Solana has hit a bit of a pause after reaching an impressive ATH of $263. But while the price has cooled down, it looks like the crypto whales are still diving in headfirst.

Do they know something what we don’t?

Price corrections and whale accumulation

After its rally, SOL took a slight hit, dropping around 8% in the last week as it corrected from that big jump that broke through 2021’s previous ATH.

The entire Solana ecosystem saw its market cap went past $342 billion, thanks in part to the rise of Pump.fun and some new meme coins based on SOL.

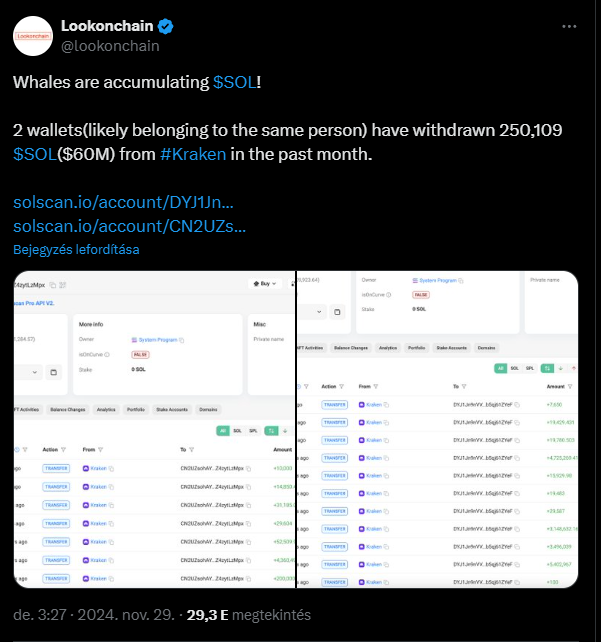

In just the last month, two wallets, likely belonging to one big whale, but we can’t be sure, have accumulated over 250,000 Solana, which is around $60 million worth, all sourced from Kraken.

SOL’s price has still climbed 34% over the past 30 days, and now, in the time of writing SOL is trading at about $240.

The token peaked at $263.83 last week, solidifying its position above BNB and getting closer to Tether.

Pump.fun’s activity

Next to Solana, Pump.fun is making waves too, as data shows that a wallet linked to Pump.fun dumped 65,000 SOL into Kraken just yesterday.

So far, Pump.fun has deposited a total of 798,869 SOL, worth about $154 million, and sold off 264,373 SOL for approximately $21.64 million USDC.

Not just Pump.fun, but Solana’s on-chain activity also ramped up big time this November. The number of active addresses hit a record high of nearly 24 million on November 19.

This growth in activity is largely attributed to Donald Trump’s victory in the U.S. elections on November 5 and an overall resurgence of memecoins within the Solana ecosystem.

Challenges

Of course, not everything is rosy, because Solana’s revenue dipped to $3.7 million as of November 28 from $6.93 million recorded on November 22 when SOL hit its new ATH.

On the bright side, Solana’s stablecoin market cap reached an all-time high of $4.6 billion on November 22 and remained steady since then.

Plus, Solana recently set a new record for trading volume on DEXs.

On November 25, SOL’s monthly trade volume on DEXs surpassed the $100 billion milestone, outperforming Ethereum’s $55 billion during the same period.