Senator Elizabeth Warren rejected Changpeng Zhao’s (CZ) defamation threat as “without merit.” Her lawyer said the Oct. 23 X post correctly summarized the Bank Secrecy Act violation CZ admitted.

The dispute followed President Donald Trump’s pardon of the Binance founder and renewed scrutiny of reported links among Binance, the USD1 stablecoin, and World Liberty Financial.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Elizabeth Warren vs. Changpeng Zhao: Defamation Claim and Trump Pardon

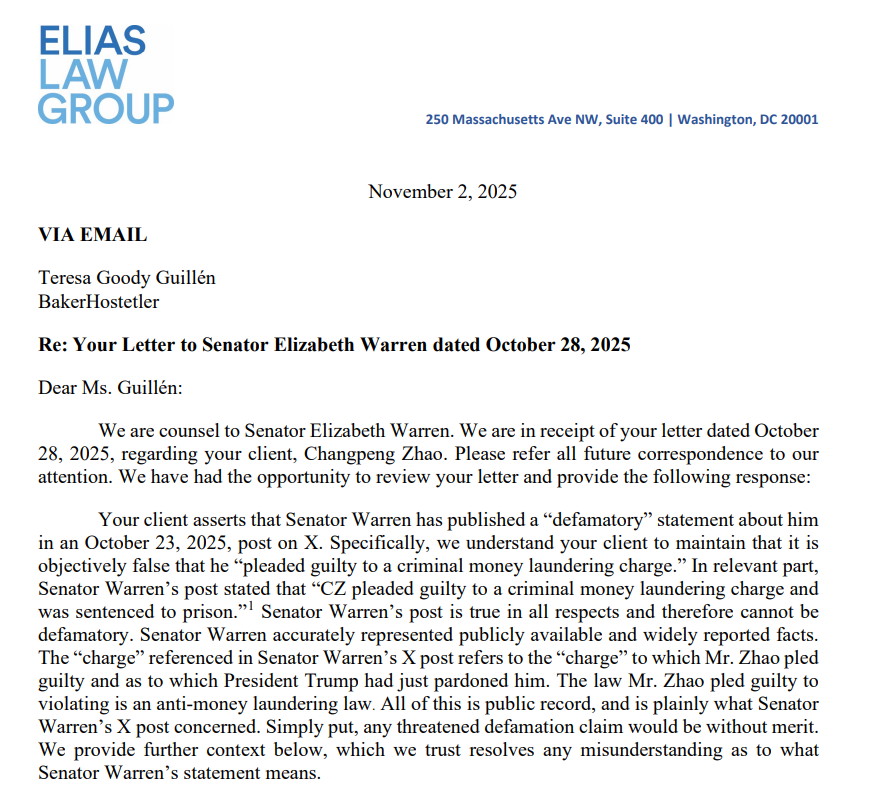

The New York Post reported that Teresa Goody Guillén, CZ’s lawyer, threatened to sue Elizabeth Warren for “defamatory statements.”

The letter demanded the removal of the Oct. 23 X post that criticized the Trump pardon as “corruption.”

Warren’s attorney, Ben Stafford, responded in a letter obtained by Punchbowl News. He said any threatened defamation claim is “without merit.” He added that the post relied on public records and widespread reporting.

The X post said CZ

“pleaded guilty to a criminal money laundering charge and was sentenced to prison.”

Days later, CZ wrote,

“there were NO money laundering [charges].”

The exchange set the central issue: the exact Bank Secrecy Act offense and how defamation law applies to a public figure.

Bank Secrecy Act Facts: What CZ Pleaded Guilty To

Court filings show CZ pleaded guilty in November 2023 to failing to maintain an effective Anti-Money Laundering program at Binance, violating the Bank Secrecy Act.

A Seattle federal court sentenced him to four months in April 2024.

Stafford wrote that Warren’s post

“simply references the fact that Mr. Zhao pled guilty to a violation of U.S. anti-money laundering law.”

He added,

“Her X Post does not state — and should not be construed to state — that he pled guilty to any other money laundering charge.”

Therefore, the defense rests on the charge’s wording, the April 2024 sentence, and the November 2023 plea.

These dates and terms appear in court records and press coverage, which the letter cites as the basis for accuracy.

USD1 Stablecoin, Binance, and World Liberty Financial: Reported Links

The Wall Street Journal and Bloomberg reported that Binance helped create USD1, a stablecoin tied to World Liberty Financial.

Those reports surfaced alongside reactions to the Trump pardon, placing the token inside a political and business context.

Moreover, USD1 reportedly featured in a $2 billion deal for MGX, a UAE state-owned investment firm, to buy a stake in Binance in March. The figure and timing drew attention because they appeared close to the pardon debate.

Additionally, Politico reported on Oct. 25 that the pardon followed a months-long, costly outreach by Binance and its legal team to figures in Trump’s circle. The reporting formed part of the background for Warren’s Senate action referencing the pardon.

Actual Malice Standard: Why the CZ Defamation Case Is Hard

Stafford emphasized the actual malice requirement that governs public figure defamation claims. To prevail, CZ must show a false statement of fact published knowingly or with reckless disregard for the truth.

The letter argued Warren’s statements were true in all respects, because CZ pleaded guilty to violating an anti-money-laundering law—the Bank Secrecy Act. The post did not state he pleaded guilty to money laundering itself.

Furthermore, the letter said the post reflected “publicly available and widely reported facts.” That framing aims to defeat a defamation claim early by showing no falsity and no actual malice.

Retraction Demand and Senate Resolution: What CZ’s Lawyer Sought

Goody Guillén asked Warren to retract statements in the Oct. 23 X post and in a Senate resolution that sought to denounce the Trump pardon of CZ. The letter warned that CZ could “pursue all legal remedies” if she refused.

Warren’s legal response did not offer wording changes. Instead, it highlighted the November 2023 plea, the April 2024 four-month sentence, and the Bank Secrecy Act violation. It also cited the reporting on USD1, World Liberty Financial, and the MGX stake bid as relevant context.

Meanwhile, CZ’s public reply

“there were NO money laundering [charges]”

underscored the distinction between money laundering and failure to maintain an effective AML program.

That legal nuance now anchors the dispute over the wording of Warren’s X post and any potential lawsuit.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 3, 2025 • 🕓 Last updated: November 3, 2025