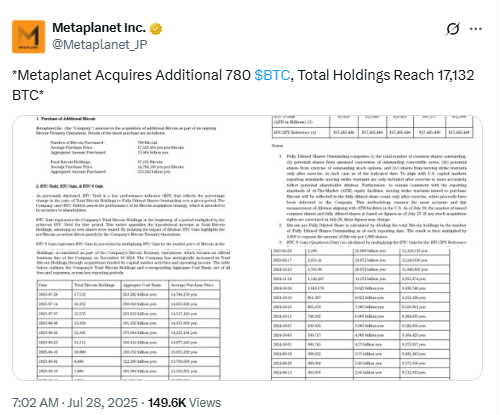

Japanese investment company Metaplanet purchased 780 Bitcoin (BTC), increasing its total holdings to 17,132 BTC.

The acquisition, valued at $92 million, was announced on Monday. The average price of the newly bought Bitcoin was 17,520,454 Japanese yen per BTC (around $118,145).

According to company data, Metaplanet has spent $1.7 billion to acquire its Bitcoin holdings at an average price of $99,640 per BTC.

At the time of reporting, Bitcoin traded at $118,171, slightly higher than Metaplanet’s latest purchase price. Nansen data also showed a 0.75% increase in Bitcoin’s price over the past 24 hours.

Metaplanet’s disclosure follows earlier reports that it plans to use its Bitcoin reserves for acquisitions of cash-generating businesses in Japan, potentially including a digital bank.

Metaplanet Leads Non-US Bitcoin Treasuries

With 17,132 BTC, Metaplanet remains the only non-US company in the top 10 Bitcoin corporate treasuries, based on BitcoinTreasuries.NET data. It is the seventh-largest Bitcoin corporate holder globally.

Metaplanet ranks below Trump Media & Technology Group, which holds 18,430 BTC, and above Galaxy Digital Holdings, owned by Michael Novogratz, which holds 12,830 BTC. The global leader, Strategy (formerly MicroStrategy), holds 607,770 BTC worth over $72 billion.

Metaplanet recently overtook Cleanspark after a $108 million Bitcoin acquisition, reinforcing its position among the leading Bitcoin treasuries.

Metaplanet’s Stock Growth Linked to Bitcoin Holdings

Metaplanet’s Bitcoin purchases have aligned with a sharp increase in its stock price. The company’s shares rose 517% over the past year and 246% year-to-date, according to Google Finance. As of Monday, the stock traded at $8.36, reflecting a 5% increase on the day.

In an interview with Forbes Japan, Metaplanet CEO Simon Gerovich said,

“In just a year, we became the country’s top-performing stock, with record trading volume and a ¥1 trillion market cap.”

Localized Bitcoin Strategy in Japan

Gerovich stressed that Metaplanet is building a “Japan-native model” that complies with Japanese regulation, taxation, and capital markets.

He noted that the firm provides Bitcoin exposure compatible with Japan’s tax-free savings accounts, which follow local investment rules.

Metaplanet’s approach has positioned it as the leading non-US Bitcoin treasury and among the largest corporate Bitcoin holders globally.

Its focus on regulatory compliance aligns its Bitcoin holdings with Japan’s financial framework while maintaining a strong presence in global Bitcoin treasury rankings.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.