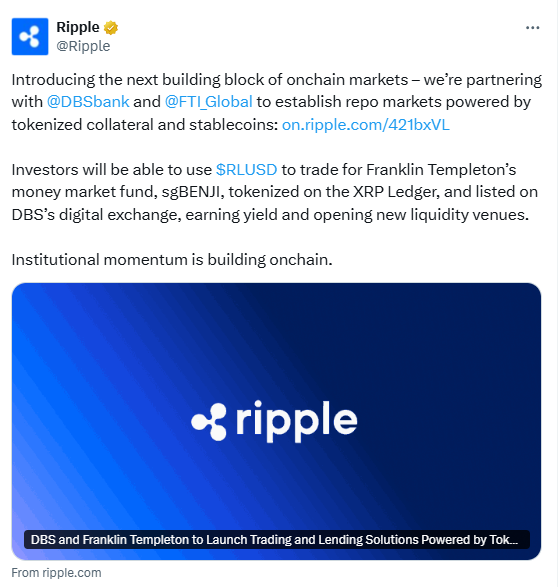

DBS, Franklin Templeton, and Ripple signed a memorandum of understanding to deliver tokenized trading and tokenized lending for institutional investors.

The plan runs on the XRP Ledger (XRPL) and centers on Ripple USD (RLUSD) and Franklin Templeton’s sgBENJI tokenized money market fund. DBS Digital Exchange will list both assets for accredited clients.

DBS Digital Exchange will pair RLUSD with sgBENJI so clients can move between a stablecoin and a fund position inside one venue.

Settlement occurs on XRPL, while issuer records for the fund remain with Franklin Templeton. This keeps custody and reporting aligned with bank standards.

The firms said the workflow addresses round-the-clock operations in digital markets. Investors can rebalance without wiring cash across separate platforms.

The approach focuses on audit trails, access controls, and clear responsibilities under the bank’s oversight.

“Digital asset investors need solutions that can meet the unique demands of a borderless 24/7 asset class,”

said Lim Wee Kian, CEO of DBS Digital Exchange. “This partnership demonstrates how tokenized securities can play that role while injecting greater efficiency and liquidity in global financial markets,” he said.

How tokenized lending works: RLUSD, sgBENJI, and collateral

Franklin Templeton will issue sgBENJI on the XRP Ledger (XRPL). Clients then swap RLUSD for sgBENJI and back through DBS Digital Exchange.

On-chain instructions move the stablecoin, while fund shares update in issuer systems. The split keeps the ledger for securities with the issuer and trading infrastructure with the bank.

DBS manages exchange access, custody, and reconciliations. As a result, tokenized trading and settlement stay within regulated entities. Haircuts, eligibility lists, and reporting use existing bank policies.

In the next phase, DBS plans to accept sgBENJI as collateral for credit. The bank is evaluating repurchase agreements with DBS and loans via third-party platforms, with DBS acting as collateral agent.

That role covers margin processing, custody of pledged assets, and collateral recalls under documented procedures.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Market context: institutional demand and on-chain settlement

Industry coverage cites a Coinbase and EY-Parthenon survey showing 87% of institutional investors expect to allocate to digital assets by 2025. This demand underpins bank-grade products such as tokenized lending, tokenized trading, and stablecoin rails that connect to fund exposures.

Separately, SBI Shinsei Bank, Partior, and DeCurret DCP signed a memorandum of understanding to test multicurrency tokenized deposits for cross-border settlements.

Their study targets real-time clearing across currencies with continuous operations.

The work aligns with the goal of keeping settlement on chain while banks manage balance-sheet risk.

These efforts show how RLUSD can provide the transactional leg, sgBENJI can provide a yield-bearing instrument, and XRPL can record settlement.

DBS supplies exchange access and custody, while Franklin Templeton maintains fund records and Ripple supports RLUSD issuance and XRPL integrations.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: September 18, 2025 • 🕓 Last updated: September 18, 2025