Bitcoin daily supply, according to Michael Saylor, stands at just 450 BTC, or roughly $50 million at current market prices.

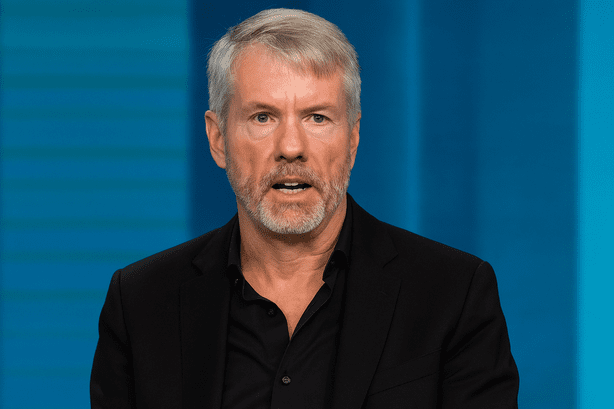

In a June 10 interview with Bloomberg, the Strategy Executive Chairman said the current supply pressure supports a long-term bullish case. “Winter is not coming back,” Saylor said.

“We’re past that phase; if Bitcoin’s not going to zero, it’s going to $1 million.”

He explained that Bitcoin miners produce 450 new BTC per day. If institutions or public companies buy that amount daily, prices are expected to react.

“If that $50 million is bought, then the price has got to move up,”

he said.

Saylor added that the market’s structure forces buyers to compete for a limited supply. He said,

“At the current price level, it only takes $50 million to turn the entire driveshaft of the crypto economy one turn.”

Strategy’s Bitcoin Holdings Reach 582,000 BTC

Saylor’s firm Strategy holds 582,000 BTC, worth around $63.85 billion, based on CoinMarketCap prices.

The firm started accumulating Bitcoin in 2020, and its strategy remains focused on long-term holding.

Data from Saylor Tracker confirms the total holdings. This makes Strategy the largest corporate holder of Bitcoin globally. The purchases significantly reduce the available supply for other participants in the market.

Saylor acknowledged that large price movements would increase volatility. He said,

“If Bitcoin surges to $500,000 or $1 million, it may be more realistic to forecast it crashing down by about $200,000 a coin.”

Bitcoin accumulation by firms like Strategy contributes to ongoing pressure on available supply. According to ARK Invest, Bitcoin’s long-term forecast now stands at $2.4 million in a bull case scenario by 2030, revised in April 2025.

Trump, Treasury, and SEC Names Cited in Bitcoin Support

Saylor pointed to Donald Trump’s support for Bitcoin, naming Treasury Secretary Scott Bessent and SEC Chair Paul Atkins as additional backers. He said these figures reflect a shift in political attitude toward digital assets in the U.S.

He also mentioned that traditional U.S. banks are preparing to offer Bitcoin custody services, making it easier for institutions to buy and hold the asset under regulatory frameworks.

“Bitcoin has gotten through its riskiest period; the accounting has been corrected,”

Saylor said. However, Trump’s February 2025 tariff announcement was followed by a 40% drop in Bitcoin price, falling from a January high of $109,000.

BlackRock and Pakistan Add to Bitcoin Demand

BlackRock and other Bitcoin ETF providers continue to purchase Bitcoin daily, according to Saylor. These institutional flows contribute to a demand-supply imbalance in the market.

He also referenced nation-state interest, citing Pakistan’s move to create a Strategic Bitcoin Reserve. On May 28, Bilal Bin Saqib, head of Pakistan’s crypto council, announced the country’s plans to enter the space.

Earlier in March, the U.S. under Trump created a Strategic Bitcoin Reserve. This move drew commentary from JAN3 founder Samson Mow, who told Cointelegraph Magazine that the U.S. could be “front-run by Pakistan” if it delays further accumulation.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.