Stablecoins are making a comeback, and that could mean good news for Bitcoin too.

Experts say that stablecoins and exchange-traded funds might just be the fuel for another Bitcoin rally.

Liquidity up, price up?

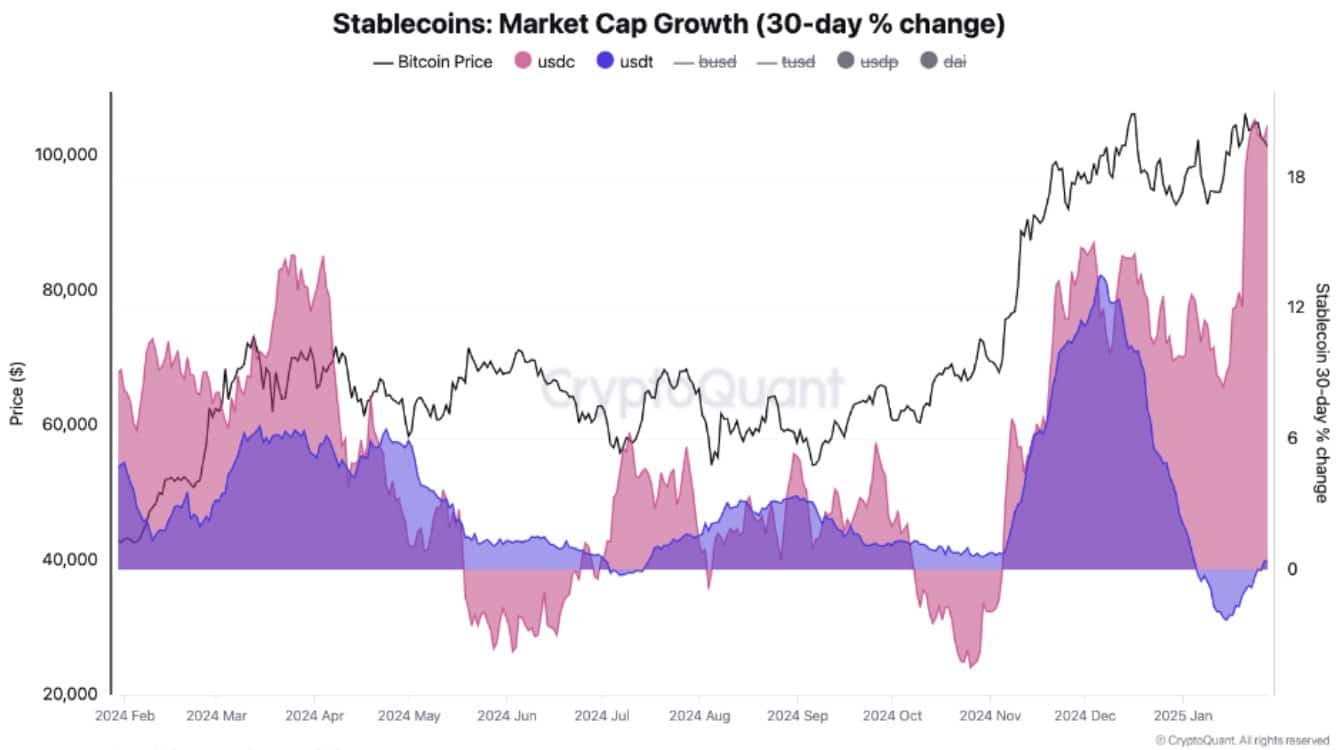

Stablecoins’ market cap is back in the green, which is a promising sign for Bitcoin’s future if this liquidity trend keeps up.

For example, USDT took a tiny dip of 2% over the last month but bounced back just in time to end on a high note. On the other hand, USDC saw a nice 20% jump, its fastest growth in a year.

Historically, when stablecoin market caps rise, they tend to pump liquidity into the market, which often precedes price rallies in more volatile assets like Bitcoin. It’s like a warm-up act before the headliner takes the stage.

Margin lending, a double-edged sword

As Bitcoin started to dip, traders began borrowing more USDT to buy up Bitcoin in hopes of a rebound.

But instead of bouncing back, Bitcoin kept falling, so those over-leveraged positions turned into a nightmare for many traders who found themselves underwater, forced to sell off their holdings to cover losses.

This sell-off and subsequent deleveraging actually set the stage for a potential reversal. After the dust settled and liquidity improved, Bitcoin began to stabilize and even slowly trend upward by the end of January.

