Listen guys, the XRP story just got a whole lot more intriguing.

Ripple CEO Brad Garlinghouse dropped the bombshell that the SEC is dropping its appeal, effectively ending the lawsuit. But something interesting happened before.

Lawsuit over, price up

XRP’s price went ballistic, surging from $2.3 to $2.6 in a flash. But here’s the thing, some investors seemed to have a crystal ball.

They loaded up on XRP before the news broke, now owning over 46 billion coins. Let me tell you, it’s quite suspicious, isn’t it? One might wonder if these investors had inside information or just a hunch.

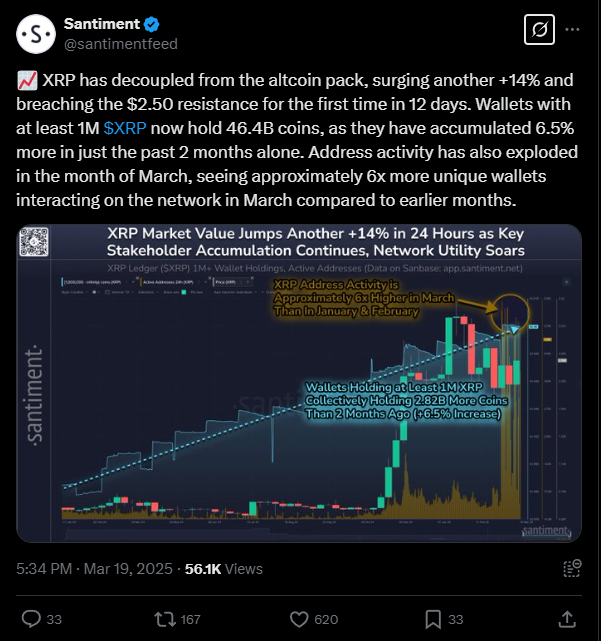

Fair enough, Santiment’s analysis shows that big XRP holders increased their stash by 6.5% in the two months leading up to the announcement.

There were hints that the case might be wrapping up, like similar lawsuits ending and former White House officials claiming it was already closed.

Visible growth

And not only the price experienced a nice jump, Ripple network activity also skyrocketed in March, with six times more unique wallets interacting with it compared to previous months.

The XRP army is already making big predictions, but there’s also talk of a classic sell-the-news moment.

Remember when XRP spiked after Trump’s election win? It was all hype about regulatory changes, but the momentum didn’t last.

Up or down?

Now that the lawsuit is over, will XRP defy expectations and hit new highs, or will it tumble back down to earth?

The million dollar question, right? Only time will tell, but this is a story that’s far from over.

So, did these investors have a gut feeling or something more? No one knows.

Maybe they just played the odds, but it’s hard not to wonder if there was more to it. Either way, XRP’s journey is about to get a lot more interesting.

Have you read it yet? The $11 million Netflix heist

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.