After a rough tumble last week, Cardano is starting to claw its way back up the charts.

Bitpanda Shuns London IPO Over Weak Liquidity Concerns

Crypto exchange Bitpanda has ruled out a public listing in London. Co-founder Eric Demuth told the Financial Times that the London Stock Exchange (LSE) lacked the liquidity needed for a strong debut.

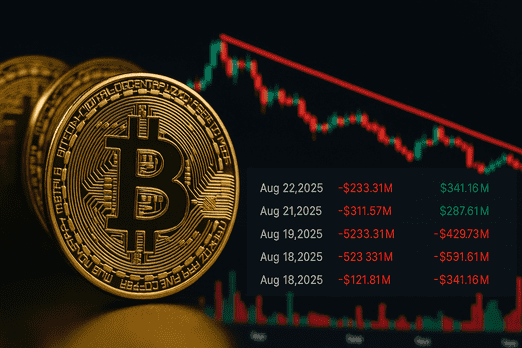

Crypto ETPs Record $1.4B Outflows as Bitcoin and Ether Retreat

Cryptocurrency investment products faced heavy withdrawals last week, ending a two-week inflow streak.

Celebrity Instagram hacks spark another crypto scam storm

Just when you think the wild ride’s settled, boom! Hackers pull off another slick move.

Bitget CEO predicts Ethereum breaking new ATHs $5200 range

Bitcoin is expected to trade in the $110,000–$120,000 range over the next one to two weeks, while Ethereum looks stronger, with targets between $4,600 and $5,200.

Ethereum’s rally past $4,300 signals robust ecosystem demand and the potential onset of an altcoin season.

A key catalyst has been Federal Reserve Chair Jerome Powell’s unexpectedly dovish comments, which boosted risk-on appetite across markets.

On-chain data shows capital rotation underway, with whales selling Bitcoin to increase Ethereum exposure, further accelerating ETH’s momentum.

This macro easing, combined with sustained ETF inflows and Ethereum’s growing utility, suggests ETH is positioned to outperform in the near term.

Bitcoin should remain supported by institutional demand, but Ethereum’s fundamentals and ETF prospects give it an edge in leading the next leg of the market rally.

Gracy Chen, CEO of Bitget

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.