It seems the memecoin party on Solana is winding down faster than a bad hangover, and the once-bustling launchpad, Pump.fun, is seeing a serious drop in activity.

Daily token launches and revenue are plummeting, leaving many to wonder what went wrong.

Who’s laughing now?

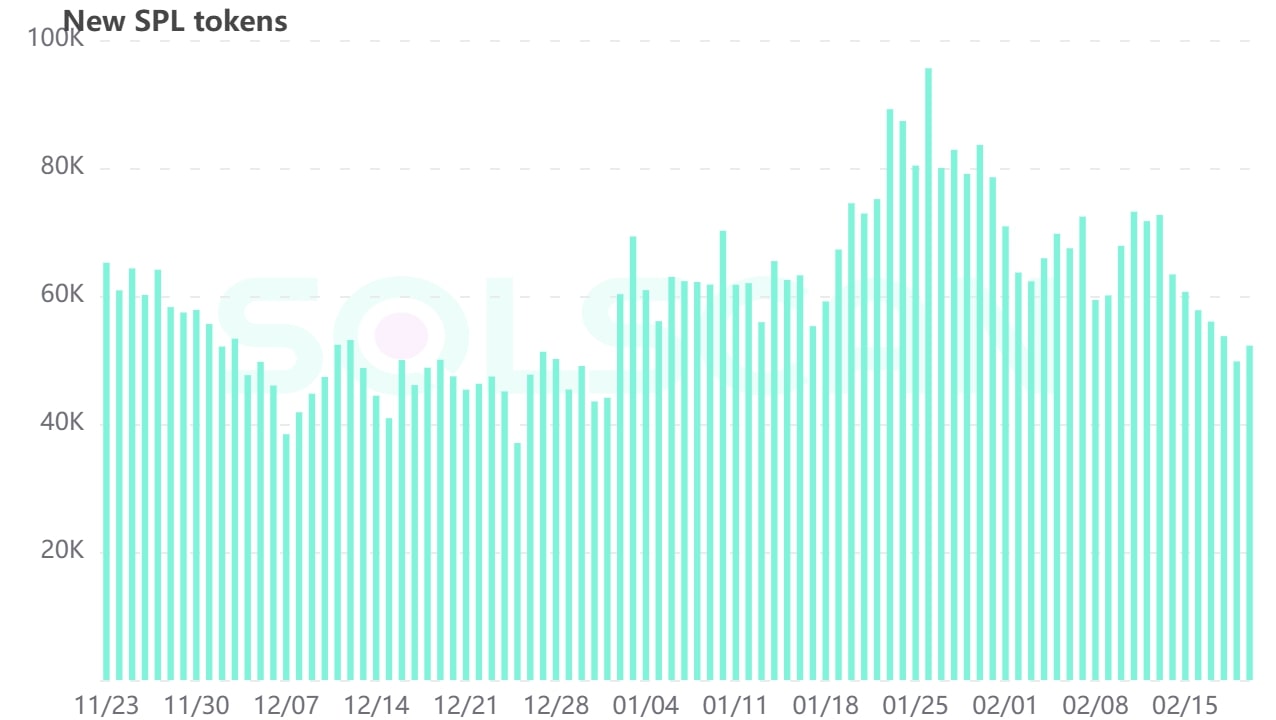

Just to give you the scoop, daily token launches on Solana hit 49,779 on February 19.

That’s a far cry from the record-breaking 95,578 launches we saw back on January 26.

In fact, it’s the lowest number since New Year’s Day. This decline comes amid growing scrutiny of memecoins and their often shady ties to scams.

January was a wild ride for memecoins, thanks to none other than former US President Donald Trump, who kicked off a frenzy by launching two tokens.

It seemed like everyone wanted in on the action, but that excitement has fizzled out quite fast.

Then Argentine President Javier Milei added fuel to the fire when he tweeted about a memecoin called Libra, claiming it would boost Argentina’s economy.

That tweet has since been deleted, and things have gone south for LIBRA investors who lost billions of dollars in just hours. Nansen shared that about 86% of LIBRA traders ended up losing at least $1,000.

Fun and games

Now, back to Pump.fun. This platform is responsible for about 60% of all Solana token launches, but it recorded only a few ten-thousands new tokens on February 19.

Revenue also took a hit, dropping to $1.69 million, the lowest since early November. Not exactly what you want to see if you’re in the crypto game.

Solana had been riding high on the memecoin wave, dominating metrics like fees and transactions.

But reports suggest much of that activity was driven by bots and inorganic trading tied to memecoins.

And here’s where it gets serious, because industry experts are worried that this memecoin madness could choke off capital and stunt growth in the whole altcoin market.

Better safe than sorry?

In response to all this chaos, Ethereum co-founder Vitalik Buterin voiced his frustration with the blockchain community’s tolerance for casinos, while Coinbase CEO Brian Armstrong warned that some memecoins have crossed the line into insider trading territory.

On memecoins…

Memecoins have generated a lot of buzz recently, and I’ve gotten some questions on how I think about them. I am personally not a memecoin trader (beyond a few test trades), but they’ve become hugely popular. Arguably, they've been with us since the beginning –…

— Brian Armstrong (@brian_armstrong) February 19, 2025

To tackle these issues head-on, the US Securities and Exchange Commission has launched a new Cyber and Emerging Technologies Unit for cracking down on misconduct and fraud in the crypto industry, especially to protect those retail investors.