Sharplink Gaming has raised the size of its share offering from $1 billion to $6 billion. This update came in a new prospectus supplement filed with the U.S. Securities and Exchange Commission (SEC) on Thursday, July 18.

The company confirmed it will use most of the proceeds to buy Ethereum (ETH). The document states,

“We intend to contribute substantially all of the cash proceeds that we receive to acquire Ether […] We also intend to use the proceeds from this offering for working capital needs, general corporate purposes, operating expenses and core affiliate marketing operations.”

The increase from the initial May 30 filing signals Sharplink’s ongoing accumulation strategy.

If all $6 billion is spent on ETH, the company could own about 1.38% of the total circulating supply.

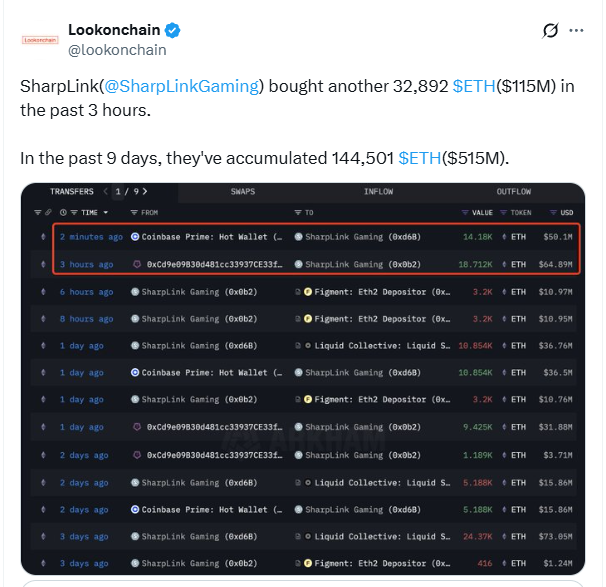

Sharplink Adds $515M Worth of ETH in Nine Days

Over the past nine days, Sharplink Gaming has purchased Ethereum worth $515 million.

According to blockchain data shared by Lookonchain, the company made its latest buy after the SEC filing, acquiring 32,892 ETH for $115 million.

As of July 16, Sharplink holds over 280,000 ETH in its treasury. It acquired 10,000 ETH directly from the Ethereum Foundation as part of the ongoing accumulation. Most of the ETH—about 99.7%—is currently staked.

The company’s recent activity follows an earlier announcement posted on X. In the post, Sharplink hinted it aims to hold up to 1 million ETH in its reserve. Ethereum traded around $3,626 at the time of the filing.

Sharplink Becomes Largest Corporate ETH Holder

On July 15, Sharplink became the largest corporate holder of Ethereum. This move puts it ahead of the Ethereum Foundation itself, according to Galaxy Research.

Between June 2 and July 15, Sharplink earned 415 ETH in staking rewards. At current prices, that’s around $1.49 million in income.

Galaxy Research described the company’s growing ETH position as a meaningful development for the Ethereum ecosystem. This shift comes as institutional players look for blockchain-based treasury strategies.

The Ethereum Foundation, which has historically sold ETH during market rallies, now holds less than Sharplink, signaling a change in the distribution of large-scale holdings.

SBET Stock Falls After Filing, Still Up 350% in 2025

Sharplink Gaming trades on Nasdaq under the ticker SBET. On Thursday, July 18, the stock closed at $36.40, down 2.62% on the day.

In after-hours trading, the price dropped another 4.95% to $34.60, based on Google Finance data.

Despite the dip, SBET is still up 350% year-to-date. However, it is down 54% from its high of $79.21 reached on May 29.

In its most recent earnings report, Sharplink saw a 24% year-on-year decline in revenue during the March quarter. The company’s net profit margin also dropped by 110%, marking a significant decrease in profitability.

Sharplink is scheduled to report its next quarterly earnings on August 13, 2025, according to Nasdaq.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.