Remember Solana, the Ethereum-killer? Looks like it won’t kill Ethereum soon. It was indeed the star of the crypto show not too long ago, but now it’s facing some serious challenges.

The asset has taken a beating, with 15.56% single-day drop and a nearly 20% weekly decline.

The volume crisis

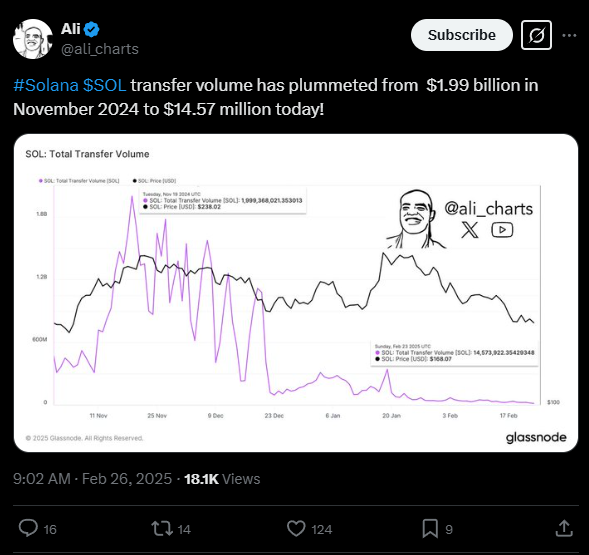

Solana’s on-chain transfer volume has plummeted to $14.5 million, a staggering 99% drop from its peak of $2 billion in November.

Let’s be honest, that’s not just a dip, it’s a full-blown crisis.

Analysts like Ali Martinez are sounding the alarm, highlighting how weak volume metrics are undermining Solana’s price structure. It’s like trying to build a house on shaky ground, it just won’t hold up.

The moment of truth

Right now, in the time of writing Solana is trading at $139, and it’s quite at a make-or-break point.

If it can’t flip this level into solid support, long-term holders might start to lose hope.

And let’s be real, Solana has already lost nearly $40 billion in market cap this month. That’s a lot of money to just vanish into thin air! Investors aren’t happy, let me say this.

What’s next? Moon or goblin town?

In the past, whenever Solana dipped, bulls didn’t exactly rush in to save the day, but this time, though, there’s a glimmer of hope.

On-chain volume metrics have surged, reaching $5.28 billion. But here’s the thing, we need to see more, lot more of this momentum to believe in a real turnaround.

If not, this could just be a short-term profit grab rather than a genuine recovery.

For Solana to truly bounce back, it needs strong accumulation, and big I mean big, think of it like a huge crypto hug from investors, more is better.

This would create a supply shock and soak up all that excess liquidity floating around. Until then, Solana’s volume metrics will be the indicator to watch. And it’s not looking too good.

Have you read it yet? Nvidia’s AI boom is an unexpected success?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.