El Salvador’s bold Bitcoin journey is paying off big time. Since adopting Bitcoin as legal tender, the Central American nation has racked up an impressive $111 million in profits.

Political changes

With Donald Trump making his way back to the White House, it seems like a win for crypto enthusiasts everywhere, including Tesla’s Elon Musk and El Salvador’s own President Nayib Bukele.

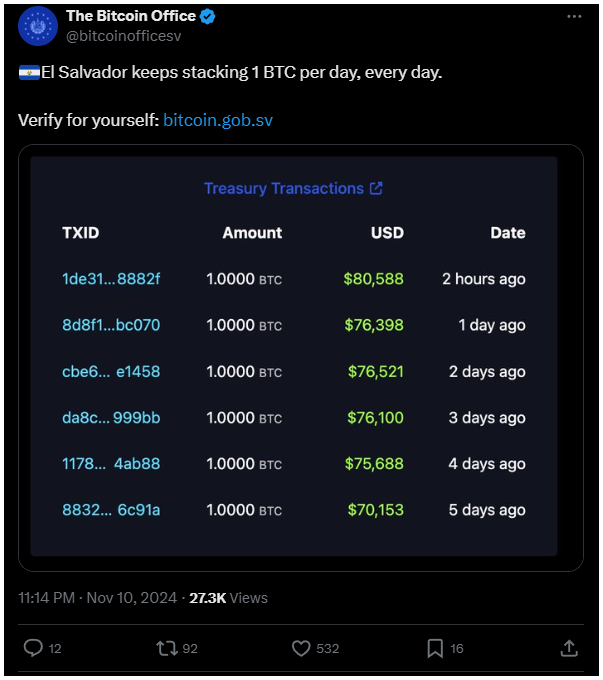

Bukele has committed to adding one Bitcoin to his country’s publicly accessible cold wallet every day. And he did that.

In March, Bukele shared the wallet address with a cheeky comment: “It’s not much, but it’s honest work.” This nods to a popular internet meme about hard work and humility, which has resonated with many.

Bukele’s effective strategies for tackling crime in El Salvador have gained him some serious public support.

His administration has made significant strides against the infamous gangs while the country seeks a fresh identity.

El Salvador also eliminated all taxes on tech and is rolling out the welcome mat for companies like Google, aiming to become the next big crypto hub.

When $100K Bitcoin?

Thanks to the recent U.S. elections, Bitcoin has been on fire, jumping past $81,000 for the first time ever!

This surge has led to record inflows into Bitcoin ETFs, with $1.63 billion added between November 4 and 8.

El Salvador is reaping the rewards of this price surge. The nation’s stash of 6,152 Bitcoins is now valued at around $456.44 million, so this means that what was once considered a risky move back in October 2021 has turned into a 32.96% profit for the government.

As Bitcoin hit an all-time high of $81,358, everyone is buzzing about whether it can reach the elusive $100,000.

Of course it can, it’s not matter of if, but when Network economist Timothy Peterson believes this could happen within three months, drawing parallels to BTC’s rallies in 2017 and 2021.

As of now, Bitcoin is trading at about $80,475. The trading volume is sizzling too, with over $92 billion changing hands in just 24 hours.

Greed

But not everything is sunshine and rainbows. The Crypto Fear & Greed Index sits at 80, showing extreme greed among traders.

Historically, this kind of sentiment can lead to tough times ahead for the market, even though every single BTC holder is currently in profit.