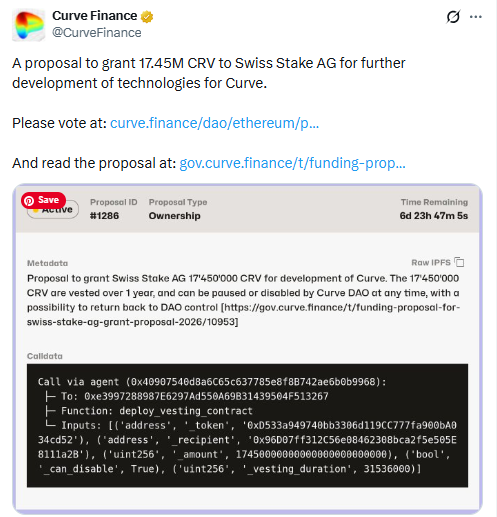

Michael Egorov, the founder of Curve Finance, proposed a 17.45 million CRV grant for development work.

The Curve CRV grant would support research, security, and tech work tied to Curve’s lending system.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The proposal values the Curve CRV grant at about $6.6 million at current prices. Egorov posted the request on the Curve DAO governance forum on Sunday.

The Curve CRV grant would go to Swiss Stake AG, the firm behind Curve’s software work. Egorov described the grant as a follow up to a prior grant from late 2024.

Michael Egorov Says Swiss Stake AG Needs Funding for a 25 Person Team

In the Curve DAO post, Michael Egorov wrote that the Curve CRV grant would fund “software research and development, infrastructure, security, and ecosystem support.”

He said the funding would keep the 25 member team at Swiss Stake AG working on Curve.

Egorov tied the Curve CRV grant to continued maintenance of Curve smart contracts and software repositories. He also linked the grant to integrations and crosschain functionality work.

“This grant will fund software research and development, infrastructure, security, and ecosystem support, ensuring that the 25-member team at Swiss Stake AG can continue its ongoing contributions to Curve,”

Egorov wrote.

Curve 2026 Plan Names Llamalend v2 and an Onchain FX Swap

Egorov shared a 2026 objective list within the Curve CRV grant proposal. The list includes launching and scaling Llamalend v2, a new version of Curve’s lending system.

The same Curve DAO proposal also names an onchain FX swap. Egorov described it as an onchain foreign currency swap, alongside other upgrades.

He also referenced user interface work in the Curve CRV grant plan. The post framed UI improvements as part of a wider set of software changes.

Swiss Stake AG Terms Cover Open Source IP, Staking, and Reporting

The proposal says Swiss Stake AG will release any intellectual property created with the Curve CRV grant under an open source license. The license would remain compatible with Curve’s software repositories.

If the Curve DAO approves the Curve CRV grant, Swiss Stake AG may stake some received CRV to generate yield. However, the proposal says the firm cannot use the funds outside the purposes listed.

Swiss Stake AG also committed to reporting on spending. The proposal says the firm will provide bi annual reports on how it used the grant amount.

Swiss Stake AG Revenue Streams Include Curve Lite and veCRV Wrappers, Egorov Writes

In the Curve DAO proposal, Michael Egorov wrote that Swiss Stake AG “remains largely dependent on community support” to continue its work. He linked the Curve CRV grant request to that reliance.

Egorov said Swiss Stake AG built income streams through Curve Lite deployments on other networks. He also said the firm earned system fees by staking veCRV through wrapper protocols.

“We have additionally earned system fees by staking veCRV via several wrapper protocols (Convex, StakeDAO, Yearn) as a minority participant,”

Egorov wrote. He added that the revenue did not yet make the company sustainable.

Curve Finance TVL Near 2.2B as Curve DAO Reviews the Curve CRV Grant

Curve Finance launched in early 2020, according to the report. It currently holds about $2.2 billion in total value locked, based on DefiLlama data.

That Curve Finance TVL level ranks Curve as the 21st largest DeFi protocol in the cited dataset. The Curve CRV grant proposal now sits in the Curve DAO process.

The report cited the Curve DAO forum post and labeled Curve Finance as the source for the proposal material. The Curve CRV grant request remains tied to that governance discussion.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 15, 2025 • 🕓 Last updated: December 15, 2025