Let’s talk about gold-backed tokens, guys. You know, those coins on the blockchain that say, hey, I’m worth my weight in gold, literally!

Now, with gold smashing through all-time highs at $3,500 an ounce, these tokens are getting more attention as well.

Milestone

Last week, the total market cap of gold-backed cryptocurrencies hit $2 billion. That’s no chump change, considering they were barely a blip at $12.85 million back in 2020.

And with Goldman Sachs whispering that gold could hit $4,000 by next year, you gotta wonder, should you be stacking these tokens in your crypto portfolio, or is this just another flashy distraction?

Gold-backed cryptos are digital tokens, just like the other stablecoins, each pegged to a chunk of real gold, usually one troy ounce per token.

They’re supposed to be less wild than Bitcoin, but with all the perks of crypto, so you can split ‘em, move ‘em, trade ‘em anytime, anywhere.

Sounds like the best of both worlds, right? But don’t start popping the champagne just yet.

Liquidity?

See, these tokens are like a fancy sports car that can only drive in first gear. They’ve got potential, but they’re stuck on the sidelines in DeFi, experts warn.

Regulatory headaches, thin liquidity, and barely any use cases on major platforms keep them from joining the big leagues.

For now, you can’t even use the top dogs, PAXG and XAUT, as collateral on Aave, and trading them on Uniswap? Let’s just say you might get more slippage than you would want.

Track record

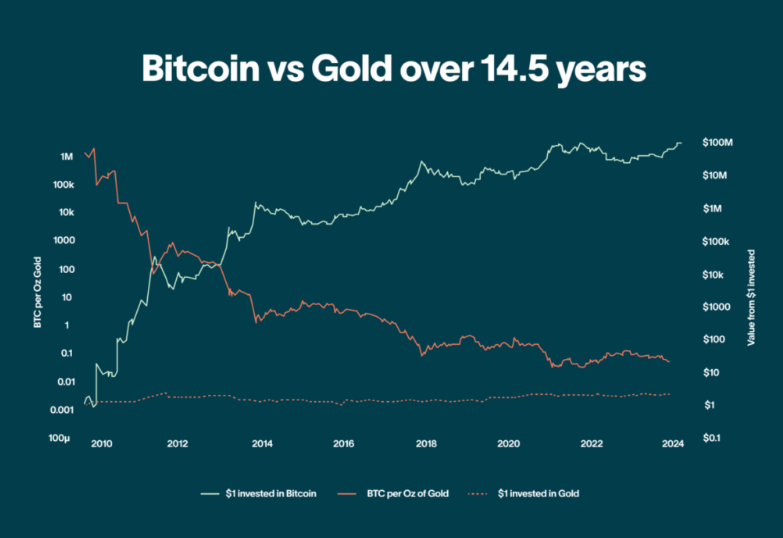

Still, gold’s got history. When the world goes sideways, wars, recessions, inflation, gold’s always there, like your old uncle who never misses a family dinner. Bitcoin?

Eh, it’s still earning its stripes as a safe haven. Since Trump took office in January, Bitcoin’s been knocked down from $109K to $85K, losing $500 billion in market cap.

Meanwhile, gold’s been flexing, up 6.6% to over $3,000 an ounce.

If you want the stability of gold with the convenience of crypto, these tokens might scratch that itch, especially when traditional markets are closed and you need to make moves fast.

But don’t forget, when Wall Street opens, the action cools off, and the premiums on these tokens vanish pretty quick.

Have you read it yet? Swiss National Bank Firmly Rejects Bitcoin Reserve Proposal Despite Crypto Industry Pressure

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.