Bitwise chief investment officer Matt Hougan said Solana gives “two ways to win.”

He said Solana is betting that the stablecoin and tokenization market will grow and that Solana will take a bigger part of that market.

He wrote on X that “those seem like good bets to me,” referring to stablecoins and tokenization on Solana.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Hougan said many people “underestimate” how fast stablecoin and tokenization rails can change markets. He said it is easy to imagine this market growing by 10x or more.

He kept Solana at the center of that view and tied the growth to payment and settlement use cases.

He also said he is still “very bullish on Ethereum and select other blockchains,” but he said Solana’s odds of gaining share look strong because it has fast tech and a community that ships quickly.

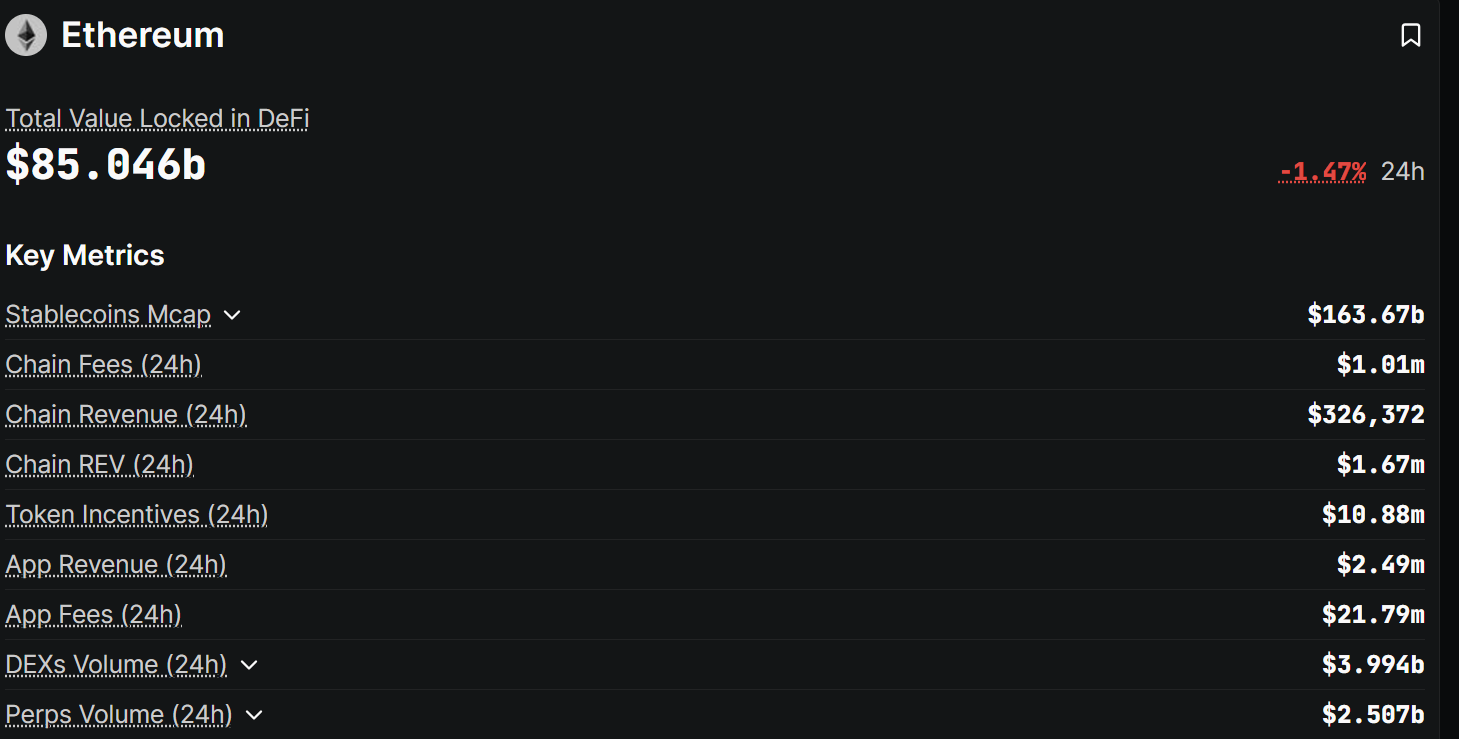

At the same time, the data still shows Ethereum in front. According to DefiLlama, Ethereum has over 163 billion dollars in stablecoin market cap and more than 85 billion dollars in total value locked.

That keeps Ethereum as the main chain for stablecoins, tokenization, and DeFi.

Solana vs Ethereum in tokenization

Solana is smaller but active. DefiLlama shows about 14.9 billion dollars in Solana stablecoin market cap and more than 11.3 billion dollars in Solana total value locked.

Hougan said Tron, Solana, and BNB Smart Chain are the “top challengers” to Ethereum in this part of the market.

So the Solana stablecoin market is still behind, but it is one of the few chains gaining users.

He also pointed to new institutional steps. Western Union said earlier this week it will use the Solana blockchain for a stablecoin settlement system.

Hougan said Solana is a newer asset and is still “playing catch up” in mandates, but it is “gaining ground.”

That shows Solana tokenization and Solana stablecoin payments already have real tests with large companies.

Bitwise, which Hougan represents, already lists Solana products, including a Solana staking ETF that launched on Tuesday.

That product gives exposure to SOL through an exchange traded fund and keeps staking inside the product.

It places Solana next to Bitcoin and Ethereum in Bitwise’s lineup but without marketing language.

Two way structure for Solana and Bitcoin

Hougan said Bitcoin has the same “two way” setup as Solana. First, the global store of value market has to grow. Second, Bitcoin has to take more of that market.

He said investors often look only at Bitcoin’s share and ignore how fast the total market is expanding.

He said the store of value market grew from under 3 trillion dollars in 2005 to 27.5 trillion dollars today, which is about 10x in 20 years.

By putting Solana, stablecoins, tokenization, Bitcoin, and store of value in the same frame, Hougan explained why Bitwise tracks these networks.

The focus stays on market size first and then on market share. In that view, Solana benefits if the stablecoin market expands and if Solana’s share of that market increases.

Ethereum keeps the lead in numbers, but Solana, Tron, and BNB Smart Chain stay in the challenger group.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: October 31, 2025 • 🕓 Last updated: October 31, 2025