Bitcoin investors are feeling the heat as market panic sets in, but this might just be a blessing in disguise.

What dip?

Bitcoin has been struggling lately, and it’s got everyone on edge, as the price took a nosedive of over 11% last week, dropping below $95,000.

As we gear up for the traditional Santa Claus rally, a time when crypto usually sees a boost, Bitcoin seems to be lagging behind. At the time of writing, it’s trading around $95,000.

Interestingly, even with this double-digit drop, only about 1.98 million Bitcoin addresses are “out of the money,” which is less than 4% of all Bitcoin addresses, so this suggests that not everyone is panicking just yet.

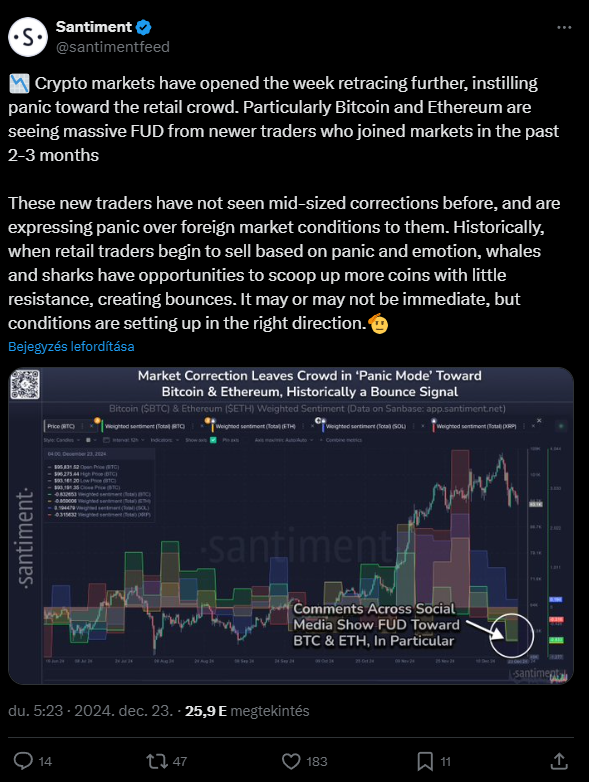

Retail traders panicking

Santiment tweeted about rising panic among retail traders, especially those who jumped into the market in the last couple of months.

They pointed out that when retail investors start selling out of fear, it often creates opportunities for larger players, like whales, to scoop up coins without much resistance.

CryptoQuant’s analysis shows that selling sentiment is currently dominating the market, as evidenced by increasing exchange reserves, but if whales start buying up Bitcoin again, it could trigger a reversal in fortunes. Unfortunately, there hasn’t been much whale activity lately.

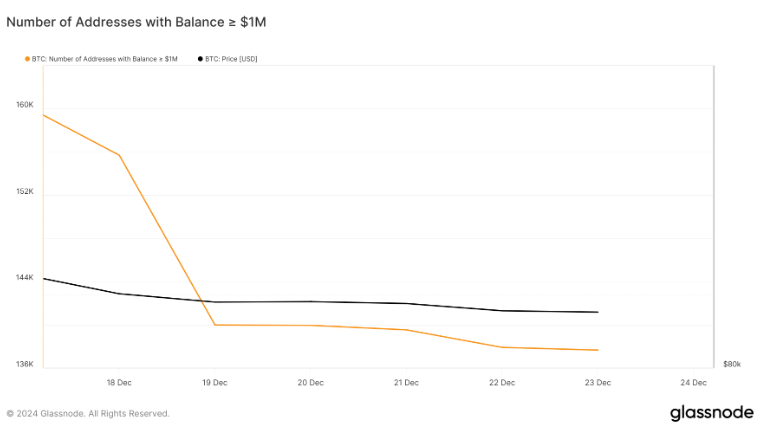

Moreover, the number of Bitcoin addresses holding more than $1 million has dropped sharply, signaling that even big investors are cashing out. This could spell trouble for Bitcoin in the short term.

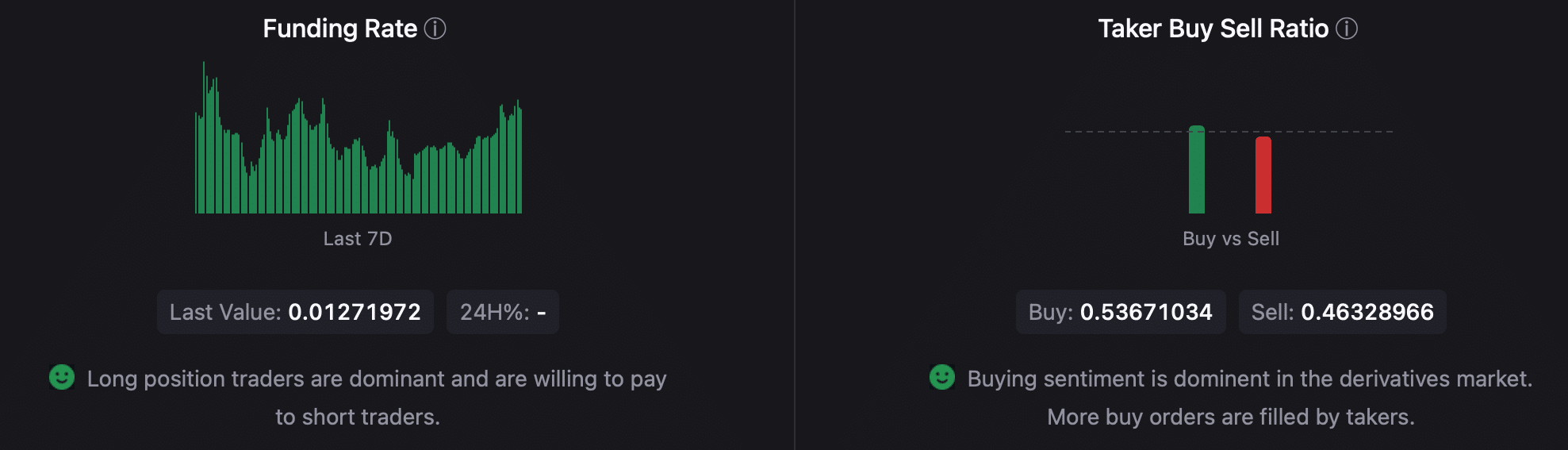

Derivatives looking good

On the other hand, things look a bit more positive in the derivatives market.

The funding rate for Bitcoin is on the rise, which means that holding long positions is getting more expensive, and this is often a sign that bullish sentiment is brewing.

Plus, the buy/sell ratio is looking good, indicating that buying pressure is stronger than selling pressure in this market segment.