BlackRock’s Bitcoin ETF, IBIT, once the undisputed chad in the arena, is suddenly sharing the limelight.

When Bitcoin hits $200k, what will happen with XRP?

There are speculations in the crypto community. Bitcoin is flirting with $115,000 right now, but many ask what if it blasts past $200,000?

India’s COINS Act is the blueprint for the nation’s Web3 future?

India stepping up in the crypto game big time. Picture this, India, a land bursting with tech talent, yet stuck in a regulatory fog that’s got blockchain builders hitting the pause button.

Money market funds are Wall Street’s weapons against stablecoins?

Wall Street suddenly feeling the heat from a flashy new contender, stablecoins. These digital dollars are making waves, promising speed, transparency, and blockchain magic.

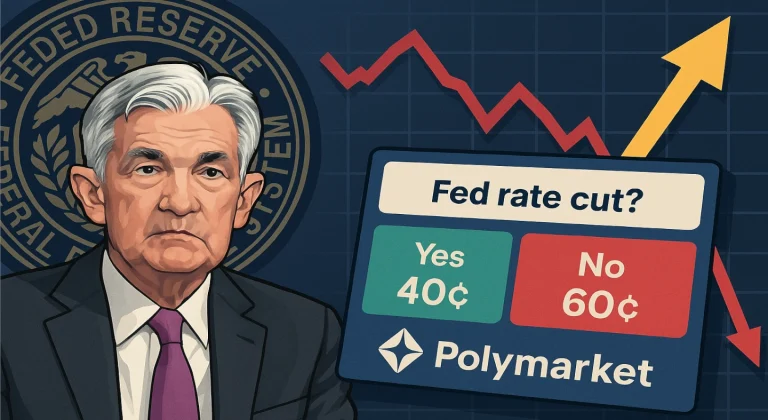

Fed rate cut? Not so fast, Polymarket’s betting big on no

The people on Polymarket are throwing down their chips with 96.3% odds that the Federal Reserve’s gonna leave interest rates exactly where they’re at.

XRP tanks double digits after ETF freeze

XRP’s latest drama is a real punch to the gut. And they’re a blackbelt drama queen, just saying.

Bitcoin’s long game gets reckless, and it’s not good

Alright, the Federal Reserve’s about to drop its rate decision in a few days. The crypto market?

FTX’s next payout comes on September 30th, here’s what you gotta know

The story of FTX’s bankruptcy drama, it ain’t over yet. The company, tangled in one of crypto’s biggest collapses, finally rolling out more cash to its creditors. The next payout? Locked in for September 30th.

PUMP token tanks, no airdrop coming soon

The native token of Pump.Fun, just took a nosedive, slipping over 14% in a single day. It’s now trading well below its initial ICO price of $0.004.