Canary Capital filed a Form 8-A with the U.S. SEC, signaling its spot XRP ETF could begin trading Thursday after Nasdaq certification at 5:30 PM ET Wednesday.

The fund would be the first U.S. product to directly hold XRP under the Securities Act of 1933.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Eric Balchunas flagged the timing; Eleanor Trent outlined the listing steps. XRP traded near $2.40, up about 10% in seven days, per CoinGecko.

Spot XRP ETF Filing: Canary Capital, SEC, and Launch Window

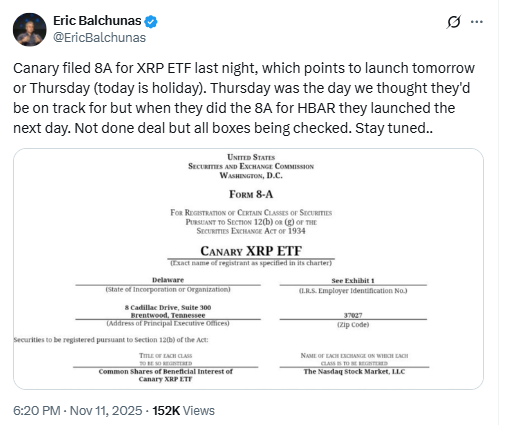

Canary Capital submitted a Form 8-A on Monday night, a required step before a security lists on an exchange. The filing covers registration for exchange trading and signals operational readiness.

Therefore, the spot XRP ETF sits close to its potential start date. The remaining step is Nasdaq certification, which triggers effectiveness at a set time.

Eric Balchunas, a Bloomberg senior ETF analyst, said the Form 8-A “points to launch tomorrow or Thursday.” He added,

“Not [a] done deal but all boxes being checked.”

Form 8-A, Nasdaq Certification, and Timeline for a Spot XRP ETF

On Tuesday, Eric Balchunas referenced the HBAR ETF precedent. He noted that Form 8-A filings for HBAR products were followed by next-day launches.

Meanwhile, crypto reporter Eleanor Trent detailed the sequence. She said Nasdaq certification would make the filing effective at 5:30 PM ET Wednesday.

As a result, the spot XRP ETF from Canary Capital could open Thursday at the market bell. The timeline aligns with recent crypto ETF launches.

Structure and Custody: Why This Spot XRP ETF Is Different

The Canary Capital product was filed under the Securities Act of 1933. This framework allows the ETF to hold XRP directly in custody.

Previously, U.S. XRP exposure often came through indirect structures. Those products invested in offshore entities that held the crypto.

Direct-hold design can simplify exposure. It may help the spot XRP ETF track the XRP spot market more closely, subject to trading costs and spreads.

Market Signals: XRP Price, Seven-Day Gain, and Liquidity Focus

XRP rose about 10% over seven days into the filing news cycle. It traded near $2.40 at the time of writing, per CoinGecko.

Because listing can affect flows, market makers monitor seeding and spreads. The spot XRP ETF launch window concentrates attention on early liquidity.

Therefore, the XRP market tracks headlines on SEC steps and Nasdaq procedures. Each update narrows timing and setup details.

Pipeline Check: DTCC Shows Multiple Spot XRP ETF Applicants

The Depository Trust & Clearing Corporation (DTCC) lists other spot XRP ETF candidates. The roster includes 21Shares, ProShares, Bitwise, Volatility Shares, REX-Osprey, CoinShares, Amplify, and Franklin Templeton.

As the government shutdown winds down, agencies resume normal processing. That context matters for the SEC, Nasdaq, and clearing workflows.

Each issuer will still follow its own path. Schedules depend on filings, certifications, and operational confirmations.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 12, 2025 • 🕓 Last updated: November 12, 2025