Let me tell you a story about Bitcoin that’s a little different than the usual buy early, get rich overnight tale. Back in 2010, when Bitcoin was just a few cents, some dreamers bought in.

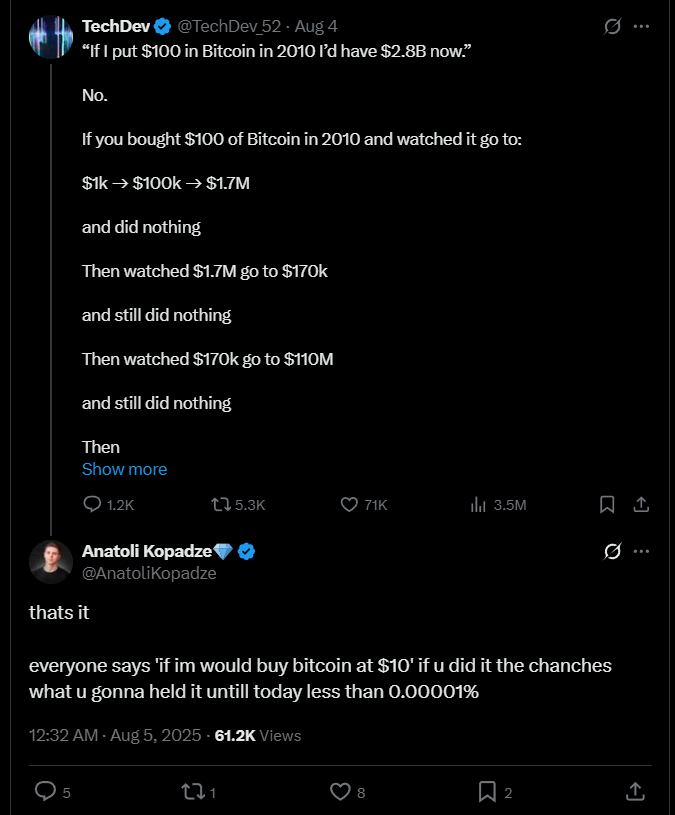

But hanging onto those coins for over a decade? That’s where the real drama begins. A crypto trader named Techdev just laid down the harsh truth on X.

Stash of coins

It ain’t as simple as throwing $100 into Bitcoin then chilling with billions today. Nope, it’s a crazy ride only the strongest could survive.

See, Bitcoin’s price history reads like a thriller. We’re talking about swings from millions, to hundreds of thousands, back up to tens of millions, then crashing again.

Techdev broke it down, from $1.7 million slipping to $170,000, growing to $110 million, then plummeting to a mere $18 million, all for the same stash of coins.

That kind of ride would make anyone’s head spin, or empty their wallet out of fear.

Consensus

And Techdev isn’t alone at all, this idea echoes through the crypto community.

The big names, like crypto entrepreneur Anthony Pompliano, agree, it’s easier said than done to hold through the madness.

You need what the community calls diamond hands, that stubborn grit not to sell even when the market’s screaming at you.

Let’s get real, most of us might’ve blown those early coins on pizza, and we know at least one guy who did that. Or lost old wallets.

Or panicked during crashes. Erick Pinos from Nibiru Chain hit the nail on the head, and said holding Bitcoin meant making a daily choice, not selling when temptation peaked.

I agree and this is why I don’t like “if you had bought x” posts

You have to make a choice every day, every hour, not to sell, for years

— Erick Pinos (@erickpinos) August 4, 2025

Luck

And some of today’s Bitcoin billionaires? The critics say they likely were the lucky ones who forgot about their coins or just didn’t check wallets until Bitcoin became a household name.

No mafia-style grand plan, just blind luck and forgetfulness turned fortune.

So, next time someone brags about turning a few bucks into billions with Bitcoin, remember the real deal was surviving the terrifying ups and downs without flinching.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 9, 2025 • 🕓 Last updated: August 9, 2025

✉️ Contact: [email protected]