The U.S. SEC has officially given the thumbs-up to Canary Capital’s application for a spot Litecoin ETF.

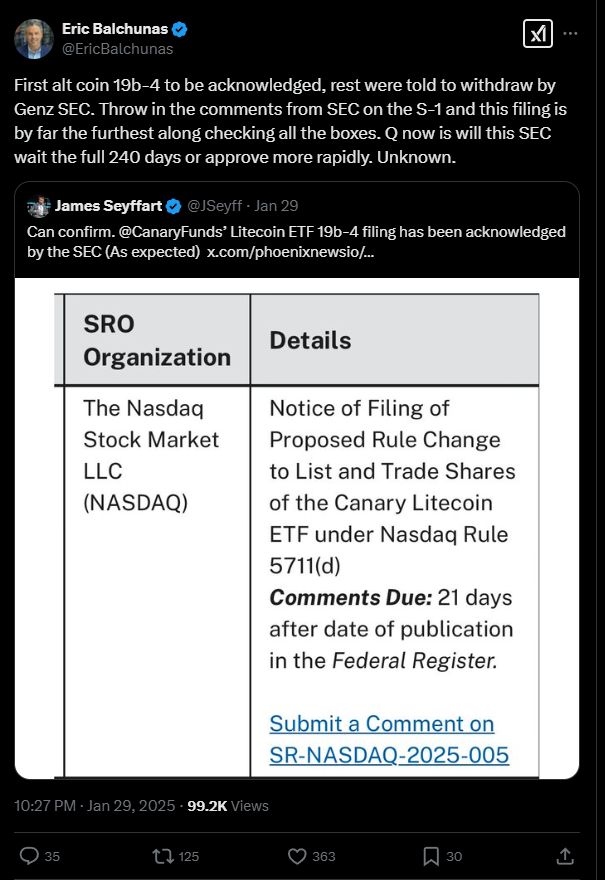

This is a big deal because it’s the first Litecoin ETF filing that the SEC has recognized, according to senior Bloomberg ETF analyst Eric Balchunas.

The clock is ticking

The SEC has a 240-day window to either give this ETF a green light or say no., so this means Canary Capital is in the spotlight, and they’re the first ones to get this kind of attention since Ethereum.

All other applications were told to hit the road by the SEC under Gary Gensler’s watch, so this is a pretty significant moment.

Balchunas has pointed out that this filing is by far the furthest along in terms of meeting all the necessary requirements.

The big question on everyone’s mind is whether the SEC will take its time with the full 240 days or if they’ll decide to speed things up.

Public opinion

In a move that’s got people excited, the SEC has also opened up a public feedback window.

This means anyone can chime in with their thoughts on the spot Litecoin ETF, so if you’ve got an opinion, now’s your chance.

While this acknowledgment from the SEC is encouraging, it still leaves many altcoin ETF applications hanging in limbo. Following Gensler’s departure, there was a flurry of activity with around 33 crypto ETF applications rolling in just after Trump’s inauguration.

It’s like the biggest obstacle for the crypto industry was Gensler himself.

We had heard chatter that the Litecoin S-1 had gotten comments back from SEC. This looks to confirm that which bodes well for our prediction that Litecoin is most likely to be the next coin approved. All that said, new SEC chair has yet to start and that's a huge variable. https://t.co/cKFswPwcr0

— Eric Balchunas (@EricBalchunas) January 15, 2025

Open the floodgates?

Litecoin’s price has already jumped by 12% since the SEC’s announcement, trading at about $125. But why does Litecoin have a better shot at getting approved?

Well, it’s often dubbed digital silver compared to Bitcoin’s digital gold, and this narrative is quite strong.

Investors love it for its speedy transactions and lower fees, plus, since Litecoin is a fork of Bitcoin, it hasn’t been labeled a security like some other cryptos such as Ripple and Solana.