In one of those classic plot twists, gold has just taken a little tumble. Analysts shared that after rising more than 30% since August to flirt with $4,400, the precious metal got cold feet and dropped about 6%.

While some investors might panic, the smart money’s eyeing the bigger picture, namely, Bitcoin’s rising star and its growing case as the ultimate “digital gold.” They’re right?

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Bitcoin/gold ratio

As gold’s price dips, the Bitcoin/gold ratio, think of it as a scoreboard measuring which asset is stealing the spotlight, has nudged upward by around 8%.

That’s right, Bitcoin is gaining ground against its old-school rival, gold. It’s a small victory, but enough to spark whispers that maybe, just maybe, Bitcoin is finally stepping into the limelight as the modern, tech-savvy version of gold.

This time for real, and not just in the narrative.

Safe haven

Wall Street is watching with keen interest. Bitwise’s chief, Matt Hougan, offers a compelling take.

He’s noticed that gold’s rally has been mainly fueled by central banks stockpiling it like squirrels hoarding acorns since 2022.

But the recent price jump might be a sign that the sellers are finally exhausted, making way for more buying.

Hougan suggests Bitcoin could follow a similar path, riding the coattails of gold’s transformation into a hot commodity.

Long-term Bitcoin holders haven’t exactly been the picture of patience, industry observers reported that some have been selling off since July, trading out of BTC into ETFs and corporate treasuries.

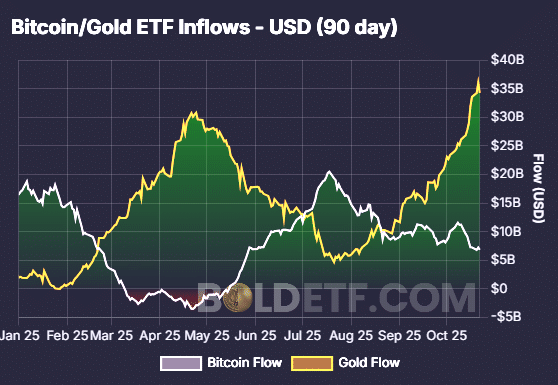

Yet, Hougan points out that these sellers are likely running out of steam. As gold’s inflows hit $35 billion from just $5 billion earlier in the year, the appetite for precious metal is clear.

That cash flood is bolstering gold’s price and its narrative as a safe haven.

Digital gold

Interestingly enough, during this gold rush, Bitcoin saw a contrasting drop. ETF inflows shrank from $20 billion to $8 billion, seemingly swapping places with gold. But expert say don’t dismiss Bitcoin just yet.

When gold’s momentum stalls, the crypto’s potential to bounce back could be swift. If gold’s decline continues, the spotlight might shift back to Bitcoin, potentially pushing its value higher.

The technical charts also hint at a possible rally. The BTC/gold ratio, a key indicator, as mentioned earlier, has been holding steady above essential moving averages since 2023, and it’s now testing critical support levels.

If this support holds, a rally could push the ratio up to 37, a roughly 46% increase, and that might mean Bitcoin hitting around $150,000 per coin. Nothing is certain, of course.

In the end, gold’s stumble might just be the prologue to Bitcoin’s next headline-making chapter.

The question is, will this ailing metal give Bitcoin its long-awaited “digital gold” moment? The moment of truth is on the horizon.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 26, 2025 • 🕓 Last updated: October 26, 2025

✉️ Contact: [email protected]