Picture our plucky memecoin heroes, those wild, retail-fueled rocket ships like Dogecoin and Shiba Inu, blasting off in late 2024, dreaming of galactic conquest.

They peak hard, dog-themed darlings swelling to a frenzied $100–120 billion market cap.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Elon-inspired oddballs, Solana speed demons, 4chan culture freaks, AI meme mutants, frog princes, even PolitiFi election clowns, all riding the hype wave.

Then, winter descends. A deep freeze grips the sector, no lifelines in sight.

„Memecoin markets are dead”

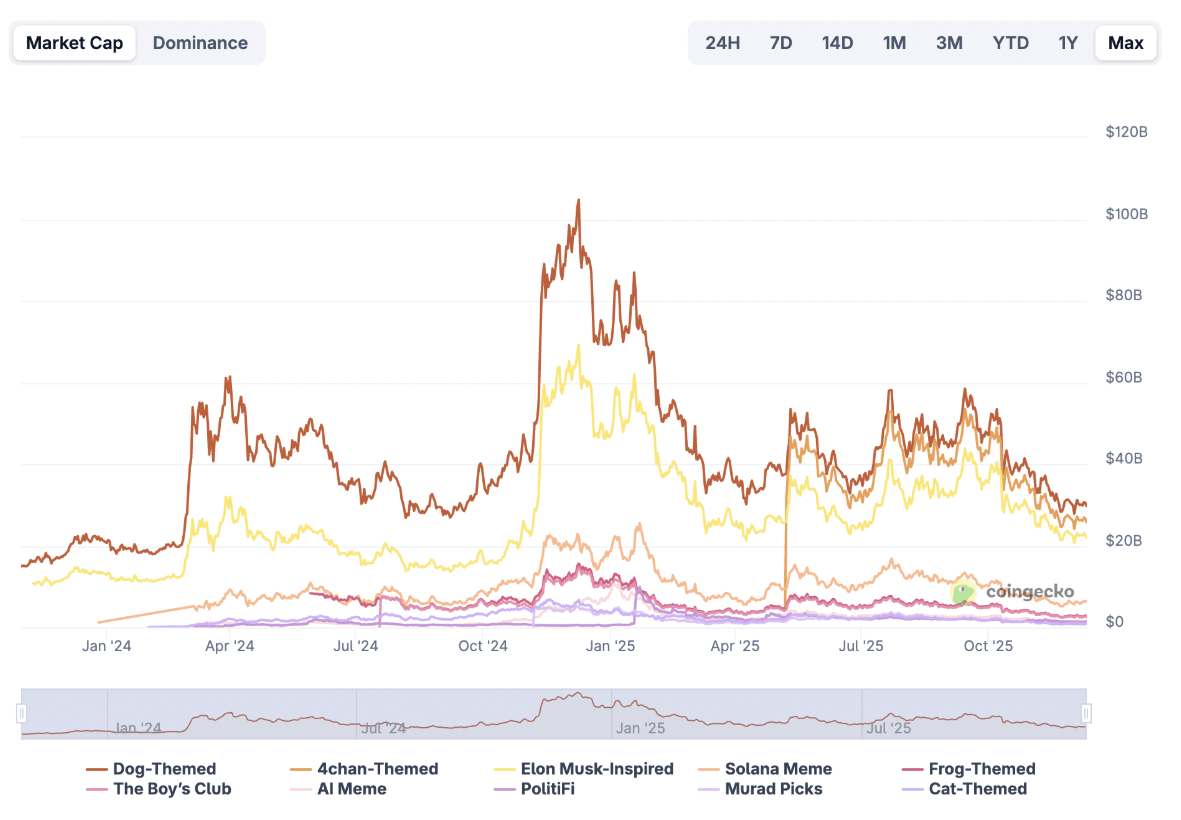

Enter the data oracles, CryptoQuant and CoinGecko charts paint a pretty grim picture. Memecoin dominance in altcoin markets?

Plummeted from above 0.11 in late 2024 to a measly 0.04 now, straight back to late-2022 corpse levels.

CryptoQuant CEO Ki Young Ju drops the mic on X, simply saying that memecoin markets are dead. No sugarcoating, just savage truth.

Memecoin markets are dead. pic.twitter.com/6kymLWH4JX

— Ki Young Ju (@ki_young_ju) December 11, 2025

This ain’t retail sentiment flickering, unfortunately.

Liquidity is vanished

Let’s face the abyss, no rotation, no new narrative saviors, zero retail revival. CoinGecko’s subsector autopsy?

Brutal. Dog-themed tokens, like DOGE, SHIB, WIF? Unwound to mid-2023 dirt. Solana memes, frog coins, AI abominations, all syncing in a synchronized nosedive.

Past cycles saw weakness in one camp spark a mad dash to the next shiny theme.

Now? Crickets. Liquidity’s vanished like a Hitchhiker’s towel in a black hole, every category shrinking in eerie unison.

Experts say dominance tanks even as altcoin market cap holds steady, memecoins fading into irrelevance.

Liquidity metrics scream contraction, high-beta jokes like these get crushed first.

Ki Young Ju’s chart flashes the sentiment gauge, complete withdrawal. No emerging “next theme” to rally the troops.

Multi-year lows

The oracle’s elixir? They say this downturn reeks structural, not some cheeky pit stop. Historical pullbacks were quick breaths before rotation rallies.

Today, evaporated liquidity and synced declines signal an extended quiet, unless fresh juice floods back or retail zombies reanimate.

But that’s quite unlikely. Memecoin market freeze hits like a gonzo fever dream gone arctic.

So, memecoin dominance collapse to multi-year lows exposes a dead meme sector, no rotations saving the day.

And the numbers tell the same, CryptoQuant and CoinGecko data confirm speculative appetite’s fled, leaving memecoin decline as the canary in the retail coal mine. Brace for the long chill.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: December 13, 2025 • 🕓 Last updated: December 13, 2025

✉️ Contact: [email protected]