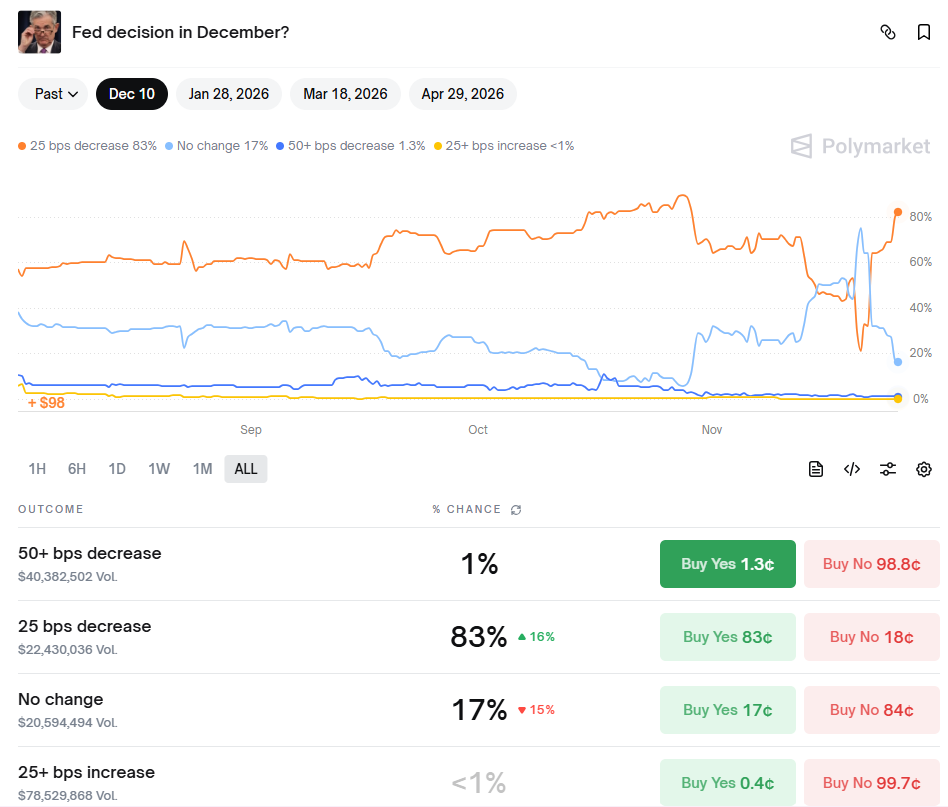

Traders are heavily backing a December interest-rate cut, with prediction markets now assigning about an 83 percent chance that the Federal Reserve trims its benchmark rate by 25 basis points at the December 10 meeting.

A Polymarket contract on the “Fed decision in December” shows the 25 bps decrease outcome dominating the board, while the “no change” option sits near 17 percent.

Contracts pricing a larger 50+ bps cut hold only about 1 percent, and the probability of a rate hike remains below 1 percent, signaling that markets see easing rather than tightening as the base case.

As these odds moved higher, liquidity poured into the market.

The screenshot of the Polymarket order book shows tens of millions of dollars staked across the different outcomes, with the 25 bps decrease contract attracting the bulk of the volume.

The pricing shift also lines up with a broader repricing of U.S. macro risk, after weeks of choppy trading across bonds, stocks, and commodities.

Gold Climbs on Fed Cut Bets as JPMorgan Sees Path Toward $5,055 per Ounce

At the same time, gold prices have already started to react. Spot gold climbed from levels near 4,000 dollars to as high as 4,165 dollars per ounce in early Tuesday trading, as investors positioned ahead of the expected cut.

The move followed comments from New York Fed President John Williams, who said he saw room for “further adjustment in the near term,” which markets interpreted as an opening for rate reductions.

Analysts note that lower interest rates typically support gold because it is a non-yielding asset.

Gold has already gained more than 50 percent year to date, helped by continued central bank demand and concerns over U.S. policy and global growth.

JPMorgan research adds that, under a prolonged easing cycle and persistent macro uncertainty, gold prices could reach about 5,055 dollars per troy ounce by the fourth quarter of 2026.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 25, 2025 • 🕓 Last updated: November 25, 2025