The U.S. Securities and Exchange Commission (SEC) has moved to drop its lawsuit against crypto YouTuber and influencer Ian Balina.

The case involved allegations of conducting an unregistered securities offering through Sparkster (SPRK) tokens.

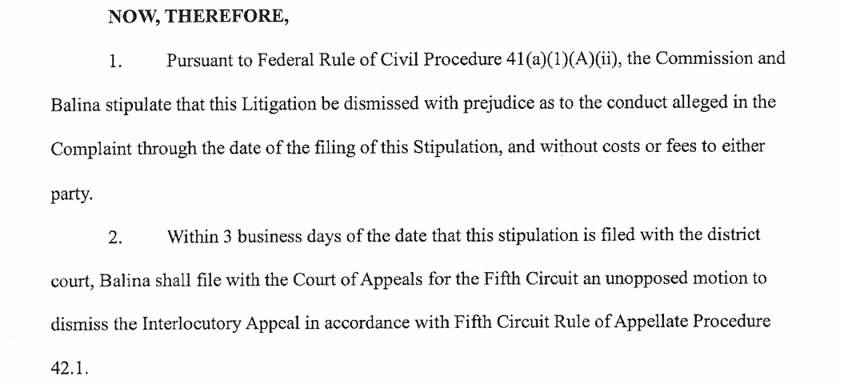

On May 1, 2025, the SEC filed a joint stipulation with Balina in a federal court in Austin, requesting to dismiss the matter.

The SEC said the dismissal is based on decisions made by its internal Crypto Task Force.

The document noted the dismissal “does not necessarily reflect the Commission’s position on any other case.”

The case against Balina began in September 2022, when the SEC accused him of promoting Sparkster tokens without registration.

The SEC claimed Balina formed an investing pool on Telegram in 2018, where U.S.-based investors took part using Ether (ETH).

According to the filing, many Ethereum nodes are located in the United States, which gave the SEC jurisdiction to act.

In May 2024, the court ruled in favor of the SEC, stating that SPRK tokens met the definition of investment contracts under U.S. securities law.

This decision was based on investors contributing to a common enterprise and expecting profit through the actions of others.

Ian Balina Cites Policy Shift in SEC’s Crypto Enforcement

In March 2025, Ian Balina told the SEC had informed him it would recommend dropping the case. He attributed this shift to changing enforcement direction at the Commission.

Under President Donald Trump’s administration, the SEC leadership changed. Former crypto lobbyist Paul Atkins was appointed as SEC Chair, replacing prior leadership.

Although no formal statement on enforcement policy has been issued, multiple crypto cases have been dropped in recent months.

The SEC’s filing stated that ending the case would help “conserve judicial resources,” and both parties agreed to close the matter “without costs or fees.”

Balina is the CEO of Token Metrics, a crypto analytics company. He is also active on YouTube and X , where he has over 140,000 followers.

The SEC had accused him of receiving undisclosed compensation for promoting crypto projects, particularly during the 2017–2018 ICO boom.

SEC Referenced Ethereum Node Concentration in Legal Argument

In the original filing, the SEC argued that Ethereum transactions related to Sparkster were subject to U.S. law because the ETH network nodes were “more densely clustered in the United States than any other country.”

This claim was part of the SEC’s broader legal strategy to enforce regulations over blockchain transactions.

The case also involved claims that Balina did not register his promotion of the SPRK token sale, which drew further attention during the SEC’s investigation of ICO-related securities violations.

The Sparkster project itself had previously settled with the SEC in 2022, agreeing to pay a $35 million fine without admitting or denying the charges. The settlement did not resolve the accusations against Balina.

SEC Ends Balina Case Amid Wider Crypto Enforcement Rollback

The SEC’s dismissal of the Ian Balina case follows several dropped crypto enforcement actions in 2025.

These include cases involving Coinbase, Ripple, Kraken, OpenSea, and PayPal’s stablecoin.

Most were tied to allegations of unregistered securities offerings or promotional violations.

The joint court filing appeared on PACER, confirming that neither party would pursue costs or fees. No settlement or penalty was included in the dismissal.

Balina has not released an official statement since the May 2 filing. The SEC has not published a separate press release about the case.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.