We got ourselves a tale of danger and drama. Monero, the privacy kingpin of the crypto world, just went toe-to-toe with a 51% attack.

That’s like the mob boss of hash power showing up and crashing the party. But Monero? It bounced back.

51% attack

Qubic, a pretty big operator, grabbed more than half of Monero’s hashrate. Yep, more than 50%, which, in crypto-speak, means total control over the network.

They started mining blocks like a maniac, raking in over 80% of them in no time. That’s like one guy running the whole printing press in a money factory.

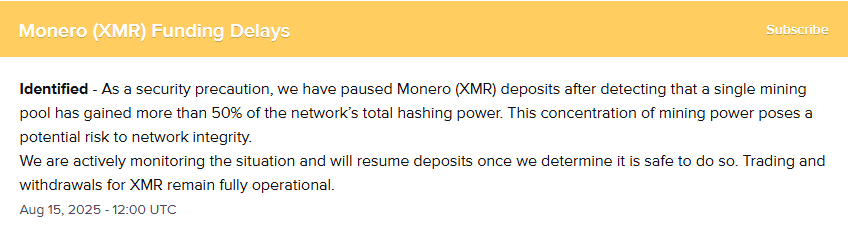

Naturally, panic spread. Prices dipped, people freaked. Kraken even paused deposits to think it through, trading and withdrawals hung on, though.

The panic didn’t last long

But surprisingly, the price didn’t stay down for long. Experts highligted that it bounced back from $256 to $266. That’s a quite solid rebound, signaling some serious confidence from the street.

The Fear and Greed Index? Sitting neutral. In other words, the heat cooled off after Qubic explained themselves, calling it a test of their computing muscle.

Still, this wasn’t a game. The attack threatened Monero’s core value, its decentralization. When one player packs that much power, things start to look fishy.

Analysts say the charts tell the next chapter. Monero broke out of a descending trend that’s been dogging it since early August.

As I said, it’s surprising. With money flow picking up and volatility dropping, it looked like XMR was gearing for a comeback.

But watch out, the price could slip back to $257. If it drops below that, it’s back to the bear market grind, and this rise would be a classic bull trap.

Price performance

Traders? Long positions dominate, with over a million in XMR being wagered between $250 and $234.

Shorts? Barely there, hanging above $266 like hesitant spectators. That means most players are betting on Monero climbing even higher, at least for now.

The big worry is that if Monero can’t reclaim its decentralized mojo, the price might tank hard.

This so-called test by Qubic may’ve been a wake-up call for the community and regulators alike.

Monero’s strength has always been its privacy and independence, if it loses that, then what?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 18, 2025 • 🕓 Last updated: August 18, 2025

✉️ Contact: [email protected]