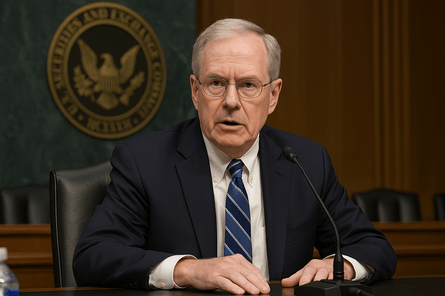

On June 3, 2025, SEC Chair Paul Atkins told the U.S. Senate Appropriations Subcommittee on Financial Services that the agency will now handle SEC crypto regulations through the notice and comment process.

Atkins said,

“The commission will utilize its existing authorities to set fit-for-purpose standards for market participants.”

This approach replaces the previous strategy of shaping crypto policy through lawsuits and settlements.

The statement marks a clear policy change from former SEC Chair Gary Gensler, who had faced criticism for what industry participants called “regulation by enforcement.”

Atkins also said that SEC enforcement would return to its original scope:

“The commission’s enforcement approach will return to Congress’s original intent, which is to police violations of these established obligations, particularly as they relate to fraud and manipulation.”

He explained that the SEC will focus on making clear rules for the issuance, custody, and trading of crypto assets.

SEC Crypto Task Force Drafting Industry Standards

During the hearing, Democratic Senator Chris Coons asked Atkins whether crypto exchanges should be allowed to handle both traditional securities and digital assets.

Atkins did not give a direct answer. Instead, he pointed to the Crypto Task Force, which was formed on January 21, 2025, by acting SEC Chair Mark Uyeda.

Atkins confirmed that the Crypto Task Force is developing rules that apply to both businesses and investors. He also mentioned that a first report is expected “in the next few months.”

Atkins added,

“Clear rules of the road are necessary for investor protection against fraud, not the least to help them identify scams that do not comport with the law.”

Since Gary Gensler left office on January 20, 2025, the SEC has dismissed several enforcement actions.

The agency also issued internal guidance explaining that some common crypto staking practices do not violate securities laws.

FinHub Disbandment and Internal SEC Changes

Atkins told the Senate he has asked Congress to approve the closure of FinHub, officially called the Strategic Hub for Innovation and Financial Technology. The SEC launched FinHub in 2018 to handle fintech matters, including digital assets.

Atkins explained that the agency is now incorporating FinHub’s priorities across all departments.

“Innovation should be ingrained into the culture SEC-wide and not limited to a relatively small office,” Atkins said.

“The principles and priorities under which it was established are being integrated into the very fabric of the SEC.”

This change means FinHub will no longer operate as a separate unit. Instead, its responsibilities will be spread across the main SEC structure.

Key Information at a Glance

-

Paul Atkins: Current SEC Chair, confirmed rulemaking shift to notice and comment

-

Gary Gensler: Former SEC Chair, resigned January 20, 2025

-

Crypto Task Force: Launched January 21, 2025 by Mark Uyeda, working on formal SEC crypto regulations

-

FinHub: Created in 2018, now set for closure

-

Senator Chris Coons: Asked about exchange permissions for securities and digital tokens

-

New Rulemaking Focus: Issuance, custody, and trading of digital assets

Atkins did not provide a timeline for finalizing the new rules. However, the expected publication of the Crypto Task Force’s report will mark the first detailed framework under his leadership.

The SEC continues to use its existing legal tools while shifting its focus toward public engagement and formal procedures under notice and comment.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.