Crypto exchange MEXC has introduced a $300 million Web3 fund. The initiative, revealed at the Token2049 event in Dubai, will support blockchain startups over five years. The company plans to allocate around $60 million each year, depending on market conditions and available opportunities.

The fund will focus on blockchain networks, decentralized finance (DeFi) infrastructure, and stablecoin-based systems. According to MEXC Chief Operating Officer Tracy Jin, only selected projects will be considered.

“We are committed to strategic investment, focusing not just on exciting ideas and talented developers, but on initiatives with clear long-term potential,”

Jin stated at the conference.

The MEXC Web3 fund will not be open to public applications. Jin said projects must present themselves directly to MEXC’s team. The firm will not follow the traditional “submit a form and get funded” approach.

MEXC Strategic Investment to Prioritize AAA-Level Projects

MEXC said it will choose projects based on long-term viability and alignment with its goals. The company aims to support early-stage Web3 developers building core infrastructure. Public blockchains, crypto wallets, and decentralized tools are among the targets.

Tracy Jin added that the fund seeks to back teams aiming for AAA-level development status within three to five years. The emphasis is on scale and utility across the broader crypto ecosystem.

She explained that while the target is $50–60 million per year, the pace may vary. “We may accelerate the investment pace if a project aligns well with our current business priorities. Otherwise, we will proceed steadily according to the original plan,” she said.

The $300 million Web3 fund follows a trend where exchanges back infrastructure instead of offering direct listings or incentives. MEXC joins firms like Binance and Coinbase in pursuing long-term investment in crypto infrastructure.

MEXC DeFi Funding and Stablecoin Projects Take Center Stage

In February 2025, MEXC committed $20 million to USDe, a synthetic dollar developed by Ethena Labs. The company also made a $16 million direct investment in Ethena itself. These investments show MEXC’s ongoing interest in stablecoins and DeFi.

At Token2049, Jin stressed the importance of stablecoins. She said they play a key role in supporting pricing stability and trade flows across the crypto market.

MEXC’s stablecoin strategy reflects its focus on decentralized applications that enable seamless transactions. The company believes that reliable stablecoins are critical to growing the Web3 economy.

The fund’s selective investment model highlights MEXC’s focus on impactful projects. Jin said that teams must make themselves visible to receive funding. This approach avoids open calls and reduces time spent evaluating low-quality pitches.

MEXC Token2049 Dubai Announcement Highlights Selective Process

The MEXC Web3 fund announcement took place during Token2049 in Dubai on April 30, 2025. The event gathered developers, exchange executives, and blockchain founders to discuss upcoming trends.

Jin used the platform to explain why MEXC prefers a closed investment model. She said the team wants to engage only with projects that demonstrate initiative and align with MEXC’s roadmap.

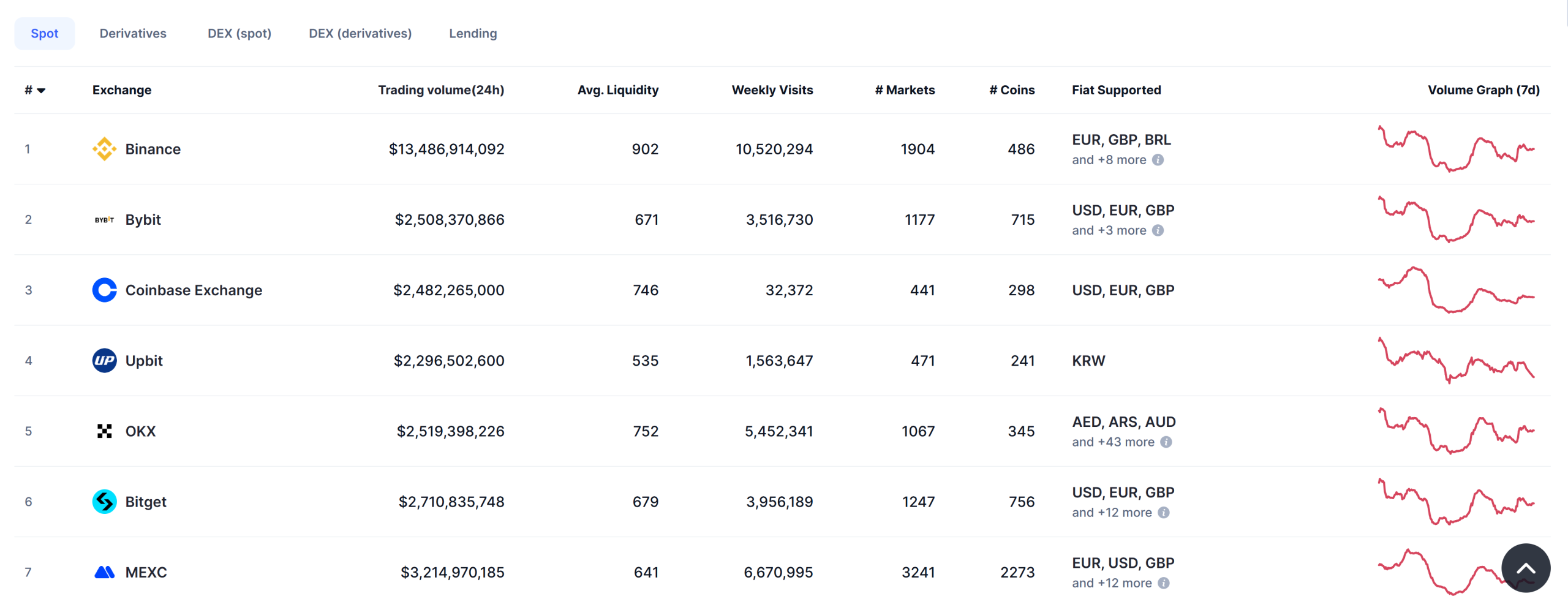

As of May 1, MEXC ranks as the seventh-largest exchange by spot trading volume. According to CoinMarketCap, the platform processed over $3.2 billion in trades in the last 24 hours. The exchange operates globally and maintains a strong presence in Asian and Middle Eastern markets.

Source: CoinMarketCap

The MEXC Web3 fund adds to its existing ecosystem efforts. By supporting public chains, decentralized finance tools, and stablecoin adoption, the exchange seeks to shape the next phase of crypto infrastructure.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.