed for international trade.

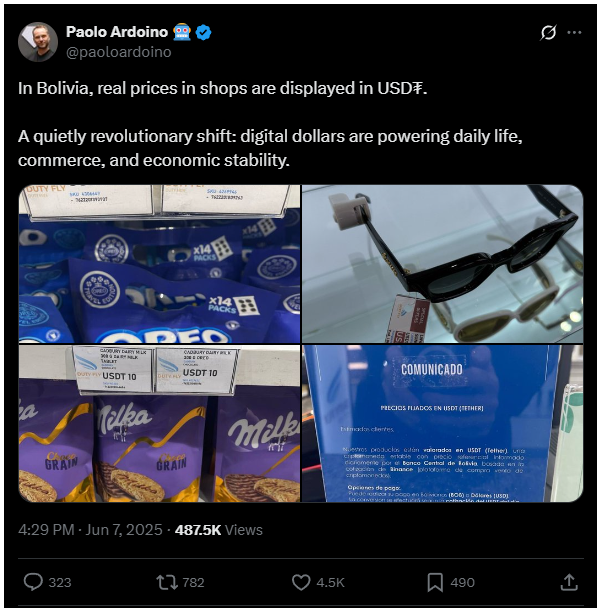

Data from Trading Economics shows Bolivia’s foreign exchange reserves dropped 98%, from $12.7 billion in July 2014 to $165 million in April 2025. Some shops have started listing prices in Tether (USDT) due to concerns over the local currency.

Although the Bolivian boliviano remains the main currency, fears about its stability have led people to favor crypto and the US dollar. The Central Bank has noted this trend as part of its recent updates.

Crypto Policy and Bolivia’s Upcoming Election

The crypto partnership was signed ahead of Bolivia’s general election on August 17, 2025. If no candidate wins over 50% of the vote — or 40% with a 10-point lead — a runoff will be held on October 19.

The crypto predictions platform Polymarket has given only a 5% chance of an outright first-round victory. The election result is expected to determine how Bolivia continues its crypto and economic policies.

The Central Bank’s agreement with El Salvador follows the removal of Bolivia’s crypto ban and comes during a period of growing crypto adoption.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.