You think Visa is the king of transactions? No. Stablecoins just blew past Visa’s annual transfer volume like it was standing still. We’re talking $35 trillion in transfers, double what Visa handles.

Dethroning?

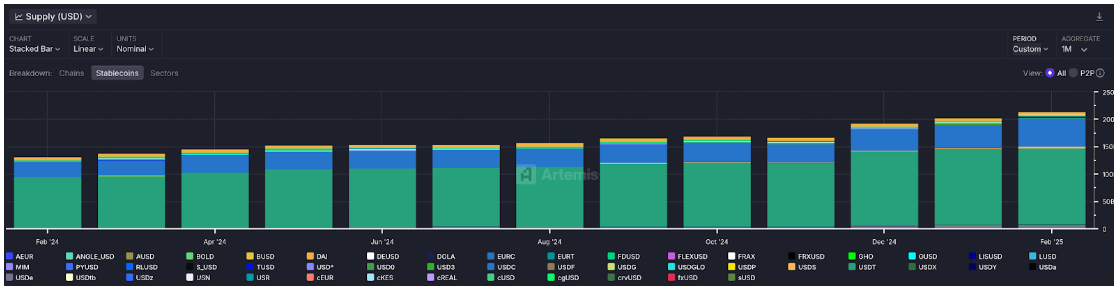

Let me say that it’s a wake-up call for traditional finance. The total supply of stablecoins? A quite impressive $214 billion as of last month.

But here’s the kicker, the number of active addresses has also jumped by 53%, hitting 30 million.

That’s a whole lot of people moving money around, and it’s not just about the big players.

USDC, for example, has seen its market cap double to $56 billion, thanks in part to some savvy partnerships with MoneyGram and Stripe.

Of course, USDT is still the number one giant, with a market cap of $146 billion, but it’s more about peer-to-peer remittances.

Liquidity and network ranking

And then there’s USDe, which has risen to become the third-largest stablecoin by market cap, now standing at $6.2 billion.

On the other hand, most of the liquidity is stuck on centralized exchanges. It’s the decentralized exchanges, yield farming, and lending protocols that are really driving the transfer volume.

Now, when it comes to where these stablecoins are flowing, Ethereum is the clear leader with a 55% market share.

But Solana and Base are the ones making waves with meme coins and DeFi. The Head of Product at Base nailed it, and said the benefits are strong.

“Stablecoins offer clear benefits over traditional financial instruments, especially when moving money across borders.”

Big changes for the average users too?

What does this mean for you and me? Imagine being able to send money across the globe without the high fees or long wait times.

That’s the promise of stablecoins. But let’s not get too excited, there are still risks involved. It’s a bit like playing with fire, exciting, but you gotta be careful not to get burned.

In the end, stablecoins are here to stay, and they’re changing the game. Whether you’re a fan or not, you can’t deny their impact.

Have you read it yet? The people have spoken, delisting vote is coming on Binance

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.