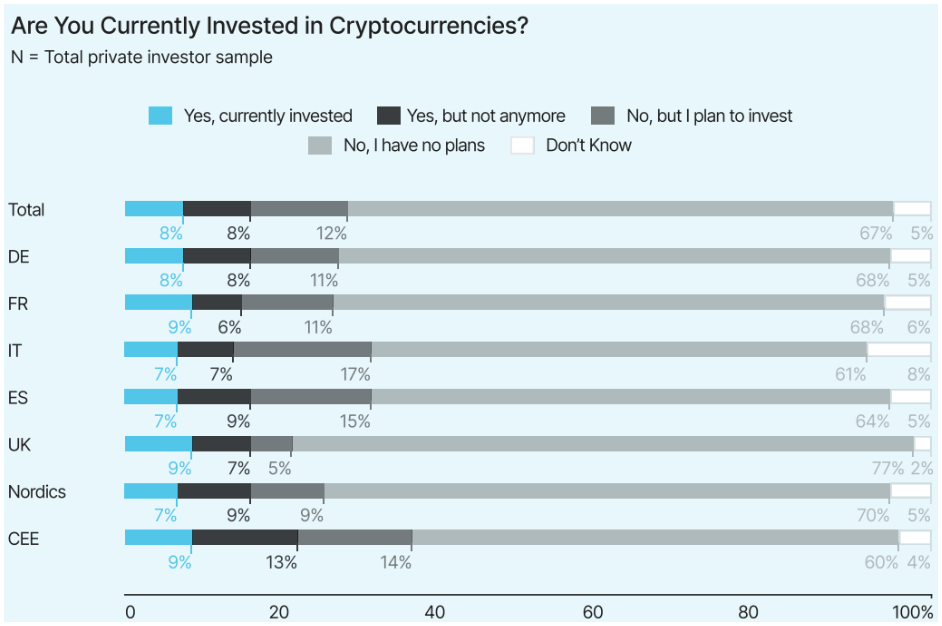

There’s a disconnect brewing in the EU’s financial scene. Despite rising demand for cryptocurrency services, fewer than one in five European banks are offering digital asset products.

Based on a survey’s numbers, only 19% of these institutions are on board, while over 80% acknowledge crypto’s growing importance.

It’s like they’re stuck in neutral, watching the crypto train leave the station without them.

Disconnection with the reality?

A new survey by Bitpanda reveals that more than 40% of business investors already hold cryptocurrencies, with another 18% planning to jump in soon.

But here’s the surprising part, only 19% of financial institutions think their clients are clamoring for crypto services.

That’s a 30% gap between reality and perception. It’s like they’re living in a different world.

The main barriers to adoption aren’t regulatory, they’re internal, usually lack of resources or knowledge.

Lukas Enzersdorfer-Konrad, Bitpanda’s deputy CEO revealed that financial institutions know crypto is here to stay, but they’re not offering services to match demand.

He suggests they should check their revenue outflows to see where customers are moving their money. It’s not rocket science, the demand is real.

Missing out?

Experts say the point is if banks start offering more crypto products, it could boost European adoption.

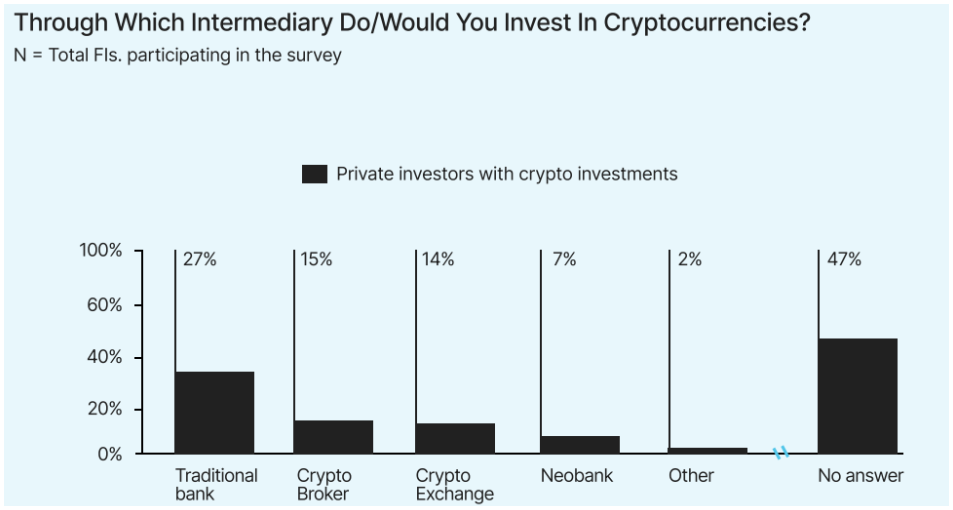

A significant chunk of investors, 27% would prefer to invest through traditional banks, not crypto exchanges.

But for now, exchanges are the go-to choice for many, especially business investors. Because there is no other choice.

Banks without crypto integrations risk losing revenue to their competitors or crypto-native companies.

With the EU’s Markets in Crypto-Assets Regulation providing clarity, the time to act is now. As Enzersdorfer-Konrad warns, this is a wake-up call for banks to get on board before it’s too late.

“Financial institutions that delay integrating crypto services risk losing revenue.”

Not if, but when

Right now it’s no longer about being a pioneer, it’s about keeping up with the changing times. The EU’s regulatory environment is developing, with MiCA leading the way.

Banks need to step up their game or risk being left behind in the digital finance revolution. It’s time to stop underestimating the demand and start meeting it head-on.

Have you read it yet? South Korea stopped Upbit’s ban

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.