ETFs are still hot, and this is a good thing

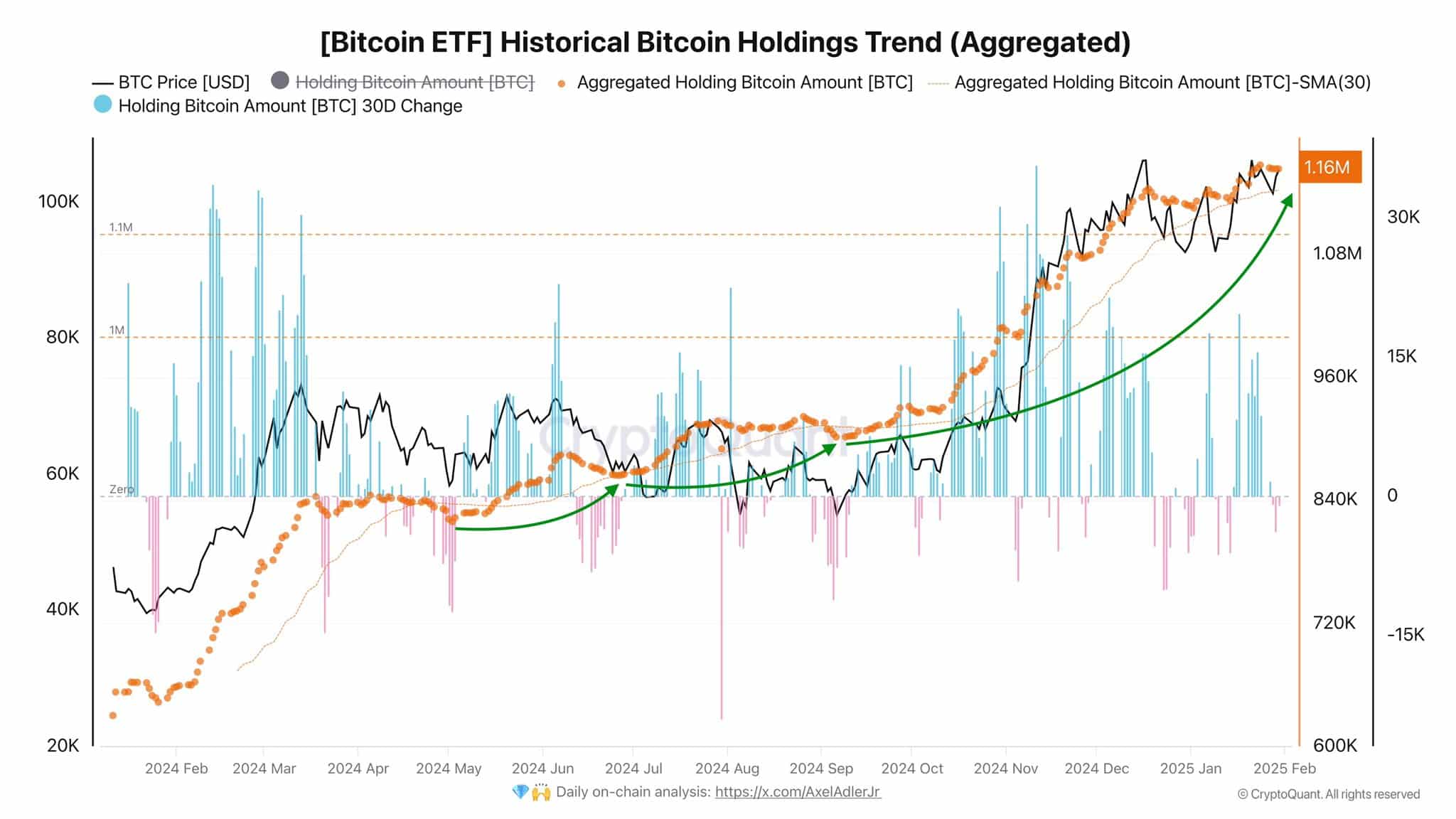

Bitcoin ETFs have been accumulating like crazy, holding 1,163,377 BTC, which is about 5.87% of Bitcoin’s total circulating supply.

Despite some outflows, often linked to profit-taking when prices spike above $100K, overall demand remains strong.

This uptick in ETF holdings suggests that investors are feeling confident about Bitcoin’s future.

The trend of accumulation followed closely with Bitcoin’s price movements; when prices hit historic highs late last year, some investors cashed out to realize their gains.

If stablecoins keep gaining traction and ETF demand stays strong, we could be looking at another bullish phase for Bitcoin.

Sure, there may be some bumps along the way, after all, markets can be unpredictable, but the overall sentiment seems to be leaning towards growth.