Listen, you ever get that feeling? The world’s holding its breath, waiting for Jerome Powell to step up to the mic, like he’s about to drop the hottest track of the year.

But while Wall Street’s sweating bullets over the next Fed move, Bitcoin’s out here doing the cha-cha, barely breaking a sweat.

Volatility

Let’s talk about April. Markets? Shaky. Gold? Doing its usual I’m safe, trust me routine. S&P 500? Floundering like a wiseguy who lost his lucky coin.

But Bitcoin? The big boss took a serious dip, down nearly 12% early in the month. Gold slipped about 3%, S&P 500 dropped 7%.

Everybody’s crying into their cappuccino. Then, outta nowhere, Bitcoin snaps back, grabs the wheel, and by month’s end, it’s up over 9%. Gold’s at 7%, S&P 500’s limping along at 4%.

Now, the so-called experts, they love to debate. is Bitcoin the new gold, they ask. Please.

Gold’s been the safe haven since your grandma’s grandma was hiding coins in the mattress.

Bitcoin? It’s more like your flashy cousin who shows up to the family BBQ in a Lambo, sometimes he wins big, sometimes he’s calling you for bail money.

The real Fed funds rate is significantly above the neutral rate of interest. Since 1971, when the funds rate less the neutral rate has been as high as it is today, the economy was either headed to a recession or a growth recession. The Fed needs to ease!https://t.co/cmZvbGqspf pic.twitter.com/qjaG0Kfblw

— Jim Paulsen (@jimwpaulsen) May 2, 2025

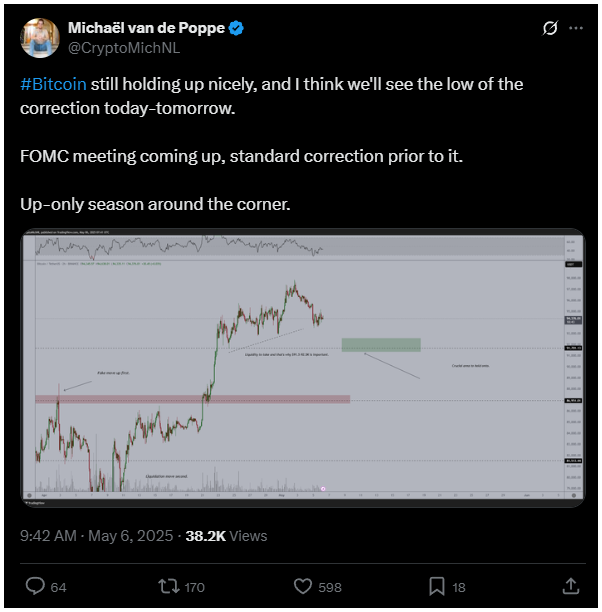

Up only?

But here’s what’s really got the suits nervous, because every time the real federal funds rate jumps above the natural rate, history says the U.S. economy either stalls out or hits the skids.

Trump’s hollering for rate cuts, but the Fed’s playing it cool, weighing a weak Q1 GDP against strong jobs numbers and those pesky tariffs.

And Bitcoin’s out here, soaking up cash like a sponge, outpacing the old guard, making the up-only crowd look like prophets.

Wishful thinking

And as we roll into the FOMC meeting, traders are on edge. Bitcoin’s been consolidating, sideways, waiting for a sign. Volatility’s in the air, you can smell it, like rain before a storm.

Some say if Powell goes soft, Bitcoin could rocket past $100,000. If he talks tough, maybe we see a dip. Either way, the sharks are circling, looking for that perfect entry.

If you’re a gambler, maybe you buy the dip, keep your stop-loss tight, and pray to Satoshi.

If you’re old school, maybe you stick with gold and watch from the sidelines.

But Bitcoin’s not waiting for anyone’s permission. FOMC or not, this boss moves to his own beat. And if you blink, you might just miss the action.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.