A wallet tied to LuBian moved 11,886 BTC soon after new DOJ actions. The value stood near $1.3 billion at current prices. The timing came within a day of the DOJ forfeiture case.

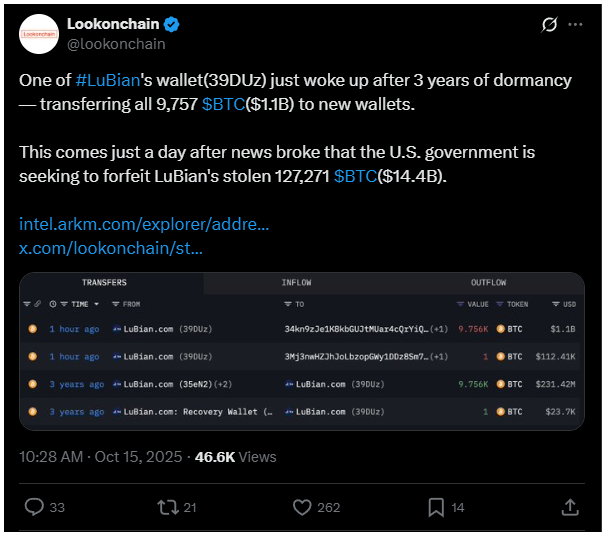

First, Lookonchain flagged 9,757 BTC moving to fresh addresses. That tranche was worth about $1.1 billion at the time. The wallet had been dormant for roughly three years.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Later, Arkham Intelligence tracked another 2,129 BTC transfer. That added about $238 million more. The combined LuBian Bitcoin transfer reached the 11,886 BTC mark.

Moreover, the sequence aligned with court developments. The DOJ forfeiture case was unsealed one day earlier. On-chain observers highlighted the near back-to-back steps.

DOJ forfeiture case: Prince Holding Group, Chen Zhi, and $14.4B

The DOJ forfeiture case names Prince Holding Group. The company is based in Cambodia. Prosecutors tied it to large crypto fraud schemes.

Authorities identified Chen Zhi as the founder. Charges include wire fraud and money-laundering conspiracy. The complaint targets about $14.4 billion in Bitcoin.

The DOJ said the Bitcoin is already in custody. Forfeiture would follow a conviction in court. The filing describes a cross-border laundering network.

The complaint also maps the operational footprint. It cites Warp Data in Laos. It references a Texas subsidiary and links to LuBian in China.

Arkham Intelligence and Lookonchain: hack history and recovery figure

Arkham Intelligence reported a 127,426 BTC hack in 2020. The loss related to the LuBian mining pool. At the time, the stack was worth about $3.5 billion.

Arkham documented recovery-linked balances. It cited 11,886 BTC routed to recovery wallets. That figure mirrors this week’s LuBian Bitcoin transfer.

Lookonchain supplied the first movement alert. It flagged the 9,757 BTC tranche to new wallets. Arkham Intelligence then tracked the 2,129 BTC follow-on move.

In 2020, LuBian ranked as the sixth-largest mining pool. Scale mattered for attribution and flow analysis. The hack still frames today’s on-chain context.

DOJ explanation: how mining produced “clean Bitcoin” from illicit funding

The DOJ described the laundering pathway through mining. It pointed to Warp Data and linked entities. It also tied operations to LuBian.

Mining creates new BTC from network rewards. Rewards come directly from the Bitcoin protocol. They do not pass through prior tainted addresses.

Therefore, newly mined coins can look clean on-chain. The DOJ used direct wording on this point. The filing said the companies “produced large sums of clean Bitcoin dissociated from criminal proceeds.”

Funding sources still matter for tracing. If criminal proceeds fund mining, investigators follow the money. They map wallets, companies, and movement paths.

The DOJ forfeiture case rests on those links. It names Prince Holding Group and Chen Zhi. It also cites Laos, Texas, and China-based operations.

Strategic Bitcoin reserve: seized BTC and federal holdings context

If courts approve forfeiture, the Bitcoin remains with the U.S. government. It then enters federal holdings as seized digital assets. That status follows established procedures.

In March, President Donald Trump signed an executive order. It set up a strategic Bitcoin reserve framework. The design referenced forfeited government BTC as initial capital.

At the time, David Sacks explained the approach. He served as the White House AI and crypto lead. He said the reserve would use forfeited Bitcoin.

A $14.4 billion pool would be significant for that context. It would mark one of the largest additions to federal BTC. The DOJ forfeiture case could therefore impact reserves.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: October 15, 2025 • 🕓 Last updated: October 15, 2025