The crypto community is abuzz with the latest drama involving Pepe, the memecoin that’s been making waves Or a downward vortex, in this case.

A whale just sold off 196.1 billion Pepe token.

The sale was worth about $1.3 million, and the whale didn’t just stop there. They exchanged those tokens for WETH and then used it to buy PENDLE tokens.

Looks like memecoin gamble back on menu, guys

Now, you might wonder why this matters. Well, when whales sell, it’s like a big red flag waving in the market.

It signals a lack of confidence, and that can send prices tumbling, simply because the size of the transaction.

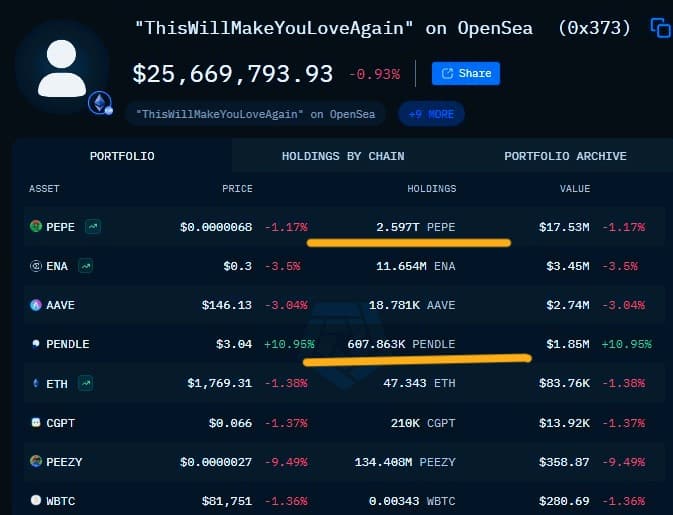

PEPE’s price has already taken a hit, dropping by about 6.5%, but despite all this selling, the whale still holds onto a massive stash of PEPE tokens, 2.597 trillion of them, valued at $17.53 million.

That’s a lot of tokens, and it shows that even with all the selling, there’s still some faith in PEPE.

Sad frog

But what does this mean for the future of PEPE? It’s a mixed bag, tbh. On one hand, retail investors are still showing interest, which could stabilize the price.

On the other hand, if the whale continues to sell, it could spell trouble.

Historically, when the RSI climbs above 50 after being oversold, it can lead to significant rallies. But if it fails to break through that barrier, PEPE could be in for a rough ride.

Crossroad

So, is PEPE in trouble? Maybe. But it’s not all doom and gloom. The token still has a strong following, and its trading volume is among the highest.

It’s like the old saying goes, when the whales sell, the sharks buy. Maybe this is just a sign that PEPE is due for a comeback.

Have you read it yet? The altseason is coming? Or it’s nothing but hopium?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.