The September Effect is a term that investors often fear, as it refers to a month historically known for poor stock market returns.

Bitcoin seems to have fallen under a similar curse, with September being the worst month for the cryptocurrency’s returns.

September rain

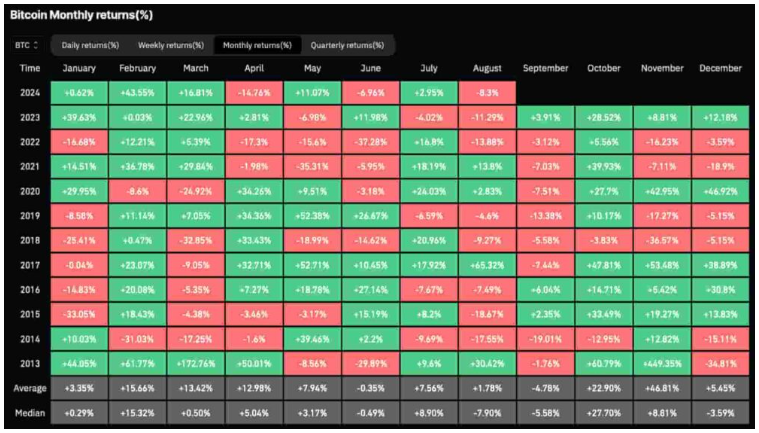

Data reveals a worrying trend for Bitcoin in September, as historically, the average and median returns for Bitcoin during this month have been negative, with average returns at -4.78% and median returns at -5.58%.

Alongside June, which has a nearly neutral average return of -0.35%, September stands out as a particularly hard time for the cryptocurrency.

August and December also show negative median returns of -7.90% and -3.59%.

Bitcoin generally has positive performance in most other months, September’s negative trend raises concerns about what this month might bring for BTC this year, because we are entering this peridon now.

60% of the time, it works every time

Since 2013 Bitcoin only managed to close September with gains in three out of eleven years. In 2015, it saw a modest increase of 2.35%, followed by a 6.04% surge in 2016. Last year, Bitcoin also defied the odds, closing September with a 3.91% gain.

Not much, but still positive. The worst Septembers in Bitcoin’s history were in 2014 and 2019, with losses of over 19% and 13%.

This pattern suggests that while the September Effect is often real for Bitcoin, there have been exceptions where the market surprised bearish traders by posting gains instead. Its chances are smaller, that’s all.

Bitcoin price, what’s next?

Bitcoin is trading at $59,110 in the time of writing, which is a 40.05% increase since the start of the year.

But Bitcoin is also on a downward trend for the past six months, with its price consistently making lower highs and lower lows since reaching an all-time high in March.

This signals a weakening momentum, and analysts think this isn’t a good sign.

Popular crypto analyst in the social media, Ali Martinez identified an important resistance level at $66,000, warning that if Bitcoin fails to break this level in the coming weeks, it could means the start of a longer bear market.