MicroStrategy made waves with the launch of its achieving an impressive $22 million in trading volume on its first day.

Volatility, the best friend of the traders?

The newly launched ETF is expected to be one of the most volatile among U.S. ETFs, as indicated by a 90-day volatility metric.

This volatility could escalate even further as issuers explore aggressive strategies to getting the attention of the investors.

Despite its high volatility, the MicroStrategy ETF, denoted as $MSTX, is expected to be less extreme than Europe’s $3LMI LN, which boasts a 90-day volatility exceeding 350%.

The relatively big trading volume and heightened volatility of $MSTX suggest that it could become a real force in the ETF market, potentially influencing Bitcoin’s future price movements too. What is pretty wild, indeed.

Inflows, ouflows, but there will be only 21 million Bitcoin

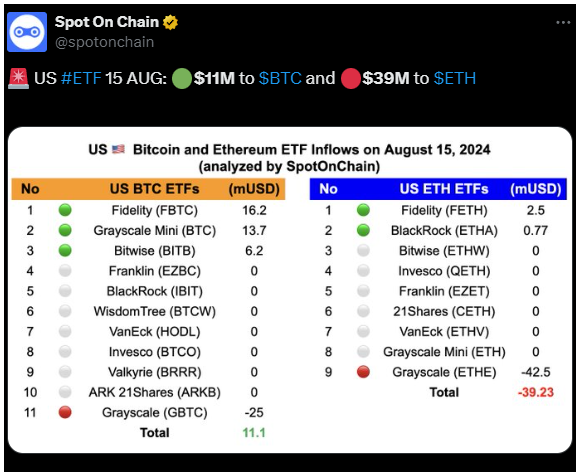

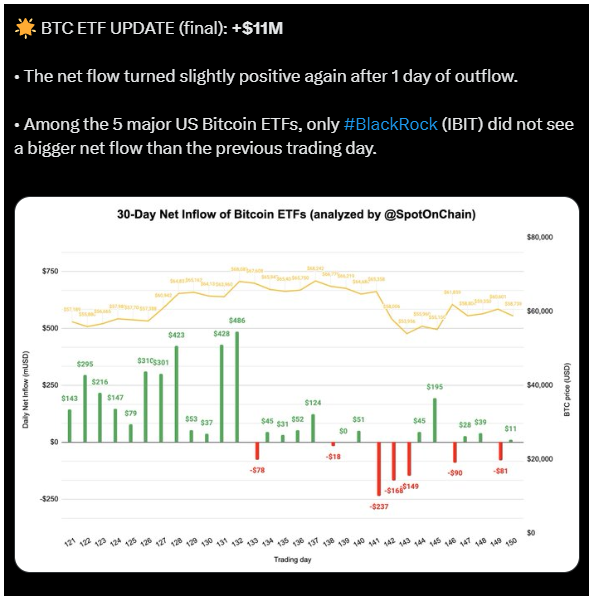

While most major U.S. Bitcoin ETFs, including those from Fidelity, Grayscale, and Bitwise, experienced notable inflows, BlackRock’s IBIT ETF didn’t see a significant change in net flow.

The strong performance of the MicroStrategy ETF shows that the ETF market is ready for more growth, driving Bitcoin prices higher given MicroStrategy’s giant Bitcoin holdings.

Bitcoin’s market cycle appears to be following a pattern seen in previous, so-called “Blue Years”, characterized by two major price peaks and two periods of sideways trading.

This cycle began with a strong rally from January to March, followed by an extended period of correction. Unlike previous cycles, this one has yet to reach new all-time highs, prolonging the correction phase.

We saw this before, more times

Now analysts say that historical patterns suggest every second peak in these cycles typically finds a bottom around August, indicating that the recent price dip is a normal precursor to an incoming surge into new highs in the following year.

The Halving Cycles Theory supports the idea that Bitcoin remains on track to reach a peak in late 2025, with new highs likely as the cycle progresses.

The market is pretty uncertain now, but major banks and large financial institutions worldwide continue to increase their Bitcoin holdings.

This clearly signals the growing confidence in Bitcoin’s long-term potential, despite the prevailing cautious, fearful sentiment among smaller investors.