Cryptocurrency investment products faced heavy withdrawals last week, ending a two-week inflow streak.

Global crypto exchange-traded products (ETPs) recorded $1.43 billion in outflows, according to CoinShares. This marked the biggest weekly losses since March 2025.

The outflows coincided with a downturn in leading cryptocurrencies. Bitcoin (BTC) slid from above $116,000 on August 18 to $112,000 by week’s end, according to CoinGecko.

Ether (ETH) also declined, moving from $4,250 at the start of the week to below $4,100 on Tuesday.

The sell-off disrupted what had been a positive trend, as the prior two weeks saw $4.3 billion in inflows. Investors appeared to pull capital across both Bitcoin and Ether products as the market reacted to macroeconomic signals from the United States.

Ether ETFs Face Second-Biggest Outflows on Record

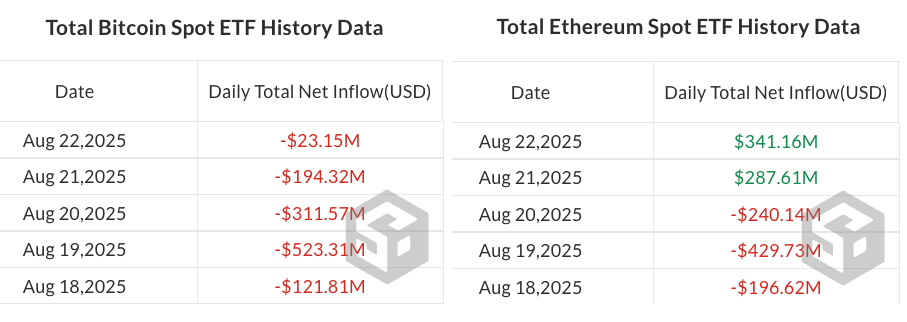

Data from SoSoValue revealed that spot Ether exchange-traded funds (ETFs) saw their second-largest outflows on record.

On Tuesday alone, investors withdrew nearly $430 million from Ether funds.

The total outflows for the week reached $440 million, highlighting the scale of withdrawals despite Ether’s mid-week rebound.

This came as Ether briefly recovered after the Federal Reserve’s policy outlook appeared less hawkish.

However, the recovery failed to offset early-week selling pressure. By the end of the week, Ether remained one of the key drivers of overall ETP outflows.

In contrast, Bitcoin products experienced much larger withdrawals, totaling more than $1 billion for the week.

These numbers underline the sensitivity of crypto ETP flows to both price action and monetary policy sentiment.

CoinShares Cites “Polarized” Investor Sentiment

James Butterfill, head of research at CoinShares, said the week’s events reflected a split in investor outlook.

“Outflows reached $2 billion early in the week,” he explained, linking the move to investor caution around US monetary policy.

According to Butterfill, sentiment began to change after Federal Reserve Chair Jerome Powell addressed the Jackson Hole Symposium.

His comments were viewed as more dovish than expected, sparking inflows of around $594 million later in the week. Still, net flows remained negative across the week, with Bitcoin taking the heaviest losses.

Butterfill pointed out that while both Bitcoin and Ether saw volatility, Ether showed a sharper mid-week recovery.

This rebound did not prevent the overall $440 million weekly outflow from Ether products, compared to Bitcoin’s $1 billion-plus withdrawal.

Month-to-Date and Year-to-Date Trends Diverge

Despite last week’s losses, Ether continues to show stronger year-to-date metrics compared to Bitcoin.

Data from CoinShares revealed that Ethereum inflows represent 26% of total assets under management (AUM) so far in 2025. By contrast, Bitcoin’s year-to-date inflows account for just 11% of AUM.

The difference is also clear in month-to-date figures. Bitcoin has seen around $1 billion in outflows, while Ether posted $2.5 billion in inflows.

This divergence suggests that while both assets face short-term volatility, investors have maintained stronger allocation toward Ether over the broader timeline.

Meanwhile, altcoin products showed mixed flows. XRP (XRP) recorded $25 million in inflows, while Solana (SOL) gained $12 million.

On the other hand, Sui (SUI) lost $13 million and Toncoin (TON) dropped $1.5 million.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: August 25, 2025 • 🕓 Last updated: August 25, 2025