Shiba Inu (SHIB) traded higher on Jan. 5 after extending a strong upside move that began at the start of the year.

The 4 hour SHIBUSD chart from Coinbase shows price accelerating out of a late December base and confirming a short term uptrend.

First, SHIB broke above its descending structure around Jan. 2, when price pushed through the $0.0000070 area with expanding volume.

That move marked the shift from consolidation into an active uptrend. Since then, price has printed higher highs and higher lows, while holding above the rising 50 period exponential moving average. As a result, trend direction now favors buyers rather than sellers.

Over the past 24 hours, SHIB moved from the $0.0000086 area to a session high near $0.00000916 before pulling back slightly.

That range places the daily advance at roughly 6% to 7% from low to high.

However, price failed to close above the horizontal resistance near $0.0000092, which capped earlier rallies in December. This level now defines the key short term decision zone.

At the time of the snapshot, SHIB traded around $0.00000874, sitting just below that resistance.

This area acts as a transition zone where price often pauses after a fast rally. Importantly, the pullback remains shallow and controlled.

Candles continue to close above the rising trendline drawn from the Jan. 2 low, which keeps the uptrend structure intact.

Momentum indicators support that view. The 14 period RSI reached the low 70s earlier in the session, reflecting strong upside momentum, then eased back toward the high 60s.

That behavior signals cooling momentum rather than trend failure. Meanwhile, volume expanded sharply during the breakout and remained elevated compared with late December, which confirms participation rather than a thin move.

If SHIB clears the green resistance line near $0.00000916 with a firm close, the chart opens room toward the next psychological zone near $0.0000095 and above.

Conversely, as long as price holds above the rising trendline and the 50 EMA near $0.0000078, the broader uptrend remains technically valid despite short term pauses.

SHIB Breaks Falling Wedge After Bullish Divergence Signal

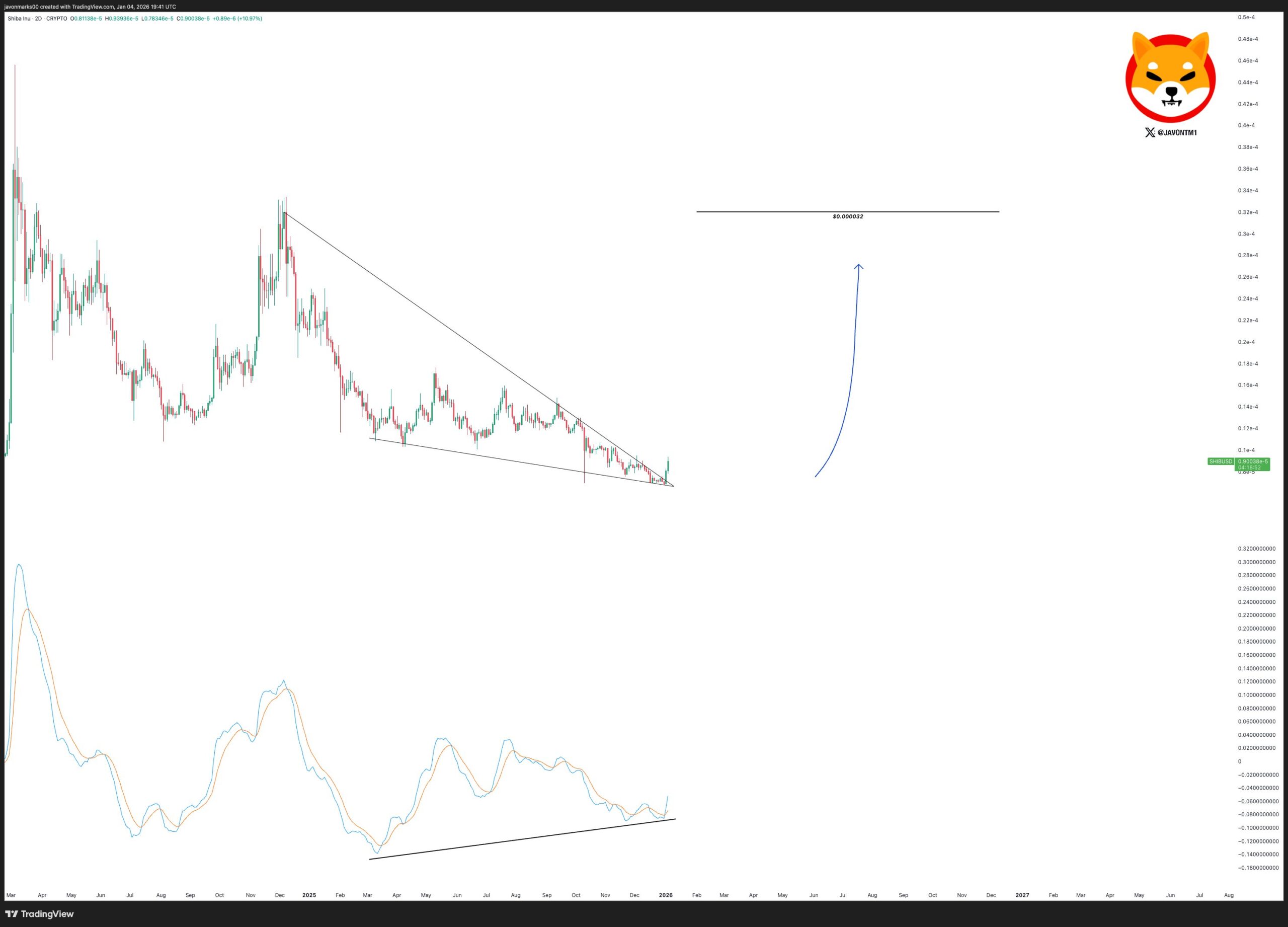

Shiba Inu (SHIB) broke out of a long, downward sloping wedge on the 2 day chart after momentum indicators started printing bullish divergence.

The TradingView chart shared by analyst JAVON MARKS showed price compressing inside lower highs and lower lows through most of 2025, then pushing through the wedge’s top trendline at the start of 2026.

SHIB opened near $0.0000081138 and climbed to an intraday high around $0.0000093936 before settling near $0.0000093086 on the candle shown.

That close marked a roughly 11% gain on the period displayed, while the breakout candle held above the wedge boundary rather than fading back into the pattern.

At the same time, the lower panel showed the divergence setup. While SHIB’s price kept pressing into lower lows near the wedge base, the oscillator line rose off its own lows, creating a higher low structure.

That mismatch often signals that selling pressure weakens even as price drifts lower. As a result, the breakout carried added weight because it followed a momentum shift rather than a random spike.

The chart also plotted a higher target band near $0.000032. That level sits well above the breakout zone and matches the area the analyst labeled as the divergence target.

Still, SHIB now trades in a transition area where follow through matters most.

If price continues to hold above the former wedge resistance, the breakout remains valid on this timeframe. However, a drop back inside the wedge would weaken the bullish setup.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 5, 2026 • 🕓 Last updated: January 5, 2026