This is Brazil! Their Strategic Bitcoin Reserve Bill just passed its first committee review.

That’s a serious step toward making Bitcoin part of the country’s official financial arsenal.

This bill, introduced back in November, would let Brazil stash up to 5% of its foreign exchange reserves in Bitcoin.

Imagine that, one of the biggest economies saying, hey, Bitcoin, you’re not just some wild card anymore. You’re part of the family.

Advanced level

This isn’t like El Salvador’s flashy Bitcoin adventures, with a based trolling-tweeting president.

No, Brazil’s taking a more measured, institutional approach. Policymakers are starting to see Bitcoin as a solid store of value, not just a speculative toy for day traders.

It’s like when your office finally stops treating the new guy as the intern and starts trusting him with the big projects.

JUST IN: 🇯🇵 Japanese public company Remixpoint announces it bought 50 #Bitcoin for ¥793.9 Million.

They now hold over 925 BTC 🙌 pic.twitter.com/xY9VKtP9cC

— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

Ball queen?

And we all know it’s not just Brazil warming up to Bitcoin. Japanese companies for example, known for their cautious ways, are quietly scooping up BTC during price dips.

Remixpoint, a big name over there, is leading the pack, but also, there’s Metaplanet, you may have heard about it. This shift signals a growing belief that Bitcoin isn’t just volatile noise anymore.

The popularity is understandable, especially as Bitcoin ETFs are pulling in more than $1 billion in net inflows over just three days.

That’s institutional money flooding back in as BTC prices flirt with the $110,000 level again. It’s like the big players are saying, we’re back, and we mean business.

Ready or not

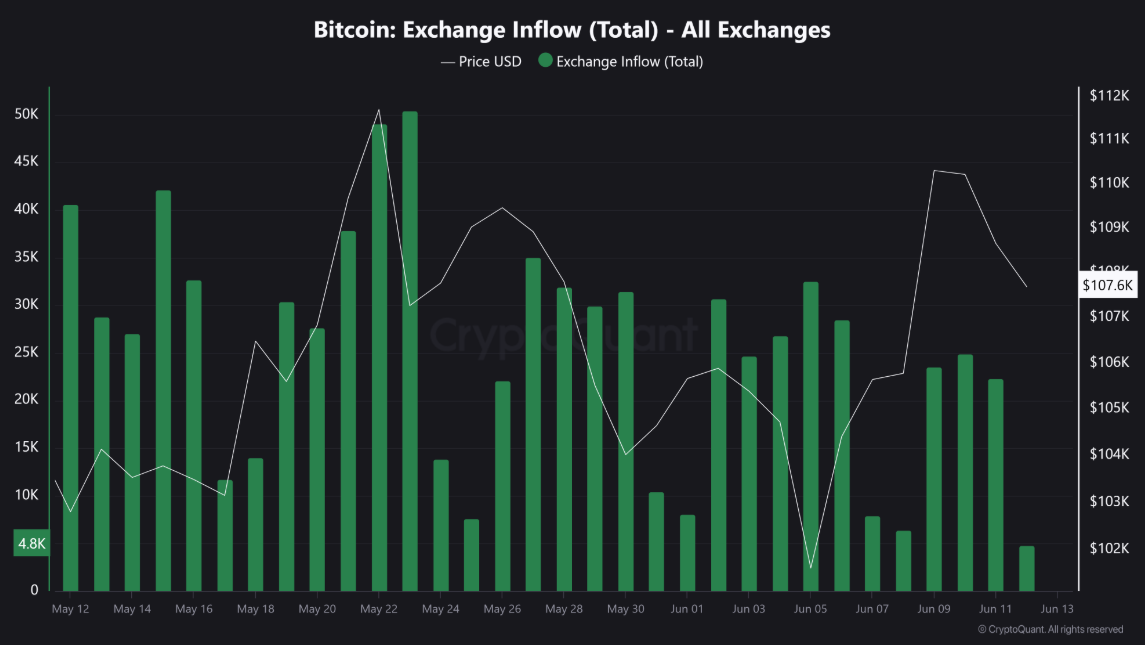

Sure, exchange inflows show the usual dance, accumulate, then a quick sell-off, price dips here and there. But these dips?

They’re shallow, temporary. Like a coffee break between intense work sessions. With inflows cooling off in the last 24 hours, BTC might be gearing up for another accumulation phase, especially if ETF demand keeps roaring and firms keep buying.

So, Bitcoin’s consolidating, not cooling off. With Brazil’s policy shift, surging ETF inflows, and global corporate interest all converging, it looks like BTC is setting the stage for its next big rally. And we’re here for it!

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.