Let me tell you a not-so-average Wall Street bedtime story. Charles Schwab, the buttoned-up, old-school titan of finance is about to wade knee-deep into the crypto market.

By April 2026, Schwab wants you buying and selling Bitcoin and Ethereum right from your brokerage account, no more of this ETF or futures nonsense. Direct, spot trading.

Meet the new boss

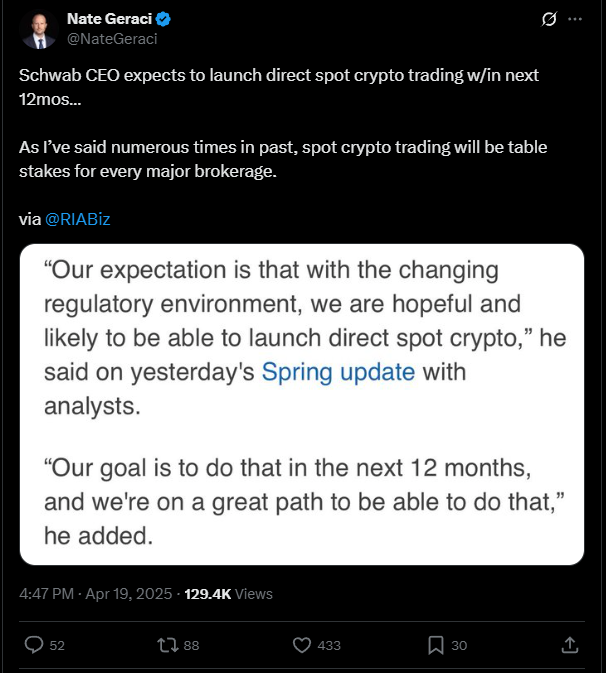

Schwab’s new boss, Rick Wurster, he steps in, sees the writing on the wall, maybe even in neon, and says, we’re on a great path.

Translation? They’re finally listening to the people pounding on their doors, begging for a taste of that sweet, sweet crypto action.

And it’s not just Schwab’s regulars, 70% of the 400% spike in their crypto site traffic comes from outsiders, people who don’t even have a Schwab account yet. If that’s not a trend, I don’t know what it is.

Now, don’t think Schwab’s just doing this outta the goodness of their hearts. Nah, they see the competition.

Coinbase, Binance, Kraken, Gemini, these guys have been running the crypto show, offering every trading pair you could dream of, with all the bells and whistles.

Even the suits at Fidelity, Robinhood, and eToro are letting people trade Bitcoin and Ethereum like they’re picking up groceries. And the fee revenue, well, you can imagine.

Clarity

For years, Schwab played it safe, offering crypto exposure through ETFs and futures, waiting for regulatory clarity.

And the clarity is finally here. With the political winds shifting, thanks, in part, to Trump’s re-election and a friendlier climate for crypto assets, Wurster’s finally ready to roll the dice.

He even admits he doesn’t own any crypto himself, says he feels silly about it. Hey, Rick, join the club. We all got that one investment we missed.

Vibe shift

If you think this is just about trading, think again. Schwab’s teaming up with Trump Media and Technology Group to launch Truth.Fi, a platform that’s supposed to be the answer for people fed up with big banks, censorship, and woke corporations.

They’re wanting to manage $250 million in assets, pushing a Patriot Economy vibe. Sounds good!

Schwab’s move is a big, fat signal that crypto’s not just for tech bros and memelords anymore.

The old guard’s moving in, and if you’re not paying attention, you’re gonna get left behind.

Have you read it yet? Strategy Adds 6,556 Bitcoin for $555.8M, Lifts 2025 Total to 91,800 BTC

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.